Capital Gains: Smart Planning Treats To Avoid The Tricks

October 14, 2024

By Matthew Andera

By Matthew Andera

Securities Analyst

With Halloween two weeks away, many Americans will celebrate by trick-or-treating, navigating corn mazes and seeking thrills in haunted houses. Much like surprises lurking around the corner in a haunted house, there is another year-end event that can catch some investors off guard: capital gain distributions.

Not quite as sweet as the candy trick-or-treaters collect, investors may find themselves collecting capital gains from mutual funds and exchange-traded funds (ETFs) towards the end of the year despite not actually selling any shares. Let’s take a look at why this occurs and what the tax implications may be.

What are capital gain distributions?

Capital gain distributions are payments made to shareholders of mutual funds and ETFs as a result of the fund’s investment activities throughout the year. When a fund sells an asset that has appreciated in value, the fund realizes a capital gain. Just as individual investors offset capital gains with realized losses, funds offset their gains with losses and the net gain is distributed proportionately to shareholders.

Funds will sell assets to make a change in investment strategy and to satisfy redemption requests. When an individual investor sells shares of a fund, the fund distributes cash to the investor. If there are more "trick-or-treaters" (withdrawal requests) than "candy" (cash) on hand, the fund must sell an asset to acquire more cash and potentially realize gains in the process.

How are capital gain distributions taxed?

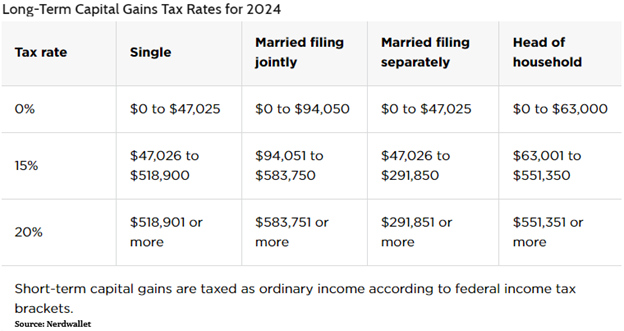

Timing and size of the distributions vary, but they generally occur at the end of the calendar year and appear in the form of short-term and long-term gains. Short-term gains are realized from the sale assets held for less than one year and taxed at ordinary income rates. Long-term gains are generated from the sale of assets held for longer than one year and are taxed at more favorable rates. 2024 long-term capital gain tax rates are listed below. Distributions from investments held in tax-deferred accounts such as a 401(k) or IRA will not affect your current tax liability.

What this means for you:

While most do not enjoy the trick of paying taxes, it is a necessary part of investing and a sign you are being treated to investment success. With your tax burden in mind, the team at Security National Bank monitors capital gain distribution estimates for the various funds we hold in taxable accounts. Should any abnormally large distributions appear, we will look for ways to potentially lower your tax liability through tax-loss harvesting or if conditions are appropriate, selling a fund to avoid the distribution.

If you have any questions or concerns about how these distributions may affect your tax situation for 2024, please reach out to your financial advisor. Your financial success matters to us.