Inflation and the Stock Market: A Brief History (and a Prediction)

November 22, 2021

By Mike Moreland

By Mike Moreland

VP - Investments

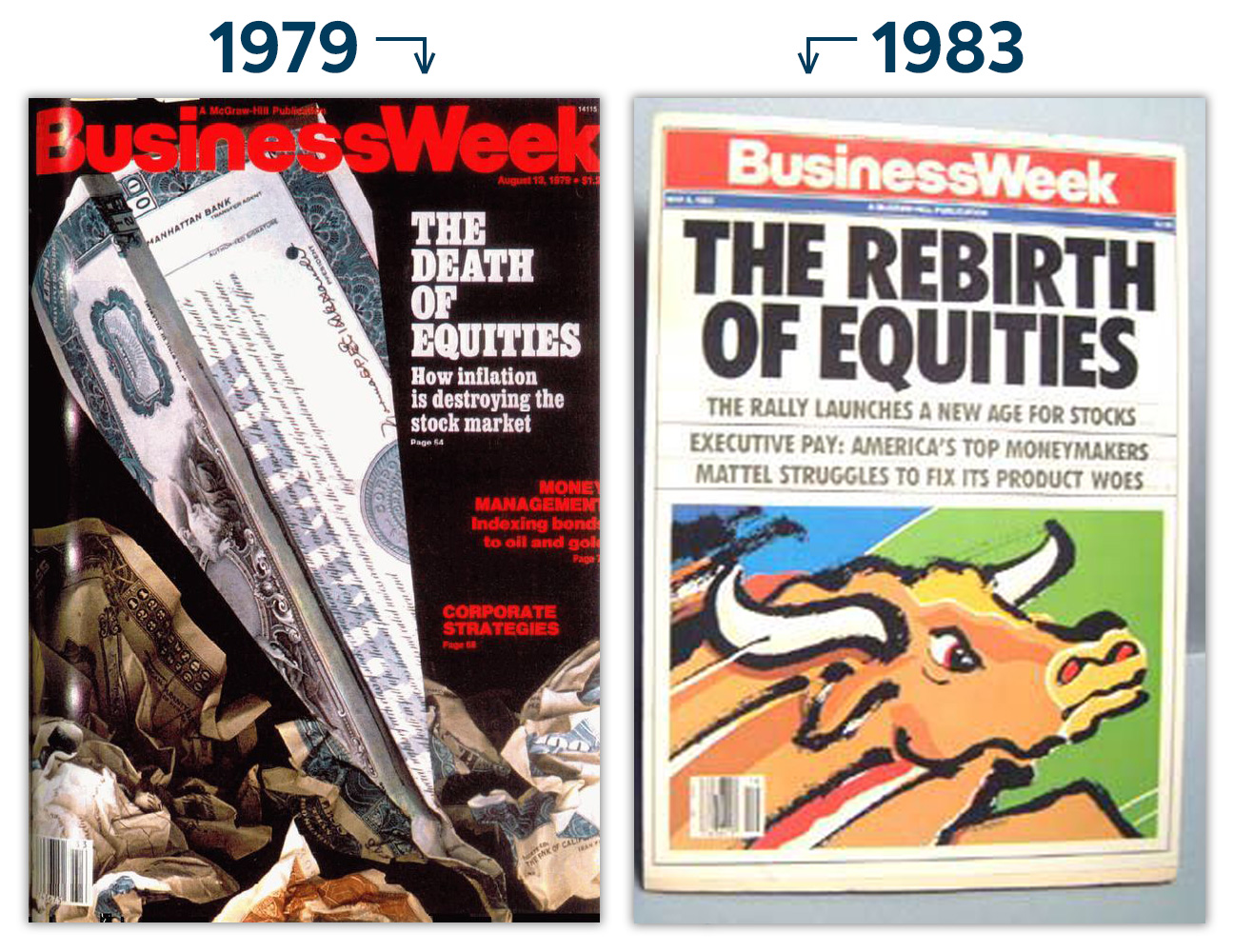

In 1979, Business Week famously declared ‘The Death of Equities’, laying out the impact of runaway inflation on stock prices. The Dow Jones Industrial Average was 875 (no zeros behind it) on the day the issue hit the newsstands. Shortly thereafter, Paul Volcker assumed leadership of the Federal Reserve, and through dramatic steps, wrung the economy free of double-digit inflation. Activity recovered from the deep recession accompanying this action, and equity markets began their multi-decade run to today’s heights.

Along the way

In the early 1990s, however, there was a bump in the road. Inflation began to creep up. Longer-term interest rates rose as buyers (then dominated by large financial institutions) backed away from the markets. The financial press characterized this as a ‘buyers’ strike’; the outcome was ‘the great bond massacre’, and the participants became known as ‘bond vigilantes’. Their collective goal was to force the federal government to rethink its taxing and spending policies in order to keep value-eroding inflation in check.

It largely succeeded. James Carville, President Clinton’s political advisor, was quoted as saying, ‘I used to think that if there was reincarnation, I wanted to come back as the president or the Pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.’

The power of bond vigilantes to influence policy decisions is greatly diminished today. As noted in a Wall Street Journal editorial, How the Fed Rigs the Bond Market, Federal Reserve purchases of U.S. Treasury debt absorbed 60% to 80% of the annual fiscal deficits under its Quantitative Easing programs since 2010. No public buyers of U.S. debt? No problem. The U.S. simply creates the cash in one pocket (the Fed) and puts it in its other pocket (the Treasury). Life goes on, interest rates stay low, and the debt burden builds.

"If something cannot go on forever.."

Let’s remember Stein’s Law, expressed by economist Herbert Stein in 1986: ‘If something cannot go on forever, it will stop.’ The Fed has already signaled it will taper and end its bond-buying activity by mid-2022, and individual Fed governors are suggesting a more rapid wind-down. The outcome? Today, the yield on ten-year U.S. Treasury notes is a full three percentage points below the inflation rate. Longer term yields will likely rise in the absence of the Fed’s support.

This will create challenges for the equity markets in 2022. On the positive side, there’s a tremendous amount of stimulus liquidity looking for a home. This will support prices. At the same time, the last remaining valuation advantage of stocks is that bond yields are even less attractive. That will change – to the detriment of equities.

Our view

We’ve said before that valuation is not a timing device. It cannot be ignored, however. Our practice is to stay fully invested. We will continue to do so, but will structure our portfolios conservatively with a focus on risk control. This may sacrifice some upside, but should help preserve value in the less favorable environment we believe is ahead. Protection of wealth matters to you – and to us. Reach out to our advisors with any questions you have.

ABOUT THE PHOTO: These covers appeared on the Aug. 12, 1979 issue and May 9, 1983 issue of Businessweek Magazine. Credit: BusinessWeek/Bloomberg