Is the National Debt Painful Enough to Make a Change?

May 27, 2025

By Ted Hanson

By Ted Hanson

Portfolio Manager Laurence J. Peter (1919-1990) was a Canadian educator best known for his study of human behavior and organizational dynamics. Laurence’s most famous work included formulating the Peter Principle, which observes that in a hierarchy, employees are promoted based on past success until they reach a level they are no longer competent. A quote often attributed to Laurence, “In spite of warnings, nothing much happens until the status quo becomes more painful than change”, came to mind when the U.S. credit score was downgraded on May 16th. Let’s review:

“In spite of warnings…”

Moody’s Ratings downgraded the U.S. credit score one notch from the highest rating of Aaa to Aa1. Moody’s was the last of the big three rating agencies to downgrade the U.S. after S&P Global Ratings did in 2011 and Fitch in 2023. The downgrade reflects Moody’s view that the continued increases in government debt and corresponding interest payments pose an increased risk. Moody’s notes “successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest cost.”

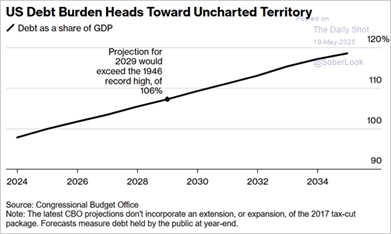

The U.S. federal government currently has over $36 trillion in debt and is projected to make more than $900 billion in interest payments during 2025, a significant increase the past several years. The debt-to-gross domestic product (GDP) ratio is a way to measure how much a government owes in comparison to the size of the country’s economy. The higher the number the more debt is owed by the government and typically raises concerns about the country’s ability to repay the debt. As seen below, the U.S. debt-to-GDP continues and projects to rise to new heights, sparking concerns.

“…Nothing much happens…”

Moody’s didn’t exactly announce a revelation; it has long been viewed the U.S. government has a budget problem. Not many were surprised by the downgrade, as reactions in both the stock market and bond market were relatively muted. Expectations for future budgetary restraint are limited. Moody’s press release states, “Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher.” Highlighting the fact politicians aiming to be re-elected are not keen on the idea of raising taxes or reeling in spending to balance the budget.

“…Until the status quo becomes more painful than change.”

While immediate action to address deficit spending is not expected, Moody’s downgrade is an important reminder to the risks of inaction. An elevated debt burden can stimulate an economy in the short term but is a long-term drag on growth. Maintaining the status quo risks increasing interest payments (reducing spending for other priorities), higher inflation, and limiting the government’s ability to respond to future crises or downturns. In turn, lowering fiscal deficits (raising taxes or reducing government spending) carry its own set of risks and challenges. Therefore, history has shown the preference has been to “kick the can down the road” until the status quo cannot be carried out anymore.

To be clear, the U.S. government is not at significant risk of a near term default. The U.S. has the privilege of multiple advantages that assist in debt management. The biggest being the dollar’s status as a global reserve currency with no clear immediate competitor. Meaning the U.S. dollar is widely used by governments and global institutions to conduct transactions and storing value. This allows the U.S. to benefit from lower borrowing cost due to strong demand for U.S. debt and currency. While the government will be able to make interest payments in the short term, recent deficit spending is on an unsustainable path. We continue to believe the U.S. has the will to manage future spending and its government debt will remain an area of attractive investment opportunity. Reach out today if you’d like to discuss the effects of Moody’s downgrade within your portfolio.