The U.S. Economy Continues to Power Ahead ... For Now

October 30, 2023

By Jonathan Smith

By Jonathan Smith

Securities AnalystAs we wrap up October, we note it has been a month full of economic upside surprises. Consumer spending reports including labor data, retail sales and gross domestic product signal that American consumption continues to be the backbone that powers the economy.

Consumers are challenged in an environment where higher prices for goods and services and higher borrowing costs for credit are expected to be around for a longer period.

Those risks indicate that strong spending trends may be temporary.

Gross Domestic Product (GDP)

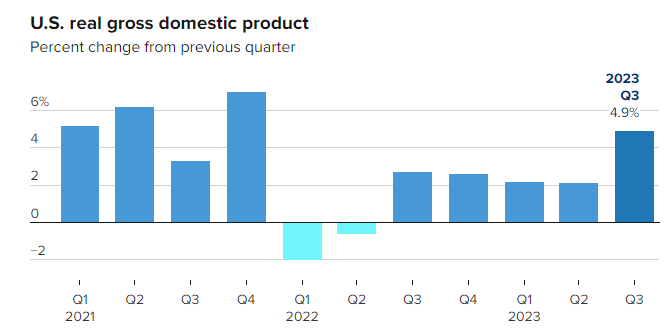

Last Thursday, the initial release of 3rd quarter U.S. gross domestic product grew at a pace of 4.9%, which more than doubled last quarter’s pace. The economy’s strength continues its trend by surprising economists’ forecasts to the upside.

Consumer spending led the charge jumping 4%, which is the most since the second quarter of 2021. A pickup in inventories, government spending, and residential investment also contributed to the advance.

Meanwhile, business investment declined for the first time in two years. The U.S. economy remains remarkably resilient as the labor market continues to fuel household consumption demand.

Good news in the economy is not always good news for the Federal Reserve. A strong GDP report poses risk to the Fed’s plan of preventing inflation from re-accelerating.

The core personal consumption expenditures index (PCE), which measures consumer spending on goods and services in the U.S., minus food, and energy components, rose 0.4% last month. This is the Fed officials’ preferred measure of inflation. A combination of strong economic data last week, keeps the door open for the possibility of an interest rate increase at their December FOMC meeting.

What to Expect in the Final Quarter

While growth was strong last quarter, expectations are for the U.S. economy to slow this quarter, while still avoiding the widely anticipated recession that has been forecasted this year. Long-term bond yields have risen to levels not seen since 2007. Last week, the 10-year treasury yield briefly reached 5%, before settling around the 4.8% range at the end of the week. The current environment provides very attractive opportunities for conservative and balanced investors seeking additional income for their portfolios.

Talk to your advisor today discuss how our fixed income strategies can assist with keeping your portfolio on track. Your financial success matters to us!