2021: The Year of Meme Stocks, Return of Inflation and a Worker Shortage

January 3, 2022

By Krista Eberly, CFP®

By Krista Eberly, CFP®

Portfolio Manager

Another year in the books and an eventful one to say the least. Out of everything that comprised 2021, three themes dominated market headlines: meme stocks, inflation, and the labor market. Let’s take a look back.

Meme Stocks

Meme stocks dominated the first part of 2021. This phenomenon started in January when retail investors, part of the WallStreetBets group on Reddit, piled in on heavily shorted stocks such as Game Stop. The goal was to have the share price go to the moon, illustrated in the meme below. This took the markets by storm, and volatility, measured by the VIX Index, reached its high for 2021 in late January. Coincidentally, the stock price of GameStop peaked on the same day as the VIX, January 27. If you don’t remember this wild ride, we broke it down in our Feb. 1 Investment Commentary.

As the months went on, this craze spilled into cryptocurrencies as well. Dogecoin, a cryptocurrency initially starting as a joke, rose from one penny to almost 70 cents by the beginning of May. Its price is a lot lower today, as are many other meme stocks (such as AMC Entertainment.)

Source: Reddit

The Return of Inflation

Also in the spring, higher inflation started to ramp up. The Fed blamed transitory factors such as supply chain issues, pent up demand, and base effects. However, it persisted throughout the year and continued to challenge the Fed’s stance. As my colleague noted in our Dec. 13 Investment Commentary, November’s year-over-year Consumer Price Index (CPI) reading was its highest level since 1982. By year-end, the Fed changed its tune. It accelerated the tapering of its monthly bond purchases, removed the word ‘transitory’ from its policy statement, and signaled interest rate increases in 2022.

Higher and more persistent inflation is the number one topic to dominate the market headlines last year and a common one discussed in our weekly commentaries as well. Higher inflation is likely to continue in 2022 as the global supply challenges remain. For example, consider the semiconductor (chip) shortage affecting the car industry. It was expected to be resolved by year-end or early 2022. We are at this point and delivery times for chips are still around six months.

The Shortage of Workers

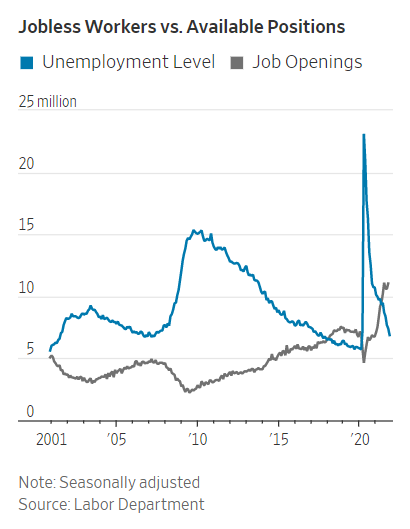

As the economy started to open back up, employers, particularly in the industries hardest hit from COVID, looked to bring workers back in the door. However, as the year went on, the U.S. experienced a shortage of workers. It affected all businesses, with help wanted signs posted everywhere you turn. With October’s JOLTS (Job Openings and Labor Turnover) data, over 11 million job openings are here in the U.S. and less than seven million people actively looking for a job.

Where did all the workers go? Good question. Various reasons are cited for the shortage; the pandemic pushed people to retire early, child care issues, extra savings, and concerns over COVID are just a few. The labor market shortage created price pressures, as employers had to raise compensation to attract new workers and retain current ones. This also contributed to higher inflation in 2021.

Year-End Video

As we close the chapter on another year, on behalf of the Wealth Management Division, I would like to thank you for entrusting us to help grow your wealth overtime and achieve your financial goals. Your success matters to us.

The Investment Department will be releasing our year-end video later this week. We recap the market environment, performance of our managed portfolios, and outlook for 2022. Stay tuned!

We look forward to continuing to work with you in the New Year.