How Labor and Inflation Affect the Battle Over Interest Rates

August 4, 2025

By Eric Johnson

By Eric Johnson

Securities AnalystThe Federal Open Market Committee (FOMC) met on July 30 to discuss rate changes. Policy members elected to hold rates steady, despite the recent pressure from President Trump to lower them. This decision, however, was not unanimous. Two Federal Reserve (Fed) Governors, Christopher Waller and Michelle Bowman, dissented, favoring a 0.25 percentage point rate cut. This marked the first time since 1993 two Governors opposed the majority. Interestingly, both Waller and Bowman were appointed by President Trump during his first term. Both justified their divergence by citing the slowdown in job creation and the need to ignore tariff-induced inflation. Let’s break down these topics.

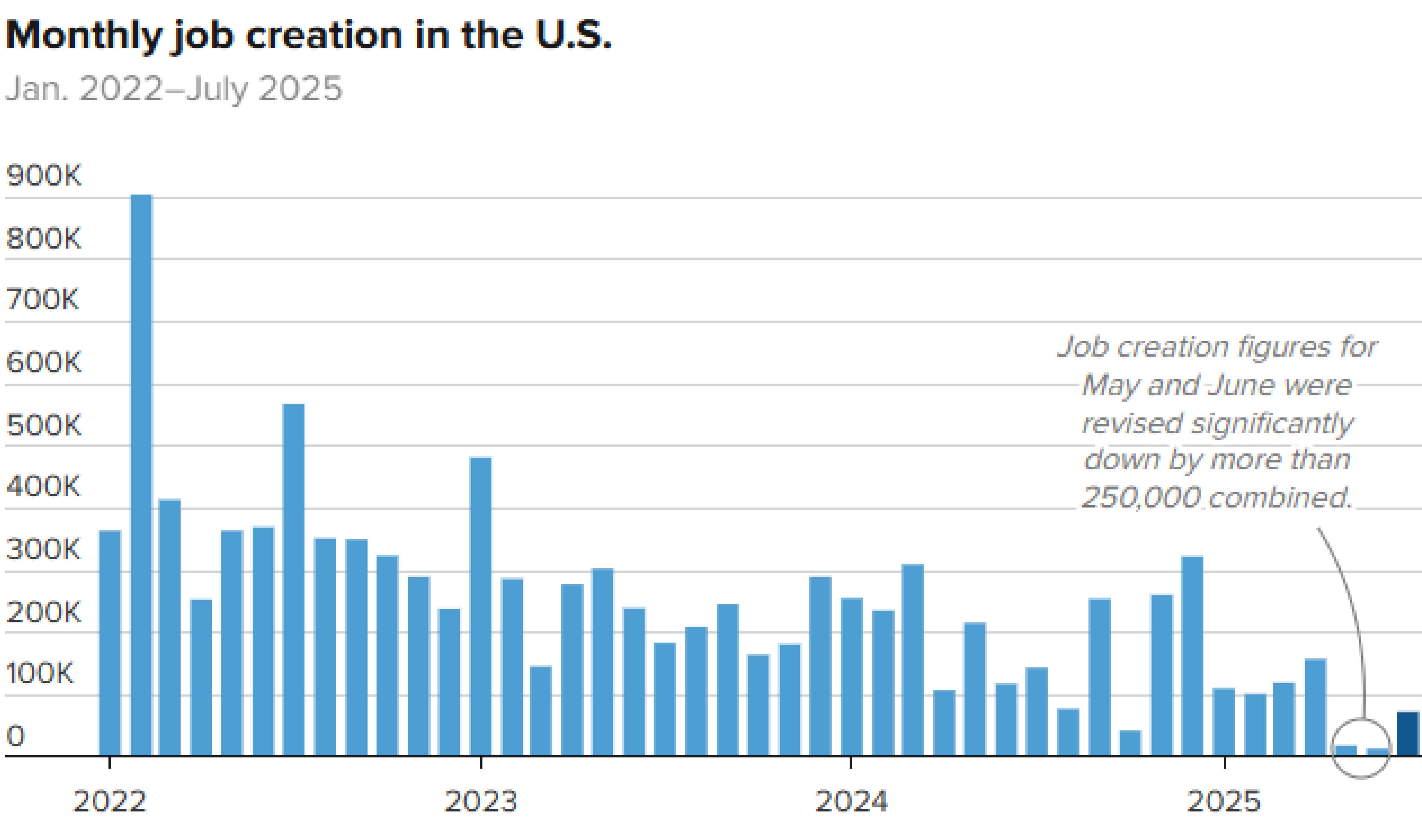

Labor Market

On August 1, the Bureau of Labor Statistics released its latest Employment Situation report. It revealed payrolls grew by just 73,000 in July and the unemployment rate ticked up 0.1 percentage points to 4.2%. More importantly, revisions to prior reports were larger and more negative than usual. Job gains were adjusted from 144,000 to 19,000 in May and from 147,000 to 14,000 in June, making the 3-month average a pitiful 35,000. A labor market considered healthy 24 hours ago suddenly does not feel so stable, as illustrated with the chart below. Uncertainty stemming from tariffs, inflation, and growth paired with government layoffs and a lack of immigration have clearly weighed on the labor market.

Source: CNBC

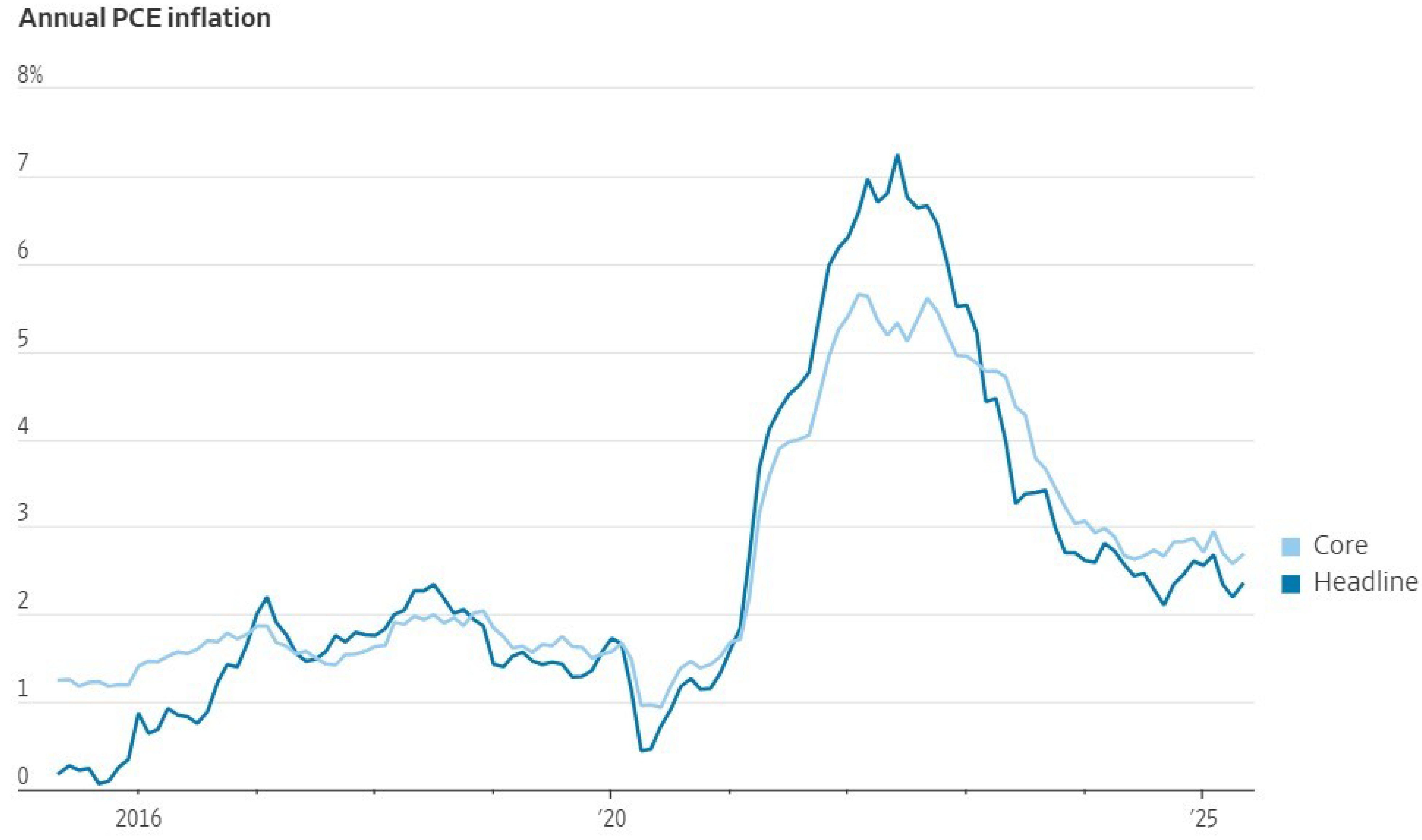

Inflation

Recent data shows prices have markedly risen for goods most affected by tariffs, such as toys, appliances, and furniture. Yet overall inflation remains stable, suggesting tariffs may have a smaller impact on inflation than previously thought. According to the latest Personal Income and Outlays report by the Bureau of Economic Analysis, Core Personal Consumption Expenditures (PCE) inflation, which excludes volatile food and energy prices and is the Fed’s preferred measure of inflation, increased 2.8% since last year, as shown below. Economic theory says tariffs lead to a one-time increase in price levels and, therefore, the Fed should “look through” tariff-induced inflation when conducting monetary policy.

Source: Wall Street Journal

Despite slowing job growth and moderate inflation, the Fed remains cautious because it is unclear where tariff rates will settle, whether retaliation will follow, or how these developments will affect inflation expectations. Furthermore, the unemployment rate continues to be near historic lows, making it tough to concretely say the labor market needs saving. To support Waller and Bowman’s argument, the current estimate for consumer spending growth in the first half of 2025 is a seasonally-adjusted 1% annualized rate, well below the 4% rate in the last quarter of 2024.

While dissents are rare for the Fed, it is not inherently bad. In fact, it signals they are having active, dynamic conversations and not falling victim to groupthink. If anything, it is proof of how difficult it is to project an economic outlook with any confidence right now. At a time when economic uncertainty is high, our value-driven investment philosophy of broad diversification is designed to weather all cycles. If you have any questions regarding the economy or markets, please reach out to your advisor today if you have any concerns. Your financial success matters to us.