Don't Fight the Fed? The Markets Just Got a Reminder

February 20, 2023

By Samuel Richter

By Samuel Richter

Securities Analyst'Don’t fight the Fed' is an old investment saying Krista mentioned in last week’s commentary. The markets got a harsh reminder of this last week, as economic releases indicated higher-than-anticipated inflation and strong retail spending.

Those numbers will likely add to the Federal Reserve's motivation to keep interest rates higher for longer.

Last Week's Numbers

The January Consumer Price Index (CPI) cooled less than anticipated. CPI rose 6.4% year-over-year, above the forecast of 6.2%. Core CPI, which excludes the often-volatile food and energy prices, rose 5.6% compared with a 5.5% forecast. While inflation moderated slightly from the December reading, the pace of disinflation slowed in the first month of 2023.

Meanwhile, retail spending was strong in January, increasing 3%. Sales from consumers dining out were especially strong, rising 7.2%. In addition, vehicle sales significantly rose, as used car prices are on the decline. The retail spending increase in January is the largest monthly gain in nearly two years. A positive sign for the consumer and U.S. economy — but not so much for inflation.

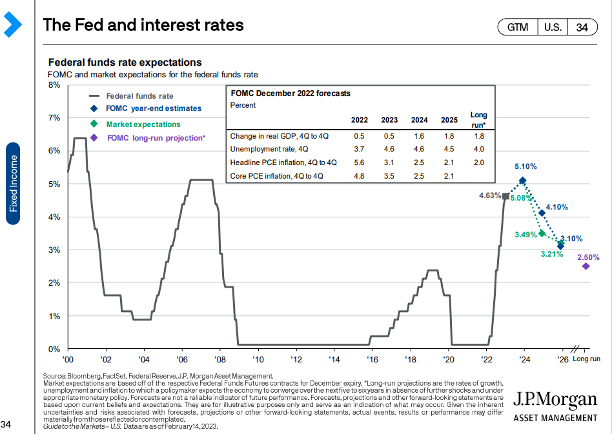

These data releases have caused a "change in heart" for the markets, which are starting to believe the Fed’s rate projections for this year. As you can see in the chart below, markets now expect the Federal Funds rate to end the year above 5%.

As recently as a few weeks ago, in late January, the markets had been expecting the Fed to cut rates in the back half of the year to around 4.5%. Not anymore.

What does this mean for your portfolio?

The markets have started to take the ‘Don’t fight the Fed’ advice. A lot can change throughout the year, so the Federal Reserve’s rate projections and market expectations will continue to adjust. Therefore, heightened volatility will continue as the inflation battle drags on. Contact us today to discuss what higher interest rates mean for your portfolio.