Cautionary Pause In Rates Boosts Market Confidence, But Cuts Remain Elusive

June 19, 2023

By Michael Moreland

By Michael Moreland

Retired Vice President of InvestmentsLast week’s meeting of the Federal Reserve’s Open Market Committee ended with no rate changes – the first pause in over a year. That’s the good news. The rest of the story is that the Committee’s Summary of Economic Projections (known as the Dot Plot) shows a median expectation of two more quarter-percent rate hikes in 2023. Equally important, not a single member of the Committee expects to see rate cuts this year. While it was noted that inflation data is moving in the right direction, interest rates will be ‘higher for longer’ than anticipated by many. The Fed pause and recent economic and inflation data are a breath of fresh air which should allow markets to advance in the near term – even if rates do not fall as quickly as many hoped.

Mitigating Deficit Spending Outside the Fed's Role

One short but notable exchange in Chair Powell’s post-meeting press conference was a question about federal spending and debt. Would the Fed pressure the Administration and Congress to get their fiscal houses in order and curtail deficit spending? The answer was an unequivocal ‘No’. Chair Powell noted that a balanced budget is essential to a healthy economy, but is outside the Fed’s boundaries. If the Fed interferes in fiscal matters, this opens the door to Congress limiting the Fed’s independence. A compromised Federal Reserve is in no one’s best interest.

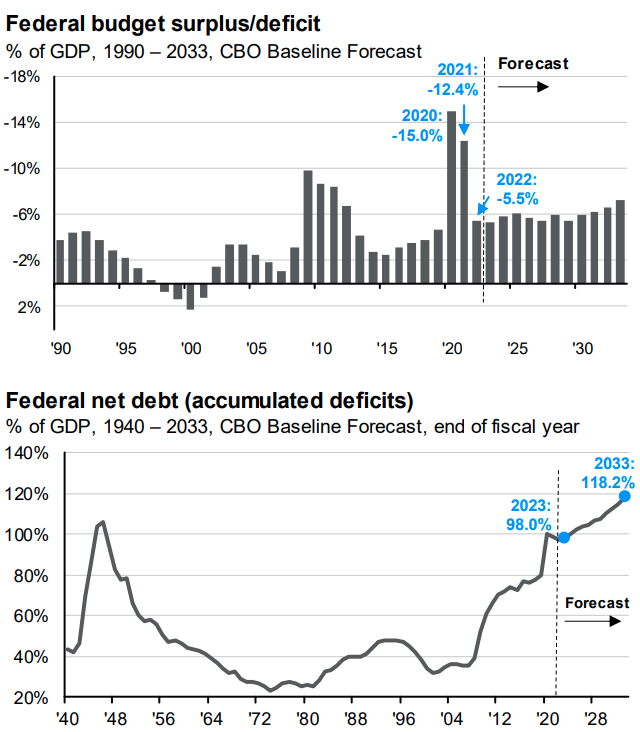

The topic of federal debt is the centerpiece of the upcoming quarterly Economic & Market Commentary. Despite the recent final-hour debt ceiling and budget agreement, there is no end in sight to deficit financing and federal debt buildup. See the charts below, courtesy of J.P. Morgan:

Source: J.P. Morgan Asset Management Guide to the Markets® as of June 15, 2023

Budget Surplus Not Seen In US Since 2001: Persistent Annual Deficits Fueled by Borrowing

The U.S. has not produced a budget surplus since 2001, the end of the stock market technology boom. Capital gains tax revenues far exceeded estimates and (for once) spending did not keep pace. Since then, annual budget deficits financed by borrowing have been the norm. In over half the years the addition debt buildup exceeded $1.0 trillion.

The ratio of our debt-to-GDP is now essentially 1:1. Among industrialized nations our debt-to-GDP ratio is exceeded by only Japan and Italy. Others in a similar position to the U.S. include Venezuela, Suriname, Portugal, and Zambia. While our economy is much stronger and more diverse than all others, it’s well past time to reign in spending. The ramifications of an increasingly large portion of our national income directed to debt service is too critical to ignore.

In sum, even with last week’s ‘hawkish pause’ by the Fed, challenges remain. Conservative, broadly-diversified, value-oriented investment strategies have always been favored by the Division, and are particularly appropriate today. Talk to your Advisor or Investment Manager; your success matters to us!