Down to the Wire: Tariffs and the Fed

July 28, 2025

By David Newton

By David Newton

Wealth Management InternTwo decisions. Trillions at stake. On August 1, the U.S. faces a pivotal moment. A new wave of trade tariffs is set to take effect—potentially reshaping supply chains, prices, and investor sentiment overnight. At the same time, all eyes are on the Federal Reserve. They must decide whether to hold steady on interest rates or pivot toward cuts in the face of economic uncertainty. Together, these two forces—tariff policy and monetary policy—could have far-reaching consequences for markets, borrowing costs, and long-term financial plans. Let’s take a look at what this might mean for you.

The Fed's Wait and See Attitude

As of late, the Fed is on standby mode due to the uncertainty of tariffs. Cutting rates before knowing the full impact of tariffs could make inflation much harder to control. The Fed also doesn’t want to jump the gun and react to market news. Doing this limits their ability to respond if tariffs escalated to a broader trade war. As a result, the Fed is hesitant to cut the Fed funds rate.

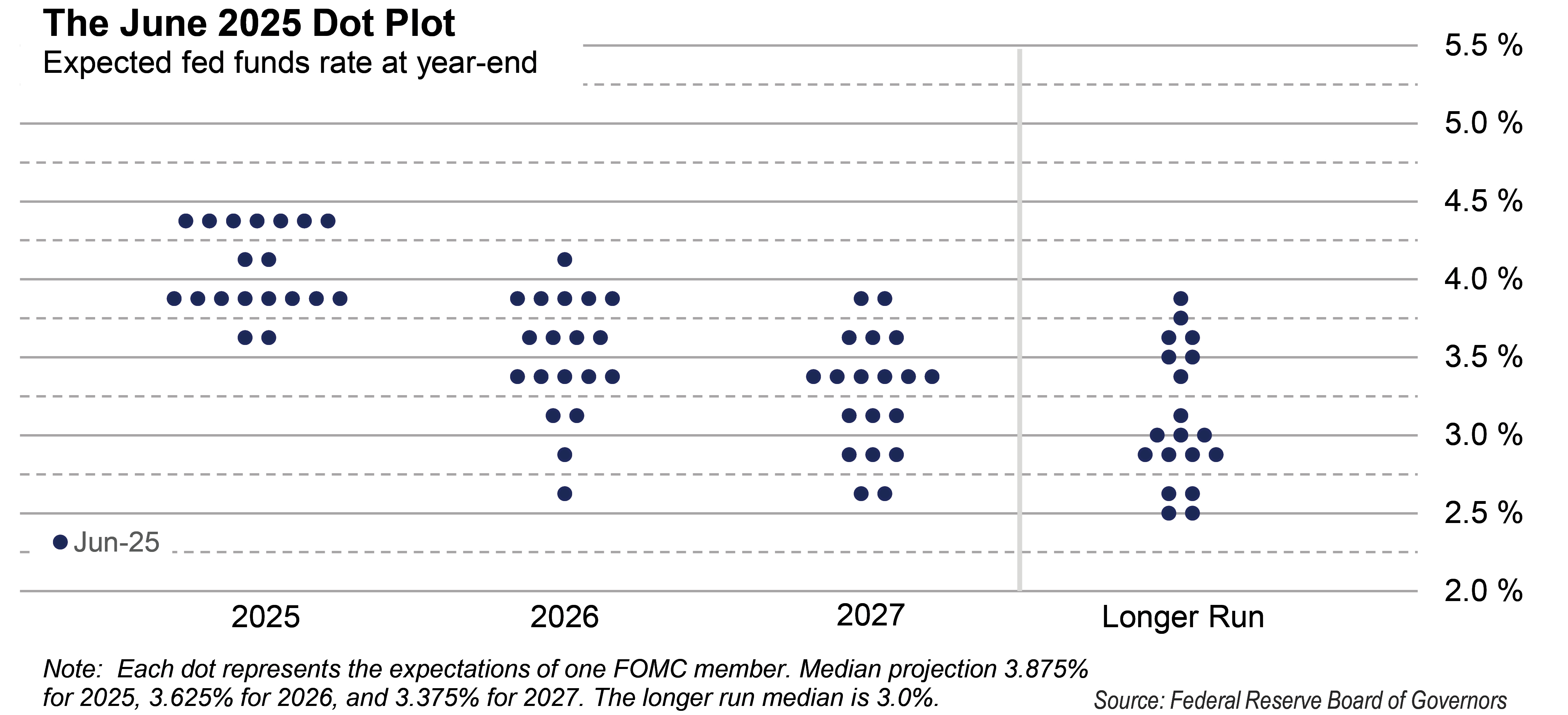

Below are the Fed’s most recent interest rate projections, aka the dot plot, as of June 18th, 2025. This allows us to see how the members of the Fed are reacting to economic data. Most members (eight) expect two rate cuts this year starting in September.

The Aug 1st tariff deadline feels like the entire world is holding its breath due to the potential impact on the prices of imports from dozens of countries. There are a few different scenarios possible.

Potential Outcomes

Outcomes range from mild relief to severe disruption. On the optimistic end, the U.S. might reach partial agreements with key trading partners or extend negotiation deadlines, easing market volatility, calming inflation fears, and giving the Fed room to consider rate cuts later this year—though uncertainty would linger until a permanent deal is struck.

A middle-ground scenario sees tariffs imposed at lower rates or limited to specific industries, causing modest inflation pressures and minor supply chain disruptions. Markets would stabilize if the scope remains narrow.

On the more severe end, full-scale tariffs of 10%–50% would hit major imports, raising consumer prices, driving up costs for U.S. companies, and triggering retaliatory tariffs on exporters like farmers and automakers. Markets could sell off, safe-haven assets would increase, and the Fed delays rate cuts due to higher inflation risks.

As the August 1 tariff deadline approaches, the economy stands at a crossroads. Regardless of the outcome, the ripple effects will shape inflation, growth, and ultimately the Federal Reserve’s next moves. For now, the Fed is exercising patience by holding rates steady as it weighs the risks of inflation against the potential drag on economic activity.

No matter which scenario unfolds, staying informed and proactive—not reactive—will be the key to navigating the weeks ahead. Talk to your Investment Manager or Advisor today if you have any concerns. Your success matters to us.