Is the Fed Prepared to Drive Through the Snowstorm?

January 31, 2022

Tom Limoges

Tom Limoges

Vice President - Investments

Winter driving in the Midwest can be treacherous. Snow mixed with wind, rain and freezing temps can create challenges for even the most experienced driver.

At an early age, I learned that when your vehicle hits a patch of ice, it is best to steer into the direction you are sliding rather than to overcorrect by turning against it. With inflation running uncomfortably high and jobs growth slowing, the Fed is also facing similar challenges with monetary policy.

If the Federal Reserve Bank (Fed) acts too slowly, the economy may continue on the path of higher inflation and higher prices. If the Fed acts too quickly by raising rates, they risk overcorrecting by steering the economy back too far in the opposite direction. To avoid driving into the ditch, the Fed must act carefully with monetary policy and language detailing their plans.

Avoiding the Ditch

One of the tools that the Fed uses to maintain steady employment growth and price stability is to raise and lower the Fed Funds Rate. The Fed Funds Rate is the rate of interest charged by banks to lend their excess reserves overnight. Lowering the Fed Funds can help stimulate a slowing economy by pushing rates lower; raising rates can have the opposite effect.

Interest rates can impact everything from housing prices to credit card rates, from business’ decisions to expand or buy equipment and valuations in the stock markets. There are other tools that the Fed can use to maneuver around obstacles, but this past week the market was mostly focused on short term interest rates. It ended with the likelihood of an increase of rates at the March meeting.

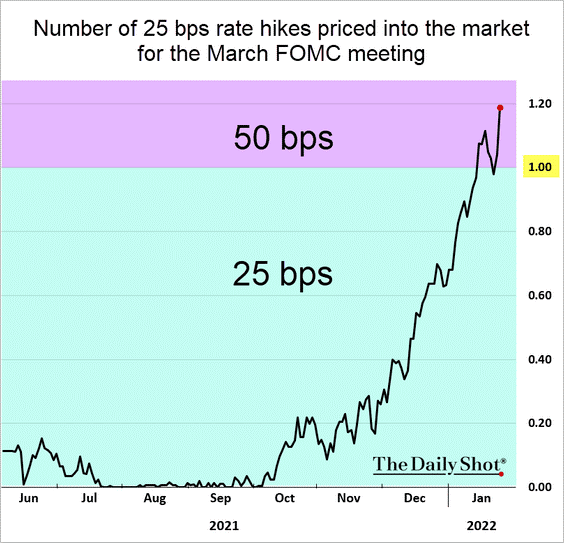

Source: The Daily Shot®

The chart above details near certainty that the Fed will raise rates at least 0.25% and sentiment is growing that it may be higher.

This past week, the Fed signaled it would begin raising interest rates in mid-March in an effort to reduce inflation. Fed Chairman Powell also indicated that the central bank was willing to raise rates faster than it did in the previous decade. As a result of this news, the interest rates on bonds rose, as did the volatility in the equity markets – creating a potential road hazard for the Fed.

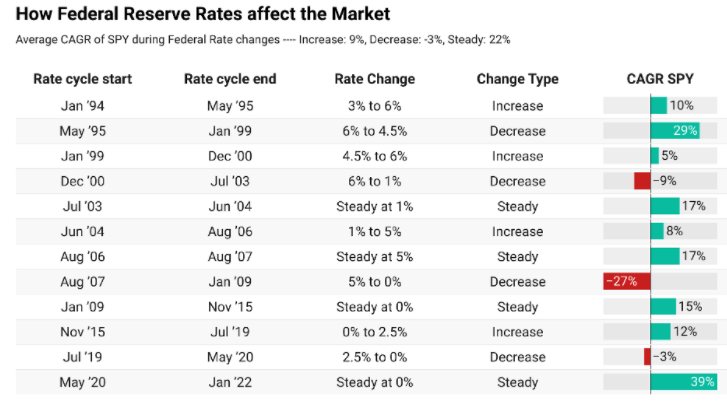

Rising interest rates don’t always signal long term declines in the stock market. The chart below shows that even during rate cycles where the Fed is active in raising interest rates, markets can still advance. What is important for investors to follow is the speed at which those rate hikes come.

Source: Market Sentiment

Our Strategy

How is SNB managing client portfolios to account for this potential shift in Fed Policy? With stocks, our focus has been to increase exposure in value oriented sectors of the markets that tend to experience less volatility from interest rate hikes. For bonds, we have been reducing our exposure to rising long term interest rates and finding investments that offer better income opportunities. Early indications are that these strategies are working well in this current environment.

If you have any questions about your account, I encourage you to reach out to your Wealth Management advisor to discuss. Just like we can’t control the weather or road conditions, we can’t control the larger factors affecting the Fed and their decisions. But we can be knowledgeable, prepared, and proactive with our driving skills. Drive safely, and know that we are looking out for the safety of your investments, as well.