Achieving Victory on the Inflation Course

June 17, 2024

By Matthew Andera

Securities Analyst

Happy belated Father’s Day to all of the dads out there. I was able to spend part of my Father’s Day watching golfers navigate the challenging landscape at Pinehurst No. 2 for this year’s U.S. Open golf tournament. For those unfamiliar, the U.S. Open is often referred to as “golf’s toughest test.” While the tournament is played at a variety of courses, a few course characteristics generally stand out: narrow fairways for the first shot to land; thick rough to get out of for errant shots; and quick, unpredictable greens to finish out the hole. While watching and reflecting on the past week, I was reminded of the similar challenge that the Federal Open Markets Committee (FOMC) also faces in navigating a difficult inflationary course.

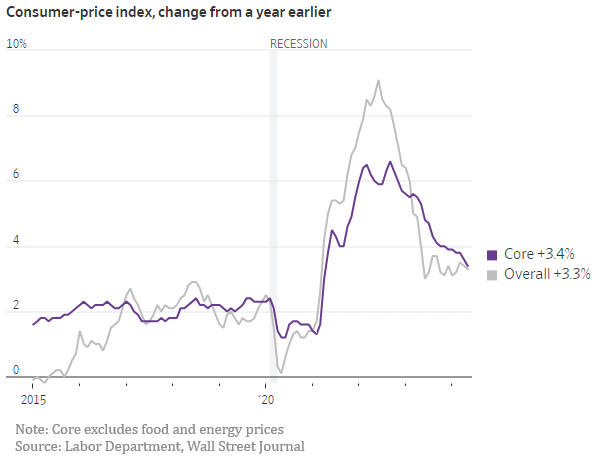

Following a lower than expected Consumer Price Index (CPI) reading that was flat for the month of May and 3.3% at an annualized rate, the Federal Reserve held interest rates steady on Wednesday at their current rate of 5.25-5.5%. Let’s take a look at how the Fed has navigated the course of inflation thus far and what will be needed to finish out the hole.

Teeing Off

After raising rates from March of 2022 through July of 2023 to their highest level in decades, the FOMC saw their efforts land in the fairway as CPI began a noticeable descent from its June 2022 peak of 9.1%. The restrictive monetary policy was achieving its goal, while also not dampening the economy and labor market.

The Approach Shot

The Fed ended 2023 leaving rates unchanged but began to approach discussions with a more dovish tone, indicating rate cuts could soon become likely. But like many golfers at Pinehurst who saw their approach shot land on the green and ultimately roll off, the Fed saw the ball roll off the green as 2024 had three consecutive months with CPI being above expectations and indicated that inflation was proving to be sticky.

Drive for Show, Putt for Dough

A common saying in golf is that you “drive for show, putt for dough.” This means more or less how you finish a hole is more important than how you start it. While the Fed made substantial progress on tackling inflation initially, they are having a more difficult time finishing out the hole and getting inflation down towards their 2% target. The inflationary ‘green’ is proving to be unpredictable. The Fed can leave rates higher for longer to get inflation down to their goal, but risk seeing an economic slowdown and a jump in unemployment. Cut rates too soon and they risk igniting the economy with increased spending which would put upward pressure on prices.

Finishing Out the Hole

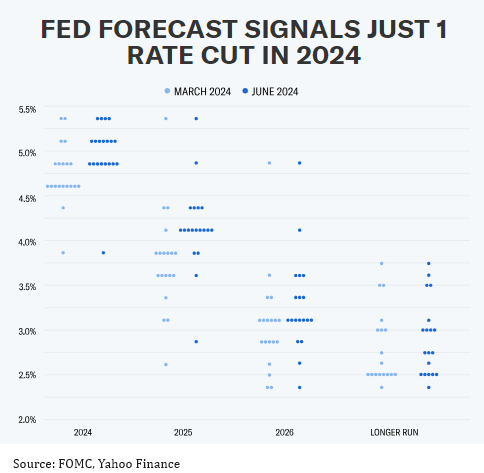

May’s CPI reading was a step in the right direction. However, Chairman Jerome Powell in last week’s press conference noted that too much attention should not be given to a single data point, and in order to cut rates they will need to see more good data. In the newly released Fed dot plot that is updated every three months, Fed officials are currently projecting one 0.25% rate cut for 2024, compared with three projected cuts in the previous dot plot. Four rate cuts are currently being projected for 2025, but officials may look to take a mulligan as new economic data is revealed.

With at least one rate cut possible in 2024 and more to follow in 2025, we continue to recommend putting cash to work and locking in longer term yields. If you would like to consult a caddie, please reach out to your financial advisor. Your financial success matters to us.