The Magnificent Seven's Double Edge Sword

August 11, 2025

By Matt Andera

By Matt Andera

Securities AnalystWe are approaching the halfway point of the third quarter, and equities have continued to advance from their April lows. While early in the quarter there was a resurgence of “meme stocks” and speculation, company fundamentals came back into focus as second quarter earnings season got underway. Publicly traded companies are required to release financial performance quarterly so investors can have a look under the hood, so to say. After cautious guidance was provided by company executives at the end of the first quarter due to tariff uncertainty, second quarter’s results are largely coming in better than expected.

Earnings Outpace Expectations

The S&P 500 overall has reported strong results for the quarter. With 90% of companies reporting as of August 7th, 81% beat analyst expectations for both earnings and revenue. In aggregate, earnings are 8.4% above estimates and represent growth of 11.8% from the year ago period. Revenues are 2.4% above estimates and represent growth of 6.3% from a year ago. Leading the charge are familiar “Magnificent Seven” names such as Alphabet, Microsoft and other companies with ties to AI.

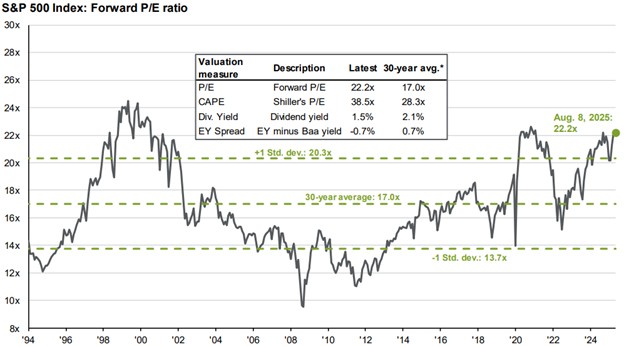

Positive earnings and forward guidance have provided relief from tariff uncertainty, and are encouraging for growth in the near term. However, a prudent investment strategy remains important moving forward to manage dynamic risks. Valuation metrics such as the Forward P/E ratio, or stock price relative to the earnings companies are expected to generate over the next twelve months, have returned to the stretched levels seen towards the end of 2024 and are well above historical averages.

Source: JP Morgan Guide to the Markets as of 08/08/2025

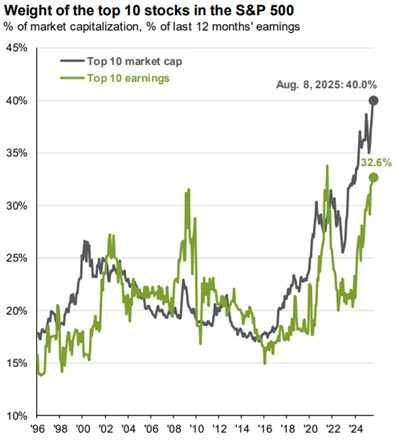

Additionally, the ten largest companies by market capitalization in the S&P 500 now account for an astounding 40% of the index, represented below by the grey line.

Source: JP Morgan Guide to the Markets as of 08/08/2025

The Challenge Facing Diversification

What does this mean for investors? Holding an S&P 500 index fund is not exactly the diversified investment that it was in years past. There is some justification for this concentration, which can be seen by the green line in the chart above: these ten companies account for 32.6% of overall index earnings. However, concentration leaves the index more vulnerable if confidence in these industry titans starts to waver. We saw this firsthand earlier this year.

Despite U.S. stocks continuing to notch all-time highs, international equities have been the top performers this year and continue to be priced favorably to U.S. issues. While we welcome the performance of these U.S. tech giants, there is a correlation between current valuations and future returns over longer time horizons. We continue to believe there is value in more attractively priced areas of the market, both in the U.S. and abroad. Much of the AI-themed investment performance so far has come from companies developing the technology. But there are many industries poised to capitalize on efficiency gains produced by AI. To further discuss how we are navigating market concentration, please

reach out to your advisor. Diversification in your portfolio matters to us.