Turkey 5 Takeaways: What Holiday Spending Really Tells Us

December 8, 2025

By Eric Johnson

By Eric Johnson

Securities AnalystGone are the days of crowds lining up outside big-box stores, ready to battle over a discounted flat-screen TV. In its place are multi-day promotions shoppers browse from the couch. Even with this cultural shift, the “Turkey 5” (the five days from Thanksgiving through Cyber Monday) still marks the kickoff to the holiday shopping season and offers a window into the biggest driver of U.S. economic growth: consumer spending. This year’s results were a mixed bag, with the headline numbers telling only part of the story.

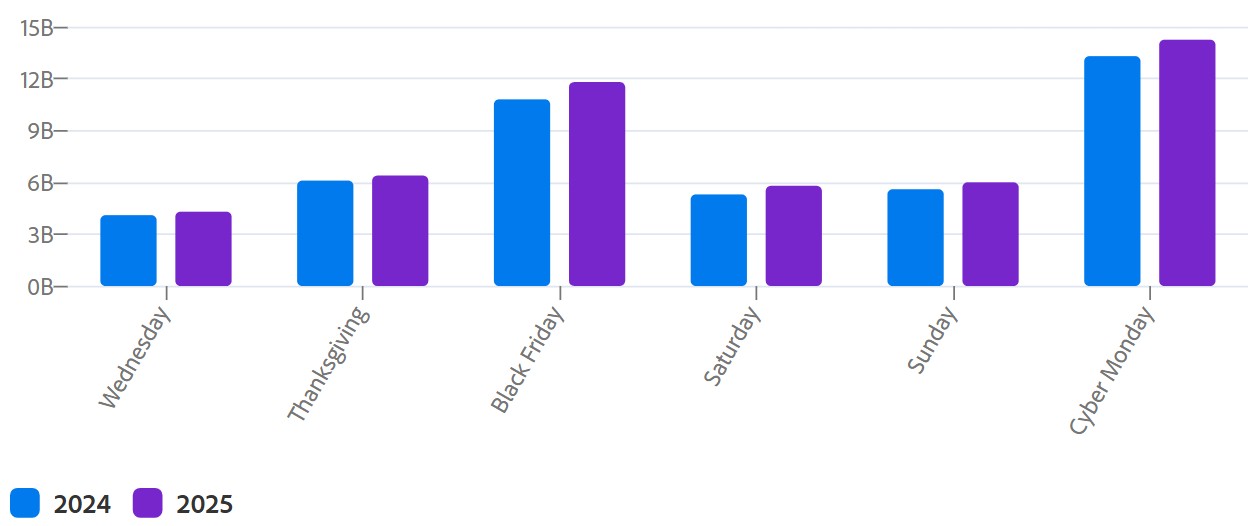

The National Retail Federation (NRF) estimates 202.9 million Americans shopped during that five-day stretch, well above expectations of 186.9 million and the highest turnout since the survey began in 2017. Spending also started earlier than ever. According to Adobe Analytics (shown below), U.S. consumers spent $4.3 billion online the Wednesday before Thanksgiving, setting the tone for the days ahead. Black Friday saw $11.8 billion in online spending and Cyber Monday reached $14.3 billion, up 9.3% and 7.3%, respectively, from 2024. Among product categories, cosmetics, grocery items, and toys posted the fastest year-over-year growth. Altogether, consumers spent $44.2 billion over the five days, a 7.7% increase from last year.

Source: Adobe Analytics

This strength, however, looks softer beneath the surface. Adobe noted buy-now-pay-later (BNPL) usage grew faster than overall holiday spending. This suggests many shoppers are leaning on short-term debt to finance purchases. Data from Salesforce paints a similar picture. They found U.S. Black Friday sales rose 3% compared to 2024, but the average selling price of items increased 7%. That implies gains were driven by higher prices more than stronger demand.

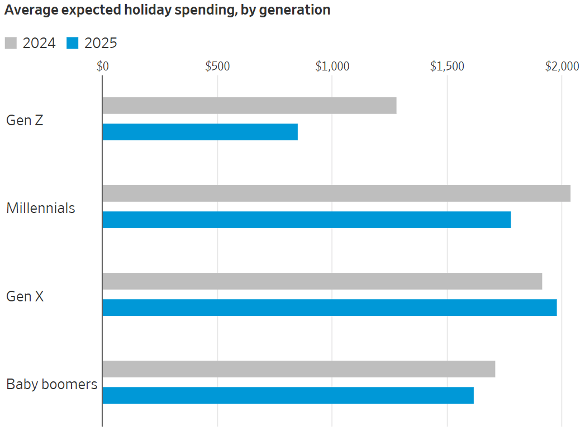

A closer look at generational spending helps explain why. A Deloitte survey (shown below) shows most age groups expect to trim holiday budgets this year, with Gen Zers (born 1997–2012) cutting back the most. Only Gen Xers (born 1965–1980), now in their peak earning years, expect to spend more. For younger and lower-income consumers, high price levels, elevated long-term interest rates, and a weakening labor market are squeezing budgets. These pressures are prompting cutbacks in discretionary categories such as gifts, travel, and dining out. Even with those strains, it’s important to remember who drives overall spending. The top 10% of earners account for nearly half of all U.S. consumption, meaning holiday sales can look resilient even if a large share of shoppers pulls back on spending.

Source: Wall Street Journal

To summarize, businesses experienced a record number of shoppers and dollars spent during this year’s Turkey 5. However, much of the growth likely reflects higher prices and greater reliance on debt rather than broad-based demand. The balance of these forces will shape how the rest of the holiday season plays out. As the data evolves, our team is here to help you separate signal from noise and stay on course toward your financial goals. If you have any questions about our outlook, please reach out to an advisor today. Your success matters to us.