A Positive Outlook - With a Caveat

July 21, 2025

By Michael Moreland

By Michael Moreland

Retired VP - Investments“It is difficult to make predictions, especially about the future.” This line has been attributed to such diverse people as Niels Bohr, a Nobel laureate physicist, and Yogi Berra, a Hall of Fame baseball player and dugout philosopher.

This phrase is particularly applicable today. If the topic isn’t tariffs, it’s the One Big Beautiful Bill just enacted. If it’s not inflation, it’s whether President Trump will push Jerome Powell out the door in favor of a more accommodative Fed Chair. There are always causes for concern – it just seems there are more today with a wider range of outcomes than we want to see.

Surprising to many, most recent economic reports have been much better than early projections. This certainly explains the strong behavior of U.S. stocks in recent weeks. Still, uncertainties abound, and while positive news is to be applauded, it’s inappropriate to ‘throw caution to the wind’.

What does this mean for SNB’s management of your wealth? First, we want to reiterate our confidence in the U.S. economy and financial markets. Portfolios under our care are essentially fully invested, with emphasis on broad diversification, high quality, liquidity, and reasonable valuations.

These considerations are the foundations of our investment philosophy. We discuss this at length in the Summer Economic and Market Commentary . While we are positive on our economic prospects, we always ask, ‘What if we’re wrong?’ That’s how our disciplines pay dividends for our clients in good times and bad.

Of these disciplines, attention to valuation is paramount. And, unfortunately, U.S. equity valuations are problematic for today’s investors.

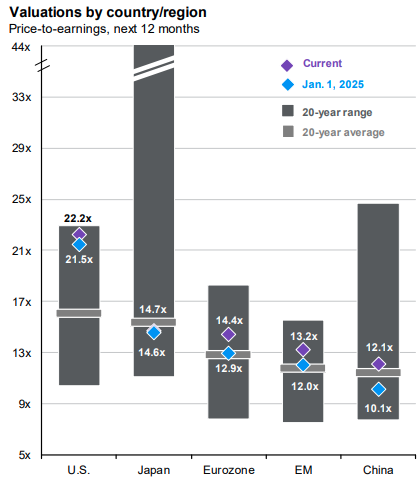

The primary equity valuation measure is the price-to-earnings (P/E) ratio. The higher the ratio, the more expensive it is to buy a dollar of the underlying company’s profits – and the longer it takes to ‘earn back’ the initial investment. And, history shows that high starting valuations are associated with generally lower returns over following years. And today?

Source: J.P. Morgan Guide to the Markets as of July 18, 2025

The above chart shows U.S. equity valuations – led by technology favorites – are near the top of their twenty-year range and well above those of all other developed markets. This leads us to have a healthy presence in non-U.S. markets. Not only are the opportunities for multiple expansion greater, but the price risks are lower. This has worked well – international stock exposures have been the stars of diversified portfolios thus far this year. In addition, history shows that non-U.S. markets tend to outperform during periods of a weaker dollar – as has been the case in recent months. As Mark Twain said, ‘History doesn’t repeat itself, but it does rhyme.’

For a deeper dive into our views, again please see our most recent Economic and Market Commentary. Our primary tasks are to grow your wealth – responsibly – while protecting value in the face of uncertainty. To learn more about how we work for you, talk to your Investment Manager and Advisor today. Your success matters to us.