2025 Resolution: Boost Your Retirement Now!

January 6, 2025

By Samuel Richter CFP®

By Samuel Richter CFP®

Senior Securities AnalystHappy New Year! I hope everyone had a great holiday season with friends and family. As we start the New Year, many people create New Year’s resolutions. Common resolutions include eating healthier, exercising more, or learning something new. While all are great resolutions, one more to consider is saving more for retirement.

The Snowball Effect of Compounding Growth

Don’t delay increasing your retirement account contributions. The earlier you increase your contributions, the more you benefit from the power of compounding growth. Compounding growth is like a snowball rolling down a hill. The larger the snowball gets, the faster it continues to grow. For your retirement account, you receive the growth from the original contributions plus the additional reinvested earnings that have accumulated over time.

Many experts now recommend contributing at least 15% of your annual income (including any employer match) into a retirement account. Everyone has his or her own financial situation. Therefore, jumping straight to that threshold is not a feasible option for everyone. Making small increases each year is a great way to make progress and benefit your future self.

Big Benefits to Step-Up Contributions

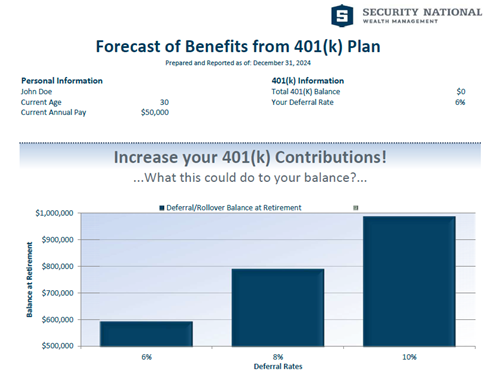

The example below shows what increasing your contributions could do for your balance at retirement. For John Doe, increasing his deferral rate by 2% could add roughly $200,000 to his balance by the time he retires at age 67. Making the changes now can help you achieve your future retirement goals.

Small increases to your contributions today can make a huge difference in funding your retirement goals. Contact us today to find out if you are on track for retirement. Your financial and life success matters to us! Let us help you reach your goals.