Investor's Usually Cheer the Fed's Rate Cuts. Not this Time.

December 23, 2024

Last week, the Federal Open Market Committee (FOMC) - a branch of the Federal Reserve (Fed) tasked with setting U.S. monetary policy - held their final meeting of 2024. As markets expected, the committee voted to cut short-term interest rates for a third straight meeting bringing the upper limit of the range down to 4.50%. Despite matching expectations, markets responded negatively to the announcement with major indices trading lower immediately following the decision. During Wednesday’s trading day, bellwethers like the Dow Jones and S&P 500 declined by 2.6% and 2.9%, respectively. What markets had not accounted for is a shift in both rhetoric and forecasts from the FOMC, signaling fewer rate cuts in 2025 and more economic uncertainty ahead.

What Changed?

As part of their December announcement, the FOMC released quarterly updated Summary of Economic Projections (SEP). The SEP is where FOMC participants provide projections on key economic indicators and interest rates over the short and long run. These projections serve as supplemental information to markets, giving further insight into the committee’s decision-making process and future expectations.

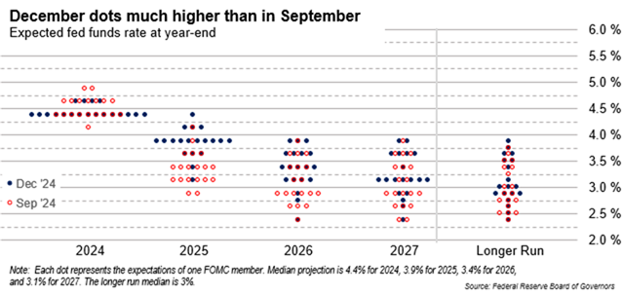

A closely watched component of the SEP is the committee’s “dot plot”, where policymakers’ projections for future rates are plotted on a graph like the one shown below. Each dot reflects a participant’s expectations for rates during the listed time frames. Importantly, it also displays the shift in projections from the Fed’s previous dot plot in September (red dots), to their December meeting (blue dots). This indicates the committee now expects only two 0.25% interest rate cuts in 2025, down from the four cuts projected in September. In addition, meeting participants notably shifted up expectations for where rates will be in 2026, 2027, and even in the longer run.

Source: FHN Financial

Why the Shift?

As part of the Fed’s dual mandate – promoting maximum employment and stable prices – the committee has made a substantial effort to bring inflation down to their two percent target by keeping interest rates elevated and restrictive. While inflation is down from the peak seen in 2022, it remains above target and recent data is prompting concerns of further progress stalling.

In the FOMC’s statement, members acknowledge that despite the progress, inflation remains somewhat elevated. Committee members now forecast Personal Consumption Expenditure (PCE) inflation, the Fed’s preferred inflation gauge, to be at 2.5% by the end of 2025 compared to 2.1% in their September projections.

With committee members expecting inflation to remain elevated, they will be more inclined to take their time on further rate cuts. Fed Chair Jerome Powell noted that some committee member’s updated projections are also factoring in the uncertainties surrounding U.S. economic policies going forward. With a new incoming White House Administration, central banks are waiting to see what new policies may be implemented and how they will impact the U.S. economy. In Jerome Powells words, “It’s kind of common-sense thinking that when the path is uncertain, you go a little bit slower. It’s not unlike driving on a foggy night or walking into a dark room of furniture. You just slow down.”

From an investment perspective, extending duration and locking in longer term yields remains advantageous in this declining rate environment. As shorter-term yields continue to decline with the Fed cutting rates, longer term yields are expected to remain range bound. The U.S. economy also remains resilient with a healthy labor market and above trend growth throughout 2024. These factors contributed to a strong year for diversified investors and should continue to do so going forward.

As we end this year, we want to thank you for your continued business and confidence in us in helping to achieve your long-term goals. We hope you have a happy holiday and look forward to working with you in 2025. Please reach out to your Wealth Management Advisor if you have any questions or would like to schedule your year-end review. Your success matters to us.