2023 Reflection: A Positive Year Amidst Stock Surges and Fixed Income Resilience

January 2, 2024

By Samuel Richter

By Samuel Richter

Senior Securities AnalystWe hope everyone had a Happy and safe New Year. As we close the book on 2023, let’s look back at the positive performance for both the stock and bond markets. We will look at major themes from the year that led to the welcomed positive performance following a difficult 2022.

Stock Performance

It was a solid year for stocks. The S&P 500 ended the year up 26.3%. The S&P 500 is a prominent index used for tracking performance of U.S. stocks. It is a market-capitalization weighted index. This means the larger a company is by market-cap (stock price multiplied by number of shares), the larger percentage of the index it comprises. This causes the S&P 500 to be concentrated in the largest stocks. The top 10 stocks in the S&P 500 make up about 33% of the index. That leaves 67% for the remaining 490 stocks. The top 10 stocks are mostly large-cap growth-oriented stocks like Apple, Microsoft, and Amazon.

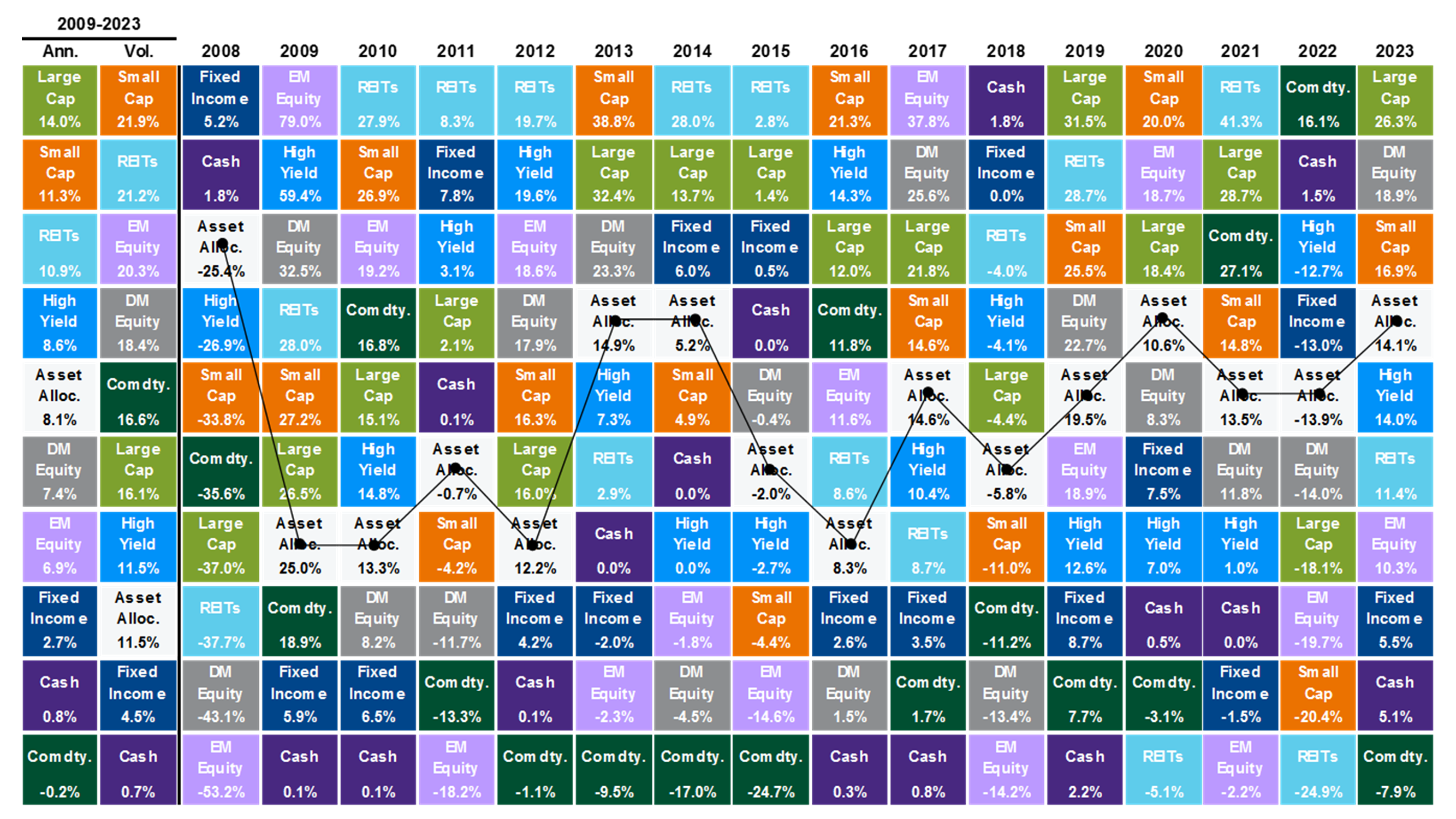

The concentration benefited the S&P 500 in 2023 as the large-cap growth-oriented stocks finished the year with great performance. Our philosophy remains to be broadly diversified. In the long run, diversification is beneficial as market leadership changes over time. The chart below produced by JPMorgan’s Guide to the Markets shows sector performance on an annual basis.

Our preferred stock benchmark is the MSCI All Country World Investable Market Index (ACWI IMI). The ACWI IMI ended the year up 21.6%. This benchmark is not as concentrated as the S&P 500. However, it has greater diversification into both domestic and international stock.

Fixed Income

In 2023, fixed income was volatile as investors continually tried to anticipate what inflation and the Federal Reserve would do. The 10-year U.S. treasury yield got as low as 3.3% in April and as high as 5.0% in October before ending the year at 3.9%. Even though volatility continued throughout the year as the Federal Reserve raised rates, fixed income produced a positive return. The Bloomberg Intermediate U.S. Aggregate Bond Index finished the year up 5.2% on a total return basis. Fixed income remains attractive moving forward as yields are elevated compared to the past decade. Fixed income portfolios still provide above average income streams compared to prior years. This income component is the main driver of fixed income performance in the long term.

Looking Forward

Overall, it was good to see positive performance in 2023 following a difficult year in 2022. Moving forward, we expect volatility to continue. Inflation came down significantly in 2023 but remains above the Federal Reserve’s target. As Krista discussed in last week’s article, economists and investors agree the U.S. economy will slow going forward, but the consensus is mixed if we see a soft landing or a recession in 2024.

Whatever the future brings, we will remain focused on helping you achieve your long-term financial goals. If you have any questions or would like to schedule your year-end review, contact your Wealth Management Advisor today. Your success matters to us.