Are Your Emotions Hurting Your Retirement Savings?

November 4, 2019

By Michelle Holmes, CFA

By Michelle Holmes, CFA

Asst. Vice President - Investments When I was a teenager, nothing personified Halloween quite like walking through a “haunted house” with my friends — creeping through the dark, not knowing what was around the next corner or if someone was about to jump out to scare us. And there was always a person with a chainsaw, who you had to muster the courage to walk (or run) around to get to the exit. Looking back, it's hard to explain why I voluntarily chose to be scared like this!

Investing in the market can sometimes seem as scary as walking through a haunted house, especially when there's an increase in volatility. You never know when the markets will go up or down or by how much. The unknown variables cause anxiety for many investors, which can affect the performance of their portfolio.

Behavior gap: how emotions harm your investments

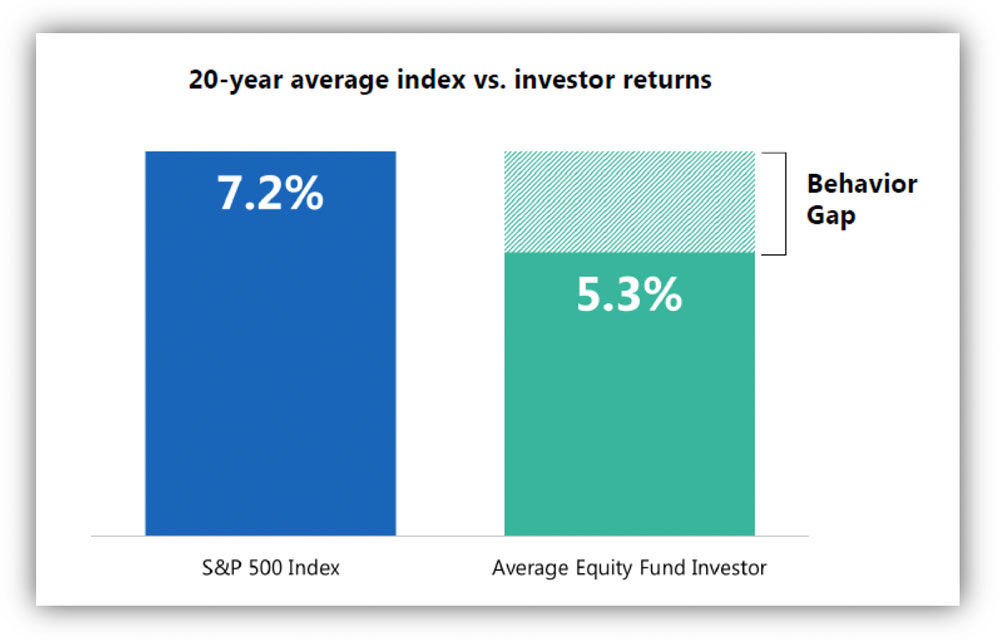

People are often their own worst enemy when it comes to investing, and emotions are largely to blame. Behavioral studies have shown that people dislike losing twice as much as they enjoy winning. This aversion to loss sometimes causes people to make the wrong financial decisions. In fact, the average investor earns less than the overall market largely because of this “behavior gap.”

Source: PIMCO; Quantitative Analysis of Investor Behavior, 2018 DALBAR, Inc.

Source: PIMCO; Quantitative Analysis of Investor Behavior, 2018 DALBAR, Inc.

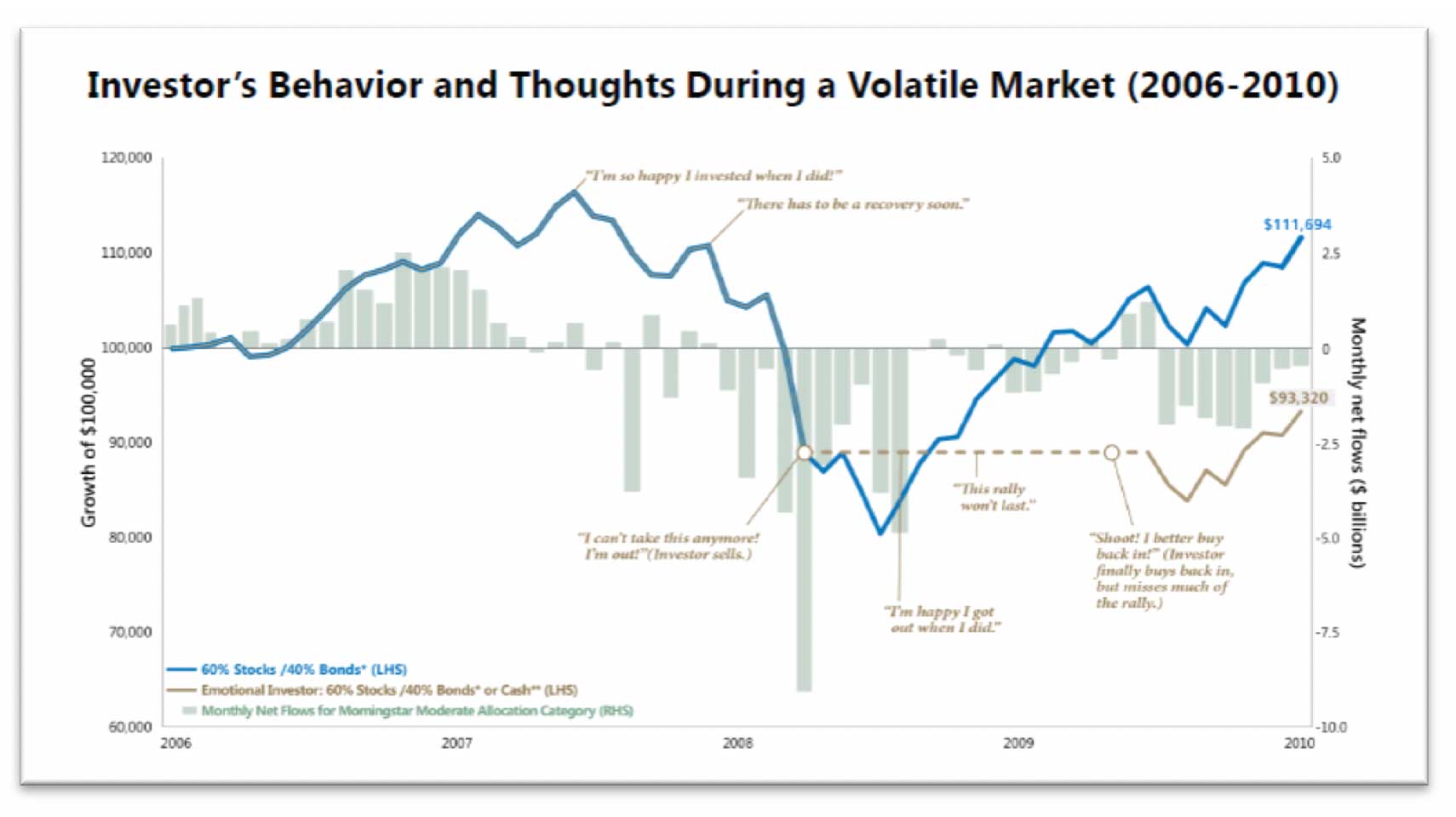

People tend to be more comfortable investing after the markets have gone up and tend to be nervous when the markets decline. This is known as “recency bias,” when someone looks at a recent trend and assumes it will continue. Recency bias often causes investors to “buy high and sell low” — the opposite of how you should invest in the market.

Source: Morningstar; Bloomberg; PIMCO

Source: Morningstar; Bloomberg; PIMCOHow can you minimize the behavior gap in investing?

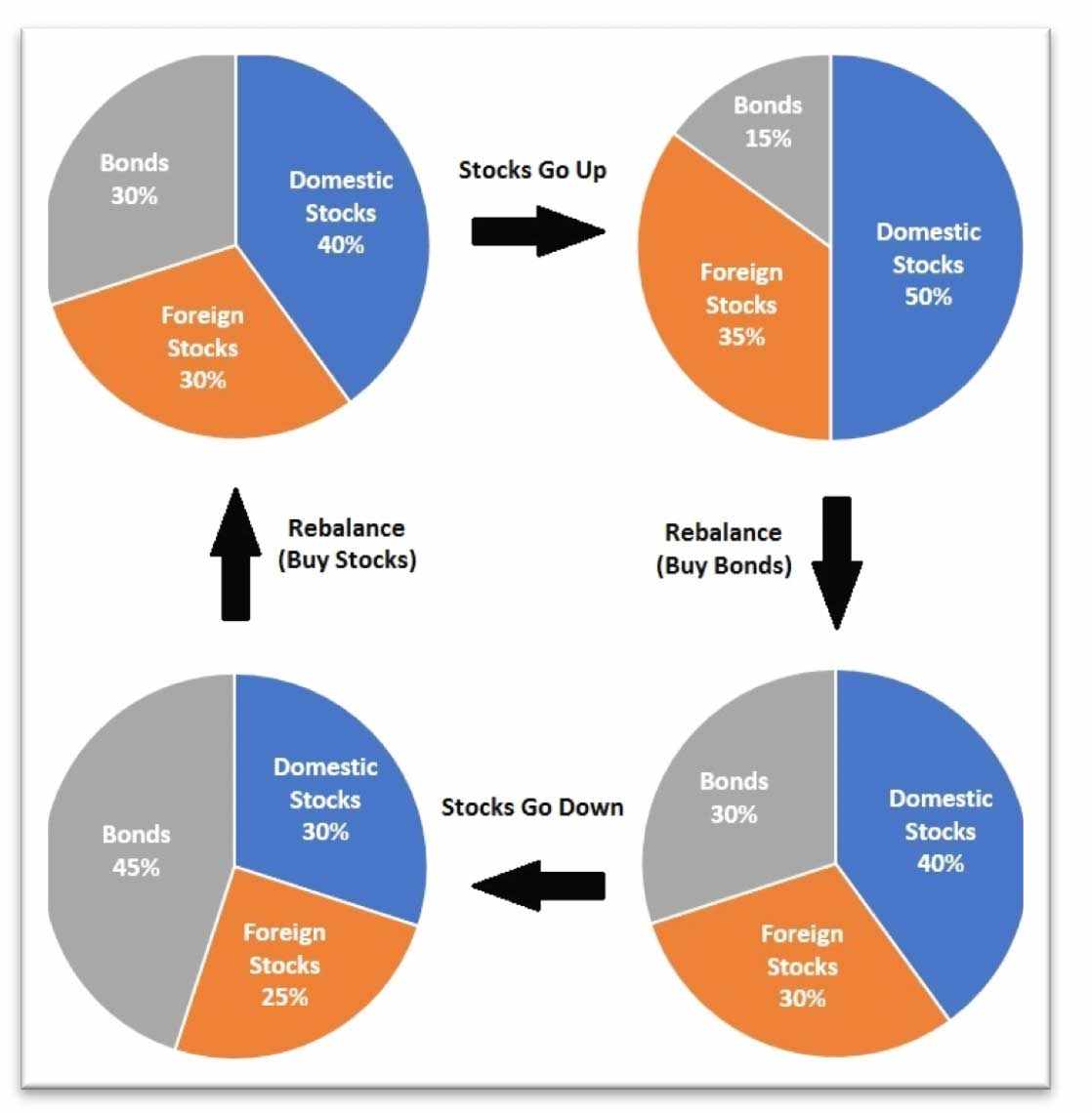

One way to minimize the behavior gap is to rebalance your portfolio at least once a year. When you rebalance, you sell the things that have appreciated in value and invest in the areas that have declined. Rebalancing brings the portfolio asset allocation back in line with the desired split between stocks and bonds. It also reduces volatility of portfolio. However, rebalancing forces investors to do what they are uncomfortable doing: selling high and buying low.

How to rebalance your portfolio:

Source: Reddit

Source: RedditIf investing on your own is still a scary thought, consider partnering with an investment professional. Investment managers will diversify your investments and periodically rebalance your portfolio, thereby reducing the effects of the “behavior gap.”

Security National Bank has helped people achieve their financial dreams for the past 135 years. Contact one of our wealth management professionals today to learn more.