A Game Plan For Success: Portfolio Rebalancing

January 22, 2024

By Tom Limoges

By Tom Limoges

VP - InvestmentsLast weekend, football fans witnessed some exciting football games. All of the games were close and featured exciting throws and catches by some of the league’s best playmakers. A well-executed game plan and flexibility to adjust to adversity are keys to success on Sundays. Similar to football, investing in financial markets requires a solid plan and a rebalancing strategy to adjust to changing market conditions. Let's explore why rebalancing investment portfolios and football teams are essential for achieving long-term goals.

What is Rebalancing

Portfolio rebalancing involves regularly adjusting the investment portfolio’s asset allocation to match the target exposure identified within the investment plan. A portfolio with a target allocation of 60% stocks and 40% bonds can see fluctuations in allocations as markets go up and down. If stocks rose during the year compared to bonds, the increase in value would cause the portfolio to become overweight in stocks. The process of rebalancing involves selling some stocks to re-align the portfolio back to the original target. This process is often performed annually but can occur more frequently because of changing market conditions and investment performance.

Managing Risk and Defense

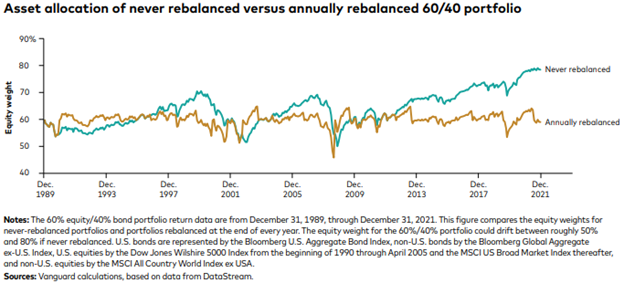

Football teams focus on a solid defense to mitigate the risk of conceding goals. Likewise, investors use portfolio rebalancing as a defensive strategy, minimizing risk by adjusting asset allocations and diversifying holdings. One of the most important reasons to rebalance an investment portfolio is to keep the portfolio’s risk in-line with the investor’s expectations. The chart below comes from a study by Vanguard research. The chart shows what happens over time if a portfolio is never rebalanced vs. being annually rebalanced. Over a longer term time period, the never rebalanced portfolio had a higher allocation to stocks and higher risk exposure.

Buy Low Sell High

Like the thrill of your favorite football team scoring the game winning touchdown as time expires, investing can pull at your emotions as well. A really strong stock market can produce a feeling of euphoria, as the value of your account moves higher. Just the opposite, a declining market can cause investors discomfort as losses occur. The process of rebalancing creates a systemic approach to investing that reduces the emotional impact as you are following a plan. It forces investors to buy when the markets are cheap and sell when assets appreciate and take profits. Depending on the situation and type of investment account (taxable vs. retirement), capital gains and taxes will need to be factored into the equation. Paying taxes on gains can also raise a whole new set of emotions!

Our Take on Regular Rebalancing

Over the course of the first quarter, we will be rebalancing our client portfolios to position for the upcoming year. In addition to positioning portfolios back to targeted allocations, we will look to position them for market opportunities. Fixed income portfolio rebalances will provide a slight boost in yields, a pickup in credit quality, and an extended maturity as the Fed approaches the end of its rate hike cycle. Stock portfolios will still see a continued slight tilt towards defensive sectors of the market as they perform better in late cycles. Both stock and bond portfolios will see a reduction in overall fund fee expenses.

At Security National Bank, we believe that regular portfolio rebalancing is a fundamental tool that empowers investors to navigate changing market landscapes, manage risk effectively, and optimize returns over the long term. Just as football teams refine their playbooks to stay competitive, investors must regularly reassess and adjust their portfolios to navigate the dynamic landscape of financial markets successfully. Strategic play, whether on the field or in the market, is the key to achieving sustained success. Please reach out to your Financial Advisor to review your playbook. Your success and future matter to us.