An Emerging Case for A “No Landing” Scenario in the U.S. Economy

September 11, 2023

By Jonathan Smith

By Jonathan Smith

Securities AnalystFor months, investors bet on U.S. growth softening enough to cool inflation and persuading the Federal Reserve to pause their interest rate hikes. Despite their efforts, the opposite scenario trended instead. U.S. economic growth and a resistant labor market outpaced expectations through recent data reports, which began a discussion of the possibility of a “no landing” scenario.

Let’s summarize the three possible landing scenarios the U.S. currently faces. A “hard landing” scenario occurs when the central bank hikes interest rates aggressively to curb inflation while leading the economy into a recession. A “soft landing” scenario takes place when the central bank raises interest rates just enough to curb inflation, while avoiding a recession. The idea of a “no landing” involves no economic slowdown, with stubborn inflation that stays higher than the Fed’s 2-percent target. A case could be made that a “no landing” scenario discussion will continue to gain steam over the months ahead.

The Case for a “No Landing” Scenario

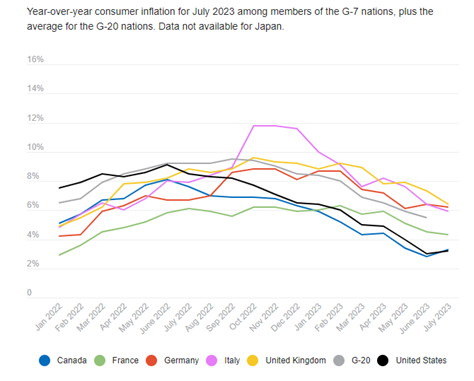

At the end of July, Federal Reserve chairman Jerome Powell and his staff abandoned language forecasting a recession in a Fed press conference following a surprise positive report of gross domestic product (GDP). Last quarter, the U.S. economy grew 2.4 percent following an annualized pace of 2 percent from the prior quarter. The report highlighted the strength in consumer spending, sustained hiring, and business investment that continues to power the economy. Inflation also is now measuring just over 3 percent, compared to prices one year earlier, which is the lowest reading among the world’s leading economies. These indicators are reassuring the Fed to believe that the U.S. economy will be able to maneuver away from an anticipated downturn.

Source: OEDC Economics

The path is not completely clear for the Fed, which will need to proceed with caution amid present risks. While inflation is not completely down to the target, the uptick in costs — particularly in medical services and restaurant sectors — adds additional pressure of elevated inflation.

Earlier this month, OPEC+, a group of 13 oil-producing countries in the Middle East and Africa regions, announced they will extend oil supply cuts through the end of the year. An oil supply reduction will squeeze U.S. consumers’ budgets with higher gasoline prices. While the Fed Funds rate currently sits at 5.25 to 5.5 percent, strained sectors at risk in the economy will need to show continued evidence of withstanding higher borrowing costs that has yet to completely make its mark.

What this means for Investors

The best case scenario is that the U.S. lands softly over the next 12-18 months. The “no landing” landscape, meanwhile, would signal interest rates remain higher, putting additional stress on already fragile markets such as real estate and financials. Near-term volatility is likely ahead as mixed signals from economic data paints an unclear picture. Maintaining a well-diversified asset allocation is the best way to navigate the uncertainty of the possible landing scenarios.

If you would like to review your portfolio allocation don’t hesitate to contact your wealth management advisor today. Your financial success matters to us!