Time in the Market vs. Timing the Market

April 4, 2022

By Jonathan Smith

Securities Analyst

As we wrap up the first quarter of 2022, we have learned that no one has a crystal ball to predict future events. There is a famous saying: “Time in the market beats timing the market — almost always.” That holds true especially in today’s volatile market climate.

This year, we have seen geopolitical headlines and U.S. economy news sway people’s emotions and how they determine whether or not to try to time the market or stay in the market.

What does “Market Timing” mean?

Market timing is an investment strategy that refers to any predictions an investor makes about the movement of a stock’s price on a certain day. Market-timing investors are essentially trying to beat the market through technical analysis using a variety of patterns and assessments.

One of the biggest challenges using this method is consistently identifying the best times to be in the market and when to get out. This strategy focuses on short-term trading to earn quicker profits. However, market trends can appear and disappear suddenly and randomly, which makes it difficult to time the market correctly.

What does “Time in the Market” mean?

“Time in the market” means that investors focus on long-term investment strategies. These investors concentrate on long-term goals, such as generating wealth or saving for retirement.

Investors who focus on time in the market employ the “buy and hold” strategy which focuses on identifying the fundamentals of companies. These same investors do not react to the daily market price volatile swings, but rather review their investments periodically to determine if broader adjustments are necessary.

Consistency matters

Occasionally, there have been investors who have been able to time the market by making the correct bet on market timing. However, it remains impossible to consistently and accurately predict the most suitable time to get in and out of the markets. Timing the market can be a very time-consuming approach, as analysts watch the market fluctuations throughout the day, waiting for that “right time”. This more active involvement from the analyst can actually result in higher trading fees and additional tax costs to the client.

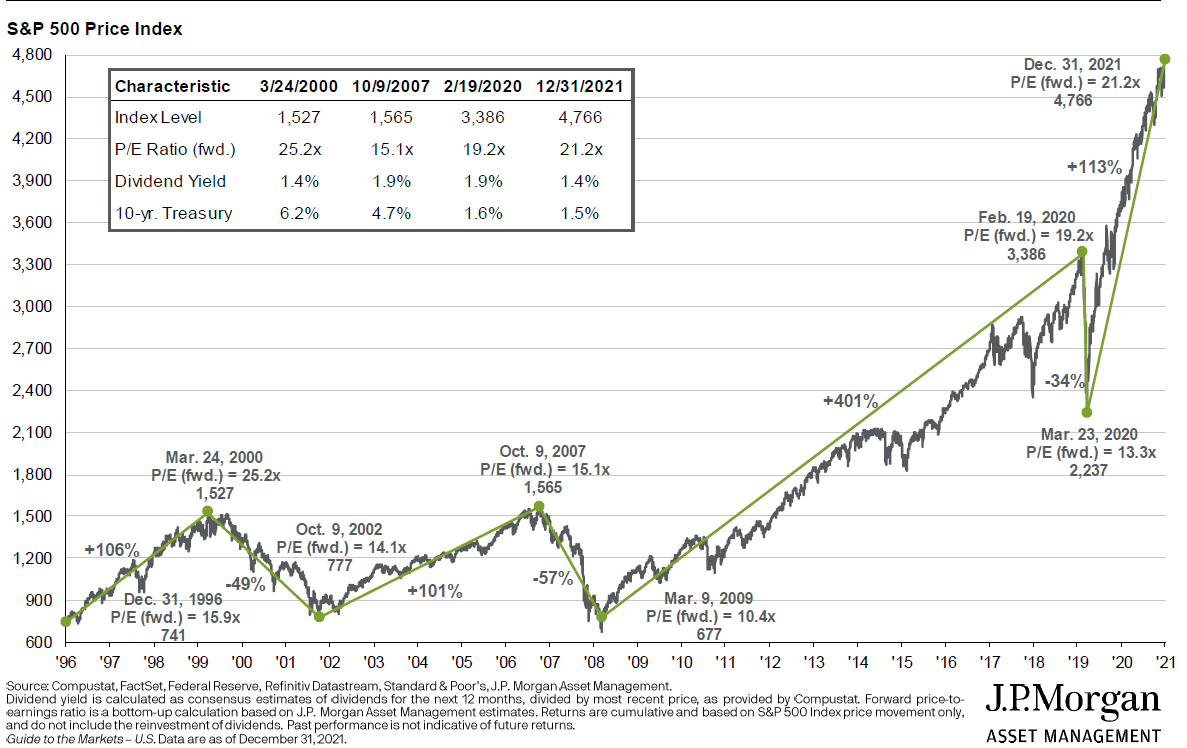

When expecting a significant drop, investors will often times get out of the market too early. However, if the market instead has a positive upswing, then the investors would miss out on positive returns. This year the S&P 500 index through February has declined 8.23%. Yet, it rebounded in the month of March gaining 3.8%. History has shown that staying invested and spending more time in the market produces better long-terms results. The chart below shows how markets have stayed resilient over the long-term, even while facing major political and economic events.

Even though the markets may experience periodic downturns, staying the course allows the investments to rebound and compound on market upswings. There is no crystal ball to let us know when to get in and out of the market on a regular basis. It is extremely important to be disciplined and stay the course. Contact your investment advisor if you would like more information on our investment approach.