An Emerging Trend: Betting on No Rate Cuts in 2024

April 29, 2024

By Jonathan Smith

By Jonathan Smith

Securities AnalystIn the dynamic world of finance, every word uttered by the Federal Reserve can send ripples throughout the financial markets. As we settle into 2024, the U.S. economy continued to build off last year’s strength with a robust labor market fueling economic growth. From recent speaking engagements, Fed officials relayed that there is no urgent need to cut rates, amid resiliency in the U.S. economy. With the recent sentiment from the Fed, an emerging trend towards betting on no rate cuts this year is gaining traction.

Resilient U.S. Economy

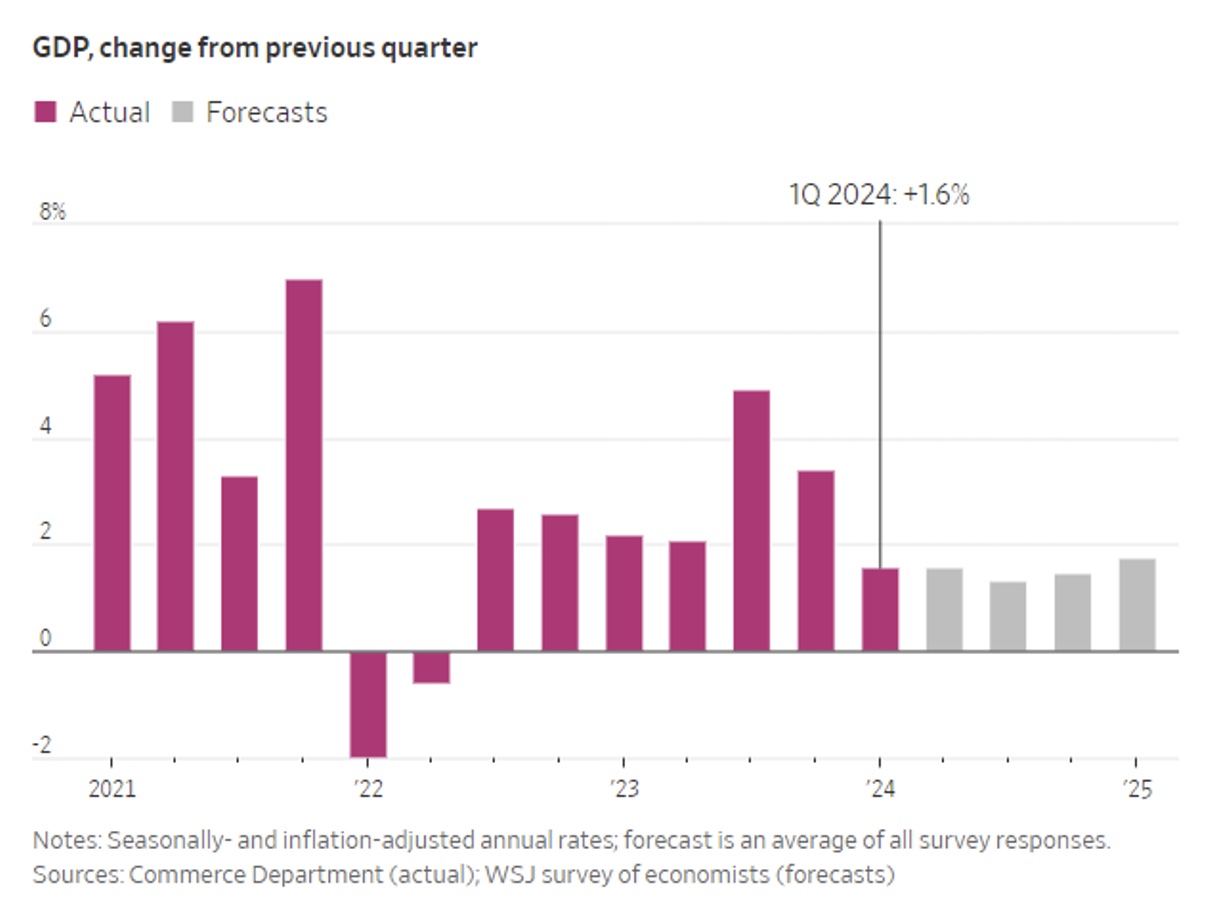

Despite lingering challenges from the COVID-19 pandemic, the U.S. economy continues to display remarkable growth. Last week, U.S. gross domestic product (GDP), which is a comprehensive measure of economic growth, increased for the first quarter at a 1.6% annualized rate. This is a slowdown in momentum from a surprisingly strong previous year, but still above trend pace levels. The report also shows a continuation of solid demand from consumers. The Fed is concerned that economic growth and a robust labor continue to add to inflationary risks.

![]()

In recent months, inflation trended higher. Their preferred metric to measure inflation is the personal consumption expenditures (PCE) index, which was reported at annualized 3.7% for the first quarter. The increase primarily came from the service sector of the economy in insurance premiums, health care, and financial services. While some argue that elevated inflation warrants rate cuts to cool down the economy, others caution the Fed against a knee-jerk response that could risk undermining their long-term price stability objective.

As investors wager on the trajectory of interest rates in 2024, the sentiment is leaning towards a possibility of no rate cuts by the Fed this year. Economic resilience, a robust labor market, and sticky inflation continue to fuel the Fed’s case for leaving borrowing costs unchanged. In this landscape, great opportunities continue to be present among fixed income by achieving higher yields without assuming considerable risks. Contact your wealth management advisor today to review opportunities present in your portfolio. Your success matters to us!