Mid-Year Market Review: “Long-Term Challenges Remain”

July 3, 2023

By Tom Limoges

By Tom Limoges

Vice President - Investments"If Something Cannot Go On Forever, It Will Stop"

The above quote is from Herbert Stein (1916 –1999), an American economist who, among other roles, served as head of the Council of Economic Advisors under Presidents Nixon and Ford. He was characterized as a ‘pragmatic conservative.’ Similarly, the Washington Post referred to him as ‘a liberal’s conservative and a conservative’s liberal.’ A related observation of his – pertinent to today – is as follows: ‘For almost fifty years polls have shown the large majority of the public believe the budget should be balanced, and for all that time they have elected office seekers who would not balance it. The public cares about deficits, but doesn’t care much.’

The Borrowing Challenge

Once again, according to the media, economic catastrophe was averted in early June. Congress and the Biden administration reached an eleventh-hour agreement to raise the federal debt limit in exchange for budget concessions. That solves the immediate problem – maturing debt will be honored and federal obligations met – but the long term challenge remains.

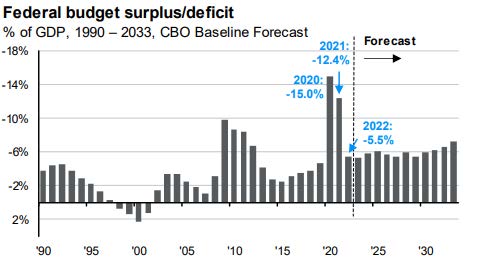

The U.S. has not produced a budget surplus since 2001, the end of the stock market technology boom. Capital gain tax revenues far exceeded estimates and (for once) spending did not keep pace. Since then, annual budget deficits financed by borrowing have been the norm – and in over half the years the additional debt issuance exceeded $1.0 trillion.

Source: J.P. Morgan Asset Management

Where’s The Tipping Point?

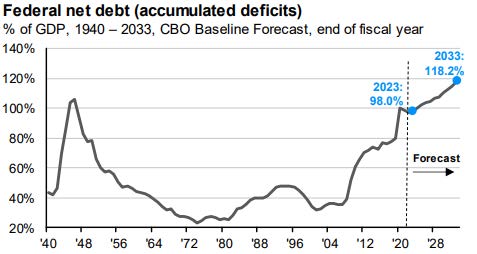

A high sovereign debt load is not pernicious in and of itself. If economic growth outpaces debt creation, the interest cost of the debt service (in theory) takes a smaller proportion of federal tax income. If the debt-to-GDP ratio grows, however, interest costs ‘squeeze out’ other needs – defense, social services, and the like.

Today, federal debt is about equal to GDP. And, even considering the impact of the recent budget agreement, the Congressional Budget Office projects that deficit financing will continue and debt will approach 120% of GDP over the next decade.

Source: J.P. Morgan Asset Management

We’ve been lucky thus far – record low interest rates since the financial crisis kept debt service manageable. Going forward, if the average interest cost rises to a historically-reasonable 4.0%, debt service will capture about half of all personal income taxes paid. All other expenditures must be met through a combination of higher taxes or reduced spending. Neither are conducive to strong, sustained economic growth.

Among major industrialized nations, our debt-to-GDP ratio is exceeded only by Japan and Italy. Others in a similar position to the U.S. include Venezuela, Suriname, Portugal, and Zambia (source: worldpopulationreview. com). While our economy is much stronger and more diverse than all others, as the saying goes, ‘You’re known by the company you keep.’ As noted at the beginning, ‘If something cannot go on forever, it will stop.’ It’s time to get serious about spending control.

Financial Market Perspective

Equity markets rallied in June following passage of the debt ceiling agreement, the Federal Reserve’s ‘hawkish pause’ at its June meeting, and continued generally upbeat near-term economic and labor market reports. Importantly, market gains started to broaden.

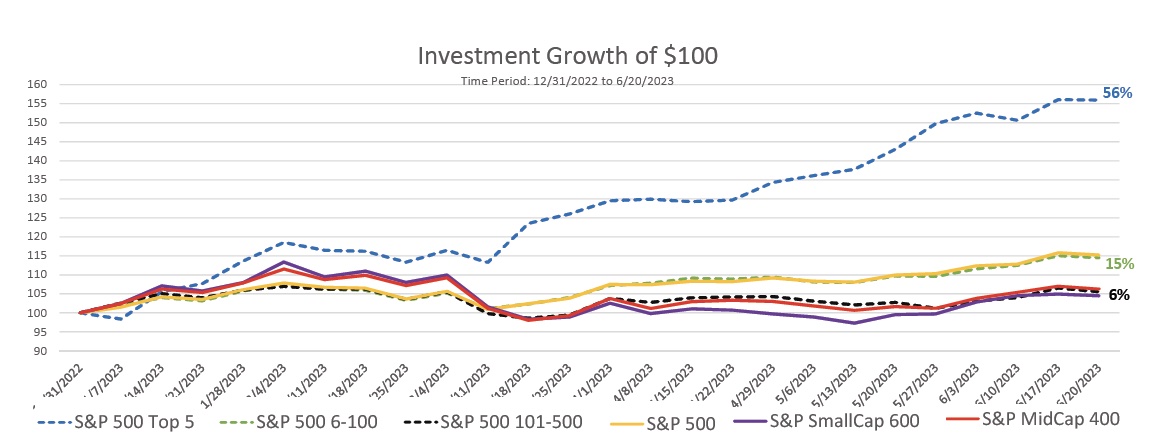

Through most of 2023, U.S. market returns were dominated by a handful of mega-cap tech leaders (META, AMZN, AAPL, MSFT, GOOGL, TSLA, and NVDA). This provided a solid start for the capitalization-weighted S&P 500 index. The broader market, however, remained stalled. Most stocks were essentially unchanged or slightly negative for the first part of the year. Traders’ money chased the winners.

Source: Morningstar Direct

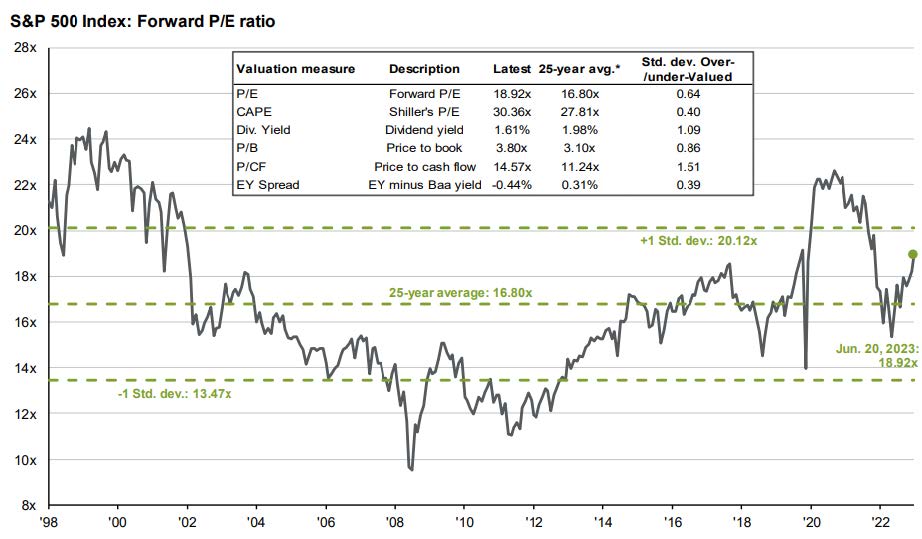

The last time market returns were this concentrated was during the tech bubble in the late 1990s – and we know how that turned out. The recent broadening of participation across styles, sectors, and capitalizations is a positive sign. In addition, valuations remain reasonable.

Even with additional rate hikes on the horizon, we are closing on the terminal point for this tightening cycle. While long term risks abound, the Fed’s goal of engineering a ‘soft landing’ may be in sight. This augers well for equity returns for the remainder of the year. Markets have a tendency to look ‘over the valley’; in the absence of negative shocks, we are increasingly comfortable with the near-term prospects for equities.

Fixed income markets are showing a similar pattern of stabilization and broadening participation. Yields rose dramatically on non-government issues as the March-April implosion of a handful of larger banks created a ‘flight to quality’. Indiscriminate selling of corporate and mortgage debt has abated, yield spreads on such issues have narrowed, and sector returns are more in line with historic relationships. High quality, short- to intermediate-term debt is a bargain today.

Source: FactSet. FRB, Refinitiv Datastream,Robert Shiller, Standard & Poor’s Thomson Reuters, J.P. Morgan Asset Management. Guide to the Markets-U.S. Data are as of June 20, 2023.

In Sum

Even with last month’s ‘hawkish pause’ by the Fed, slowly declining inflation, and generally favorable economic and employment data, serious long-term challenges remain. How should investors reconcile these conflicting prospects? Our strategies are consistent with our history. Conservative, broadly-diversified, value-oriented management has always been the bedrock of the Wealth Management Division, and remains so today.

Talk to your Advisor and Investment Manager; your success – near-term and long-term – matters to us.