At the Intersection of Economics and Politics

February 6, 2018

By Mike Moreland

Vice President of Investment Services

The investment industry lives in the short term – this quarter’s earnings reports, the next Federal Reserve meeting, etc. The long term, decades or more, is more abstract. It’s interesting to think about, but doesn’t really affect what most do today.

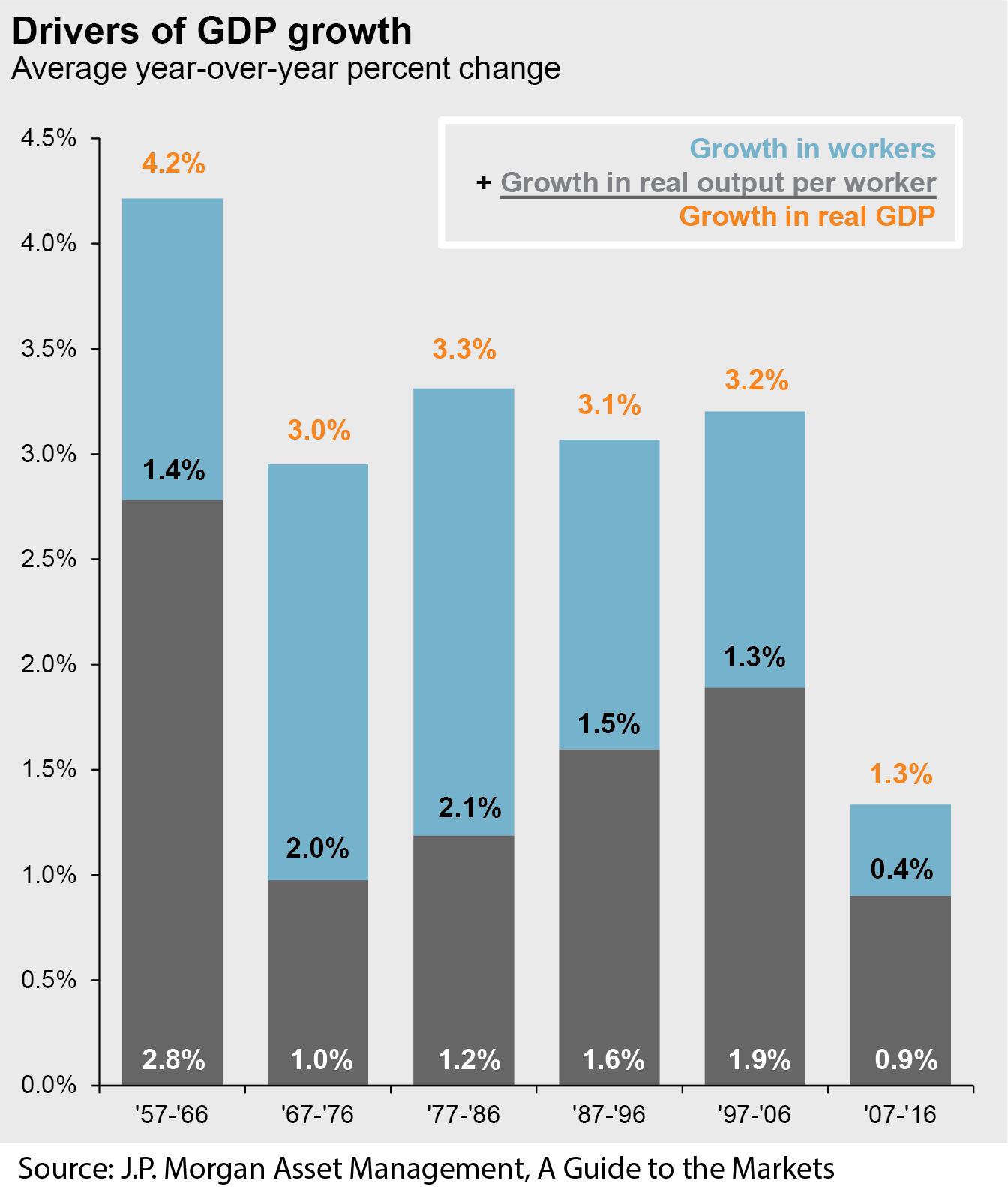

That’s a shame, because the long term prospects for our economy depend largely on two things that change slowly, almost imperceptibly: growth in the labor force and improvements in productivity. These are what drive economic activity over time. Fiscal and monetary policies influence cycles, but demographics, capital investment, and innovation determine the long term potential of our economy.

Look below. In most of the post-WWII era, GDP growth was 3.0% or better. For most of this time, the contributions from rising productivity and a growing workforce were about equal. This changed in the credit crisis and subsequent recovery. Both workforce growth and productivity were positive, but at the lowest levels in the last sixty years – particularly so for the worker population. The outcome was economic activity about one-third that of the previous half-century. While this period included the 2007-2009 recession, earlier periods had their challenges as well.

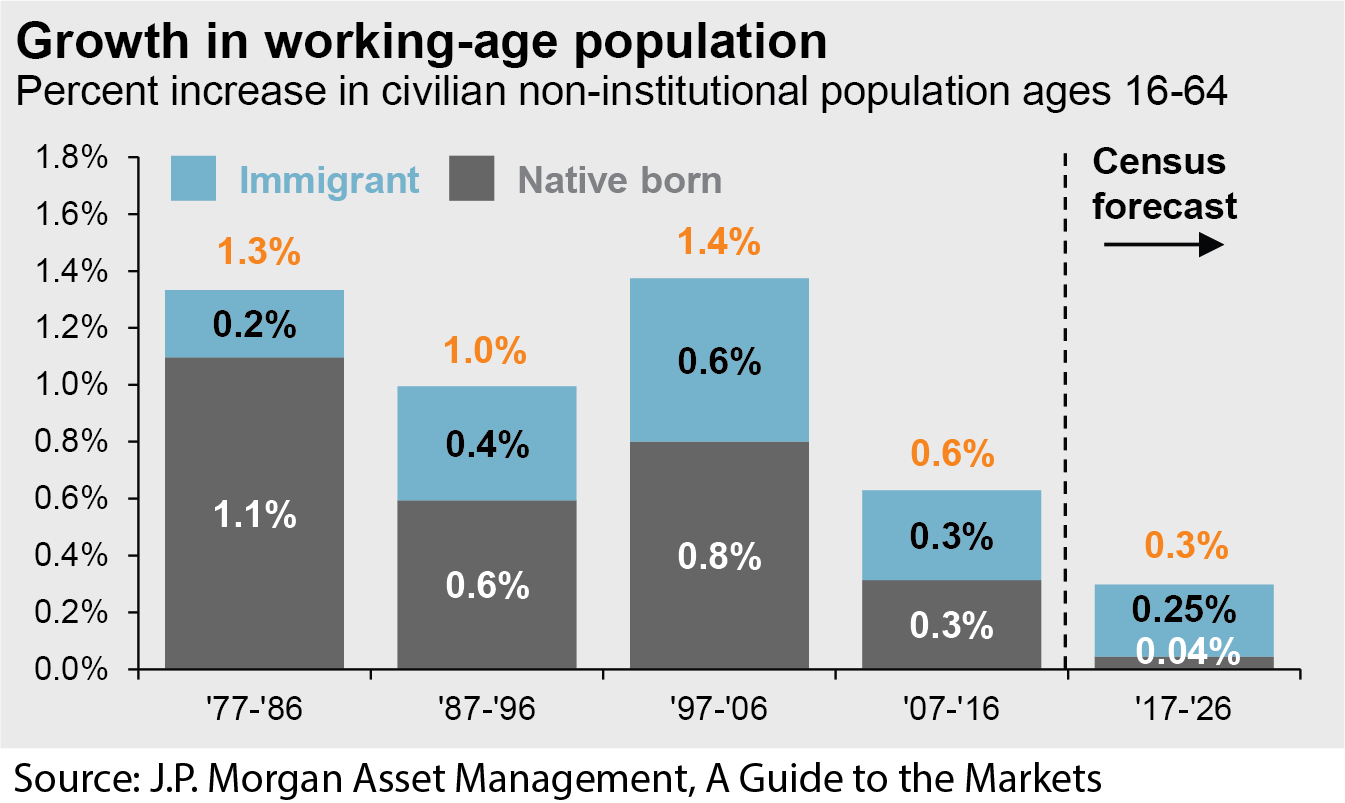

What happens next? We are early in a strong cyclical advance. The stage was set by years of accommodative monetary policies, boosted by recent changes in tax policies. We will be fine – for a while. But, eventually, demographics will catch up. Our society is not growing its workforce at a rate that is consistent 3.0%+ secular GDP growth. Again, look below.

Expected growth in the working-age population, according to the U.S. Census Bureau, will be half that recorded in recent years. Absent an unprecedented gain in peacetime output per worker, we are in for an extended period of low GDP growth. Cyclical swings will occur, but from a baseline below any point in the post-war era. The implications for deficit reduction, Social Security, and the like are clear.

What’s the solution? Here are a couple of suggestions. First, continue to reform the tax code so that capital investment is encouraged. The U.S. needs to be the innovation, efficiency, and manufacturing leader of the world. Second, we need to expand – dramatically – the pool of educated, willing workers. Immigration reform is a paramount issue, followed close behind by programs to provide new workers the tools to succeed.

This isn’t an argument about ‘the wall’. It is a recognition that our native-born population is not growing at a rate that will enable the U.S. to advance and meet its existing social obligations. The U.S. needs immigrants – a lot. Failure to recognize, accept, and address this is an error that will take a generation to correct – if then.