Fed Watch: Another Cut, and Why it Matters

December 15, 2025

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsLast week’s Federal Reserve meeting didn’t bring any big surprises, but it did send a clear message. The Fed cut interest rates again, continuing a series of cuts that resumed earlier this year. In total, rates have now been lowered by 1.75 percentage points since 2024. This move was not about jump starting the economy or declaring inflation “fixed.” It was about managing risk. Economic growth is slowing, the job market is losing momentum, and waiting too long to act creates bigger problems down the road.

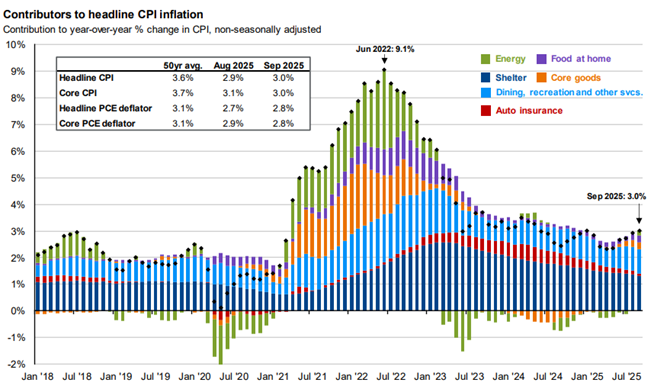

This backdrop matters. Inflation cooled meaningfully from its highs, but progress has been uneven. Core measures drifted back toward the low-3% range, and recent pressure is concentrated more in goods than services as shown in the chart below. Tariff-related price effects appear to be fading rather than compounding, and producer-level inflation has been even more subdued than consumer inflation. Price levels remain elevated, but the direction of travel improved enough to give policymakers room to act without abandoning credibility.

Source JPM Guide to the Markets 12/11/2025

Source JPM Guide to the Markets 12/11/2025

The labor market is where the Fed’s attention increasingly sits. Hiring has slowed, job growth softened, and re-employment is taking longer. While layoffs remain contained, the environment shifted from one defined by worker shortages to one characterized by weaker labor demand. Wage growth cooled alongside that shift, reinforcing the view labor demand, not supply constraints, is doing most of the work. This is not recessionary behavior but warrants caution.

Source JPM Guide to the Markets 12/11/2025

That explains why the Fed moved again. With policy already restrictive and monetary lags still working through the system, the risk of overtightening has grown. This was an insurance cut. The goal was not to reignite growth, but to reduce the probability restrictive policy unnecessarily deepens a slowdown already underway.

Fed communication reflected that balancing act. The decision itself was close, and the committee remains divided on timing rather than direction. Importantly, no one is talking about rate hikes. The debate is about how quickly to ease and how much insurance is appropriate as inflation slows and labor risks rise. The dot plot still signals restraint, but policymakers have been clear projections are conditional, and data will ultimately decide the path.

Source: The Daily Shot 12/11/2025

Markets took the message in stride. Treasury yields moved lower, particularly in the intermediate part of the curve, reinforcing the idea the peak in policy rates is behind us. At the same time, funding markets remain tight at the front end. Elevated Treasury bill issuance and declining system liquidity kept overnight and short-term funding rates under pressure, even as the Fed cuts. That tension helps explain why easing financial conditions and pockets of funding stress can coexist.

Equities responded constructively but without exuberance. Valuations remain elevated, leadership remains narrow, and earnings durability continues to matter more than policy headlines. The broader tone across recent outlooks can best be described as responsibly bullish: growth is expected to persist into 2026, supported by easing monetary policy, fading tariff headwinds, fiscal support, and productivity gains, even as labor remains the key swing factor.

The consumer picture fits that narrative, as well. Spending cooled from earlier in the year, particularly among lower-income households, while higher-income consumers continue to carry a disproportionate share of demand. Holiday spending has been solid but measured, with little evidence households are leaning excessively on credit. That combination points to resilience, not acceleration, and reinforces the Fed’s preference for gradualism.

Taken together, the Fed’s latest move aligns cleanly with the broader research backdrop. Growth is slowing, not stalling. Inflation risks are shifting from demand-driven pressures toward policy and supply dynamics. Financial conditions are supportive overall, even if liquidity remains uneven.

For investors, the implications are familiar. Rate cuts reprice risk rather than eliminate it, making diversification essential. As growth moderates, quality matters more with balance sheets, cash flow, and pricing power taking center stage. Fixed income has regained relevance, offering attractive income and diversification even if the easing path remains gradual. The Fed is no longer fighting inflation at all costs. It is managing economic risk in a more complex environment. Historically, that transition rewards patience and discipline far more than bold forecasts. If you have any questions about our outlook, please reach out to an advisor today. Your success matters to us.