A Historic Perspective: Managing AI Risk in a High-Growth Era

January 23, 2026

By Michael Moreland

By Michael Moreland

Retired Vice President - Investments

A Little Historic Perspective…

The older I get, the more useful I find comparisons of today’s events to similar episodes in the past. It helps provide a sense of perspective of the magnitude of today’s themes compared to ground-breaking efforts of prior eras.

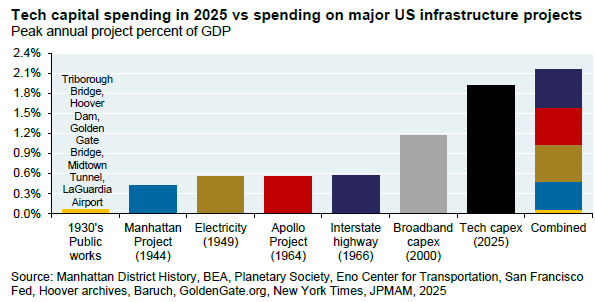

We’re all aware of the capital spending boom to build the infrastructure to support and expand usage of artificial intelligence (AI) across industries and in our daily lives. How pronounced is this? The chart below from Michael Cembalest, Chair of Market Strategy for J.P. Morgan, is clear evidence:

Through 2025, about 2.0% of our nation’s GDP was related to building out data centers, power sources, and applications for the continued expansion of AI in the world’s economy. This far outstrips the expansion of broadband capabilities a quarter-century ago. And, it is almost equal to the total expenditures of major projects (as a percentage of GDP) going back almost a century – the Depression-era public works, the Manhattan Project, the completion of a unified electrical grid and interstate highway system, and the Apollo moon landings. Incredible.

It's also interesting (to me, at least) that the expansion of AI is behind-the-scenes to most of us. We all enjoy the benefits of interstate highways (maybe enjoy is too strong a word). The Golden Gate Bridge and Hoover Dam fill us with a sense of awe. And the Apollo project still provides an undiminished sense of pride.

We don’t get the same sense of accomplishment from the expansion of AI in our lives. We all use search engines, chatbots, and perhaps ChatGPT, but it’s difficult to visualize these advances and how they will provide additional benefits moving forward. But it is a certainty they will.

In this context, the recent domination of technology themes in market performance makes sense. As noted in our Winter 2026 Economic & Market Commentary, over two-third of the S&P 500 returns since the introduction of ChatGPT in late 2022 have been derived from entities involved in generative AI.

J.P. Morgan identifies 42 companies in this universe, from hyperscalers (a new word to most of us) like Meta and Alphabet, to chip manufacturers (Nvidia is the largest), AI utilities (such as NextEra), and AI capital equipment (Johnson Controls among others).

Are these companies expensive? Absolutely. At the same time, a healthy exposure is proper to insure participation in the expansion of AI in our economy and daily lives. This presents a conundrum to conservative, value-oriented investors. How do we provide ownership while staying true to a proven philosophy?

The answer is diversification. Portfolios under Security National Bank management are well-represented in AI-related themes. We are, however, cognizant of valuations and focus our attention on those entities with the best reward-to-risk metrics. And, we balance these exposures with broad representation in non-technology areas, inexpensive international markets, and high-quality fixed income. This helps to provide a balance of risk and reward which, over time, will provide our clients a consistent and predictable path to their financial goals.

Talk to your Investment Manager and Advisor to see how we are navigating this environment for you. Your success matters to us.