Investing Vs. Speculation: The Father of Value Investing Perspective

February 17, 2026

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsMarkets have a funny way of convincing us that this time is different. New technologies. New political risks. New economic regimes. Yet there’s one investor whose ideas continue to cut through that noise decades later, it’s Benjamin Graham. Graham, a renowned economist and professor at Columbia University, is often referred to as the “father of value investing” and was a mentor to famed investor Warren Buffett. Writing through wars, recessions, bubbles, and recoveries, Graham understood something many investors still forget: markets change constantly, but human behavior rarely does. That’s why three of his core ideas feel especially relevant today.

Headline Risk

The first is his famous observation that in the short run the market is a voting machine, but in the long run it’s a weighing machine. In simple terms, prices can be driven by opinion, emotion, and headlines for long stretches of time, but eventually they reflect underlying business value. If you step back and look at today’s environment, it’s easy to see the voting machine in action. Daily market moves are often influenced by interest-rate expectations, election developments, geopolitical tensions, or the latest AI headline. Entire sectors can surge or stall based on shifting narratives rather than fundamental change. None of this is new.

Graham saw the same dynamic in his era, just with different headlines. His point wasn’t that short-term market moves are meaningless. It was that they’re unreliable guides for long-term decisions. Over time, earnings, cash flow, valuations, and balance sheets matter far more than sentiment. Investors who anchor their decisions to those fundamentals tend to navigate volatility more successfully than those who chase whichever theme happens to be popular at the moment.

Bonds as a Ballast

Another Graham principle that feels newly relevant is his appreciation for bonds as a stabilizing force in portfolios. For much of the past decade, bonds were easy to overlook. Yields were historically low, returns were modest, and equities dominated performance conversations. Many investors began to think of fixed income as optional rather than essential. Today the environment looks very different. With yields back in more normal ranges, bonds once again offer something they lacked for years: meaningful income and a credible alternative to equities.

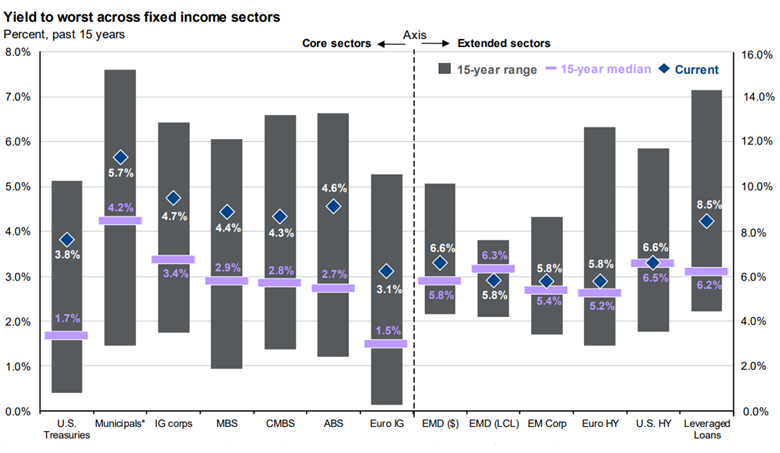

That shift changes the math of portfolio construction. When high-quality bonds can generate real yield, they provide both diversification and flexibility. They can cushion volatility, fund spending needs, and create dry powder for future opportunities. The chart below from J.P. Morgan highlights current yields (blue diamonds) across several fixed-income sectors alongside their 15-year ranges (gray bars) and historical averages (purple markers). While yields have pulled back from recent highs, they remain comfortably above long-term averages, presenting a more attractive income opportunity than investors have seen in years.

Data as of 2/17/2026. Source: J.P. Morgan

Graham always believed bonds deserved a permanent place in portfolios not because they were exciting, but because they were dependable. In a world where uncertainty remains elevated and growth is moderating rather than accelerating, that kind of dependability is suddenly attractive again. Many institutional outlooks today echo this logic, emphasizing balanced allocations and income-producing assets rather than the equity-heavy positioning that dominated during the ultra-low-rate era.

Valuations Matter

Graham was also careful to distinguish between investing and speculation, a distinction that may be more important now than at any point in recent memory. He defined investing as a disciplined process grounded in analysis and long-term expectations, while speculation was driven primarily by price movement and emotion. Importantly, he didn’t condemn speculation outright. He simply insisted investors should recognize which activity they were engaged in.

That distinction can be easy to lose sight of during periods of excitement, particularly when new technologies or themes capture public imagination. Today’s enthusiasm surrounding artificial intelligence, automation, and innovation broadly shares similarities with past periods when investors projected rapid growth far into the future. Innovation can absolutely create lasting value, and many transformative companies have justified investor optimism over time. But Graham would likely caution that enthusiasm alone is not a strategy. Participating in innovation can be wise; overpaying for it is not. The difference lies in valuation discipline and realistic expectations. That mindset closely aligns with how many professional investors are approaching markets now: constructive on long-term innovation trends, but increasingly selective about price and positioning.

Conclusion

Taken together, these ideas form a framework that feels almost tailor-made for the current cycle. Markets remain sensitive to headlines, yet fundamentals still drive long-term results. Bonds have regained relevance as yields have normalized. And the line between investing and speculation continues to blur whenever excitement runs high. Graham’s lasting contribution wasn’t predicting the next market move. It was teaching investors how to think when uncertainty is unavoidable. His philosophy suggests that success doesn’t come from reacting faster than everyone else. It comes from staying grounded while others get swept up in the moment.

That perspective can feel almost counterintuitive in a world of real-time news and constant market commentary. As history has a way of rewarding discipline. Investors who focus on business value rather than market noise, who maintain balance rather than chase extremes, and who understand the difference between speculation and investment tend to make steadier decisions over time. Graham understood that markets will always test patience. He also understood that patience, more often than not, is exactly what leads to better outcomes. Please reach out today with any questions you may have. Your financial success matters.