Built to Last

March 12, 2018

By Mike Moreland

Vice President of Investment Services

One of our priorities in working with you is to build an investment portfolio that meets your goals. These are long-term in nature, and our investment activities are designed to take the long view. This works well, but sometimes in the short term the outcomes are a little too chaotic for comfort.

We’ve seen that this year. Fear of higher inflation and rising interest rates knocked the supports from the stock markets in February. Remember, fixed income and stocks compete with one another for investor attention. The income on a safe, secure two-year Treasury note is now higher than the dividend yield on the S&P 500 – the first time we’ve seen that in a decade. The path of least resistance for an overly exuberant stock market was down.

The times, they are a-changing, to quote Bob Dylan. February was the first down month in stocks in over a year – the finish of a record-setting run of positive returns and low volatility. We do not believe this is the beginning of the end for this market cycle. We do believe, however, that we’re back to normal. Stock market progress will rely on profit growth, which looks good. Bonds will return to their traditional role of income generation and controlled price risk. The era of looking at bonds on a total return basis (income plus appreciation) is over.

Let’s circle back to the beginning. The vast majority of our clients maintain roughly balanced portfolios – stocks and bonds together. Through the end of February, our balanced models were generally flat to up a small amount, about what one would expect over any two-month period in a normal, up-and-down market environment.

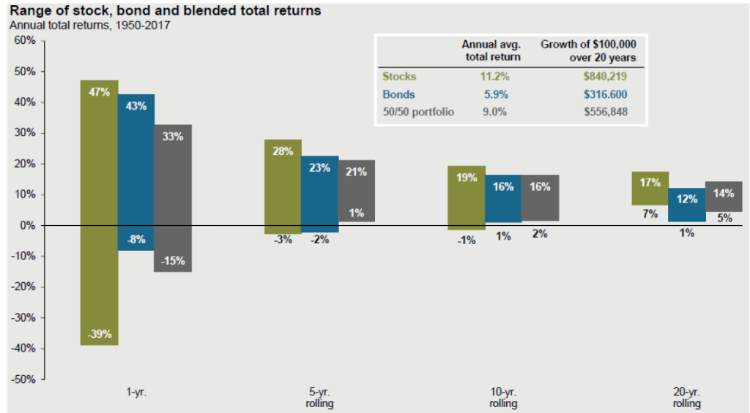

And the longer term? Balanced portfolios produce a more controlled, predictable path toward your goals. Anything can happen in the short run, but consider what happens over time – lower highs and higher lows, a more compressed range of outcomes than relying on stocks or bonds alone. Take a look at the chart below.

Source: J.P. Morgan Guide to the Markets, December 2017

So here’s the takeaway. Balanced portfolios don’t prevent losses in the near term, but they can reduce risk. And, over the long term, they enhance both the predictability of returns and our ability to build portfolios to meet your goals. The path may be winding, but it moves in the right direction. Even with the reappearance of market risk, a broadly diversified portfolio is your best opportunity for long-term success.

We enjoy talking to clients after a great year. However, it’s much more important to stay in touch when life is a little more hectic and unpredictable. Talk to your advisor today, and we will work to ensure you have a portfolio targeted to your goals, built to last.