Could You Pay a Surprise $400 Expense? More Than Half of Americans Say No

June 12, 2023

By Morgan Altman

By Morgan Altman

Securities AnalystCould you pay a surprise $400 expense? Since 2012, economists asked this and similar questions to a sample of U.S. adults while conducting the Survey of Household Economics and Decisionmaking (SHED). While the survey is comprised of over 100 questions, the question “Can you afford a $400 emergency expense right now?” stands out, and is a measurement for the financial fragility of Americans. The financial state of Americans is important because it contributes to the trajectory of the economy. While consumer spending seems strong, it may not be as stable as it looks.

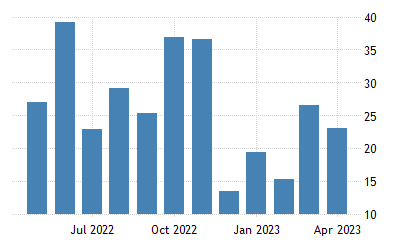

Consumer Debt Surpasses Expectations, Raising Concerns Amid Economic Growth

On Wednesday, April’s Consumer Credit data was released, and the numbers exceeded expectations. Despite interest rates being at a 15-year high, consumers increased debt in record numbers. April consumer credit estimates were expecting an increase of $22 billion. As shown in the chart below, the headline number was slightly over a $23 billion increase. With the $23 billion addition, total consumer credit jumped to 4.86 trillion.

As seen from these numbers, spending remains high, despite recession fears. The strong jobs market should keep spending afloat, although consumers have already begun to pull back. Those who have not yet reigned in their spending anticipate pulling back in the near future, with luxuries such as travel, dining out, and entertainment being the first to be cut.

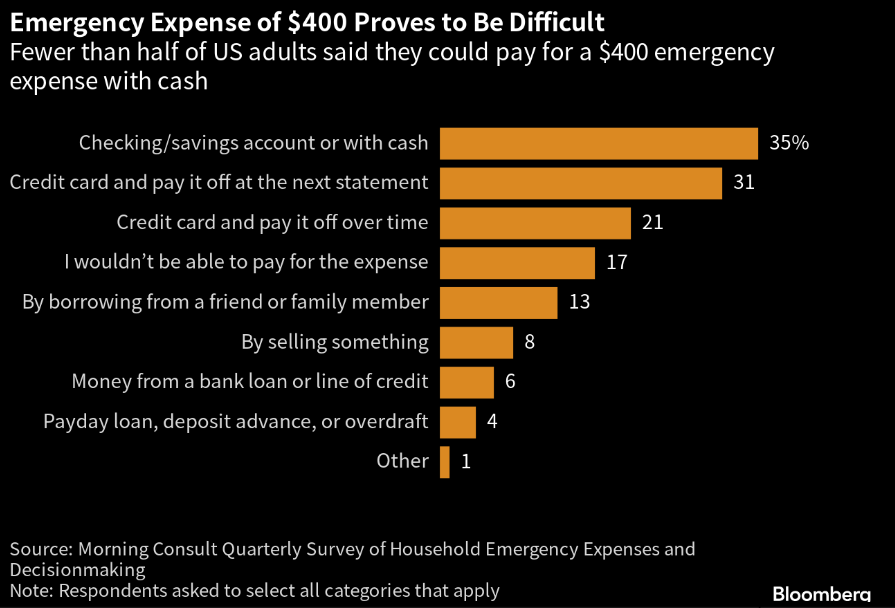

That brings us back to the question: What is the state of Americans’ finances? Unfortunately, between the SHED and Morning Consult Survey results and the data above, it’s not optimistic. The survey found that over half of Americans lack the finances to cover a $400 expense without using a credit card or another form of debt. Seventeen percent said that they would be unable to pay it at all. Overall, consumers are struggling to pay for necessities, and are turning to credit cards and other forms of debt, despite the high interest rate environment. Serious delinquencies (balances over 90 days past due) on credit card balances are increasing as well.

Money Stress Extends Beyond Low-Income Households, Affecting Broader Demographics

Surprisingly, the inability to pay is not limited to low-income households. According to the Bloomberg Morning Consult Survey, approximately 20% of the middle-income ($50,000-$100,000) bracket said they would be unable to cover a $400 expense with cash or equivalents. For those with incomes over $100,000, 8% said that they would be capable of covering a surprise expense like this.

These numbers may climb higher yet. Student loan debt has been excluded from most peoples’ monthly expenses for over three years now. In August, many will have to begin making payments on debt that they have been able to ignore over the last few years. Consumer credit may be interesting to watch come August, when student loan payments are expected to resume, as it is likely to spike.

Some argue that the $400 emergency expense metric is outdated. Expenses such as an ambulance ride or a new set of tires is likely to cost more than $400, so it is better to prepare for emergency costs that will cost more than the $400 benchmark. Consumer spending makes up 70% of the U.S. economy, so it has a significant impact on the markets. Consumer data is mixed. While employment data remains strong, spending is slowing. This could lead to a decrease in both company earnings and stock prices. Potential downturns such as this demonstrate the importance of holding a well-diversified portfolio that will protect your investments on the downside.

Please reach out to to your Wealth Management Advisor today if you have any questions. Your financial success matters to us!