People Pay: What is It?

Watch the video to learn more:

Frequently Asked Questions

This page offers a list of frequently asked questions regarding the Security National Bank “People Pay” feature, which you can use to pay another person through your online banking or mobile smartphone.

How much does People Pay cost?

Nothing. People Pay is a free feature for all Security National Bank customers, who either have an online banking login or the SNB Mobile App downloaded to their device.

What are the requirements to use People Pay?

- You must be an SNB Customer who is registered for online banking.

- To use People Pay on your mobile device, you must also download the SNB Mobile App.

- You will need to activate the People Pay feature on your online banking account using a tablet, laptop or desktop computer device.

-or-

You can also activate the People Pay feature in person, with a personal banker at a physical SNB branch location. Click here to set up an appointment.

How do I activate People Pay?

1. Log in to SNB Online Banking. If you’re new to online banking, enroll today. Or, contact us with questions or to learn more.

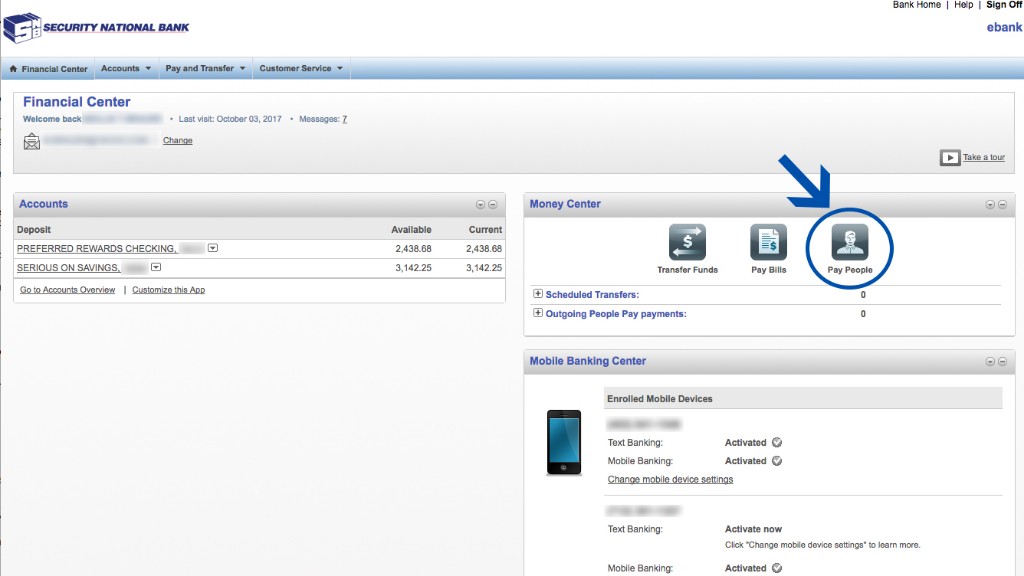

2. Click on the “Pay People” Icon on the upper right hand panel.

3. Agree to the terms and click “continue”.

4. Once your request for activation has been received, you will be contacted within 2 business days to verify your request for access to People Pay.

5. You will receive confirmation email when your request has been completed.

Questions? Contact us.

Do recipients need to be a customer of Security National Bank?

No. If the recipient is not a customer of SNB, they will receive an email or a text inviting them to claim their money through a secure link.

How does the recipient get their money?

They’ll receive an email or text message with a special, secure link to claim their money; and after entering their contact information and claim code, they can choose that the money be sent electronically to their own bank account or through PayPal.™

What if the recipient would rather receive a physical payment?

You may also choose to have Security National Bank send a printed check — free of charge — on your behalf to a designated mailing address.

Is there a transaction limit?

Yes. Transactions are limited to the funds available in your own bank account at the time of collection. For specific transaction dollar amounts, contact SNB.

What if my question isn't on this page?

For more information, or if you have additional questions, call (712) 277-6500 or contact Security National Bank online.

DON'T HAVE AN SNB ACCOUNT? GET STARTED TODAY.

Open a checking account online and experience better mobile banking with SNB.

OPEN AN ACCOUNT