What a "State of Wall Street" Address Would Sound Like

January 28, 2019

By Michael List, CFP®

Portfolio Manager

Every year around this time, the President provides a report to a joint session of the United States Congress. Looking past the politics, today I wanted to shed light on the state of corporate America:

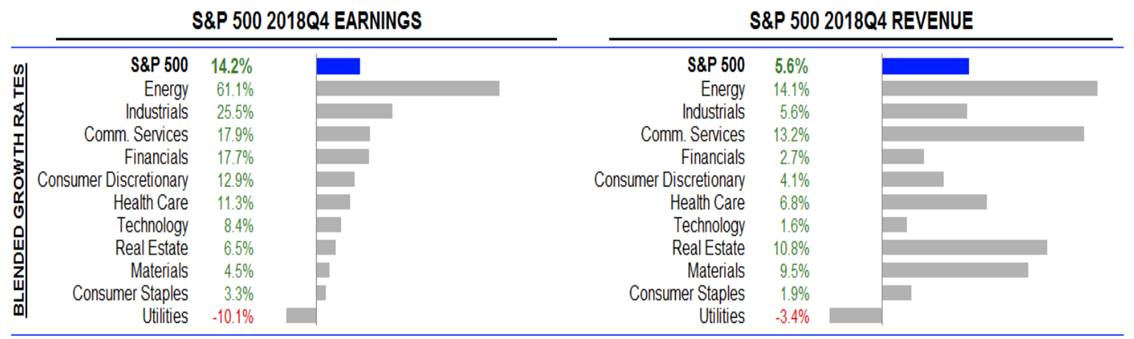

“We are a quarter of the way through earnings season, and as expected, results have been strong. Average earnings per share have increased 14.2 percent from a year ago.”

[*Pause for applause]

“Seventy percent of companies have beaten analysts’ earnings expectations.”

[*Pause]

“Ten of the 11 sectors are reporting earnings and revenue growth.”

[*Pause].

“Companies project revenue and earnings to increase around 6 percent during 2019.”

[*Last Pause — otherwise this summary will last two hours].

Source: I/B/E/S data from Refinitiv

How is the Market Reacting?

The market has been reacting to earnings calls as expected. Stock prices for companies that have beat or met earnings expectations have been positive, while companies that had disappointing results underperformed. If you would like more information on quarterly earnings for stocks in your portfolio, reach out to your wealth advisor today.

We wish you all the best in 2019. Thank you, and God bless America.