Data-Driven Strategy for a Winning Portfolio Game Plan

June 10, 2024

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsMoneyball, the book by Michael Lewis, offers insights into the world of baseball through the strategies of the Oakland Athletics’ general manager, Billy Beane. The book became so popular that Hollywood made a movie of it. While we don’t watch many movies in our household, Moneyball is on the list of favorites. Many of the quotes and ideas from Moneyball resonate deeply with investing principles, such as the connection between strategy, data analysis and value recognition. Here are some notable quotes from the book/movie and their parallels in the investment world.

“Baseball – of all things – was an example of how an unscientific culture responds, or fails to respond, to the scientific method.”

Prior to the early 2000s, it was common around most baseball clubs to see scouts huddled around a board giving their opinions about certain players and how their respective physical traits applied to the game of baseball. Many times, their decisions were based on emotions and subjective judgments. What Billy Beane did was apply a data-driven, scientific method to player selection and team building – challenging the norm at the time. In portfolio construction, we often apply a data driven approach to build a winning game plan.

Source: JP Morgan Guide to the Markets

Data as of 5/31/2024

The above chart shows three different portfolios. Green represents all stocks, blue is bonds (or fixed income), and grey is a 60/40 stock/bond investment mix. Also included, is the range of portfolio returns over the last one-, five-, ten-, and twenty-year time periods back to 1950. Over the short-term time, the expected volatility is well noted among all asset groups, but in particular, the green stock portfolio. Over the long term, more consistent results begin to emerge, as well as the importance of maintaining a balance between stocks and bonds. What can be learned and applied from these statistics? First, the longer the investor’s time horizon, more value can be added by having stocks in the portfolio. Two, applying a well-thought-out approach can reduce risk and produce consistent results over the long term (which statistically means more wins). We encourage taking the emotions and subjectivity out of the decision-making process, and instead looking at the data of the long game.

“You get on base, we win. You don’t, we lose- and I hate losing”

The above quote refers to the importance of getting on base in relation to scoring runs, and ultimately winning games. While there are true values in bringing in stars to hit “dingers”, the importance of getting on base was of high importance to Billy Beane and his team. It is the first- and most essential- part of scoring runs. When it comes to investing, diversification among various sectors and asset classes produces consistency, which is the portfolio version of getting on base.

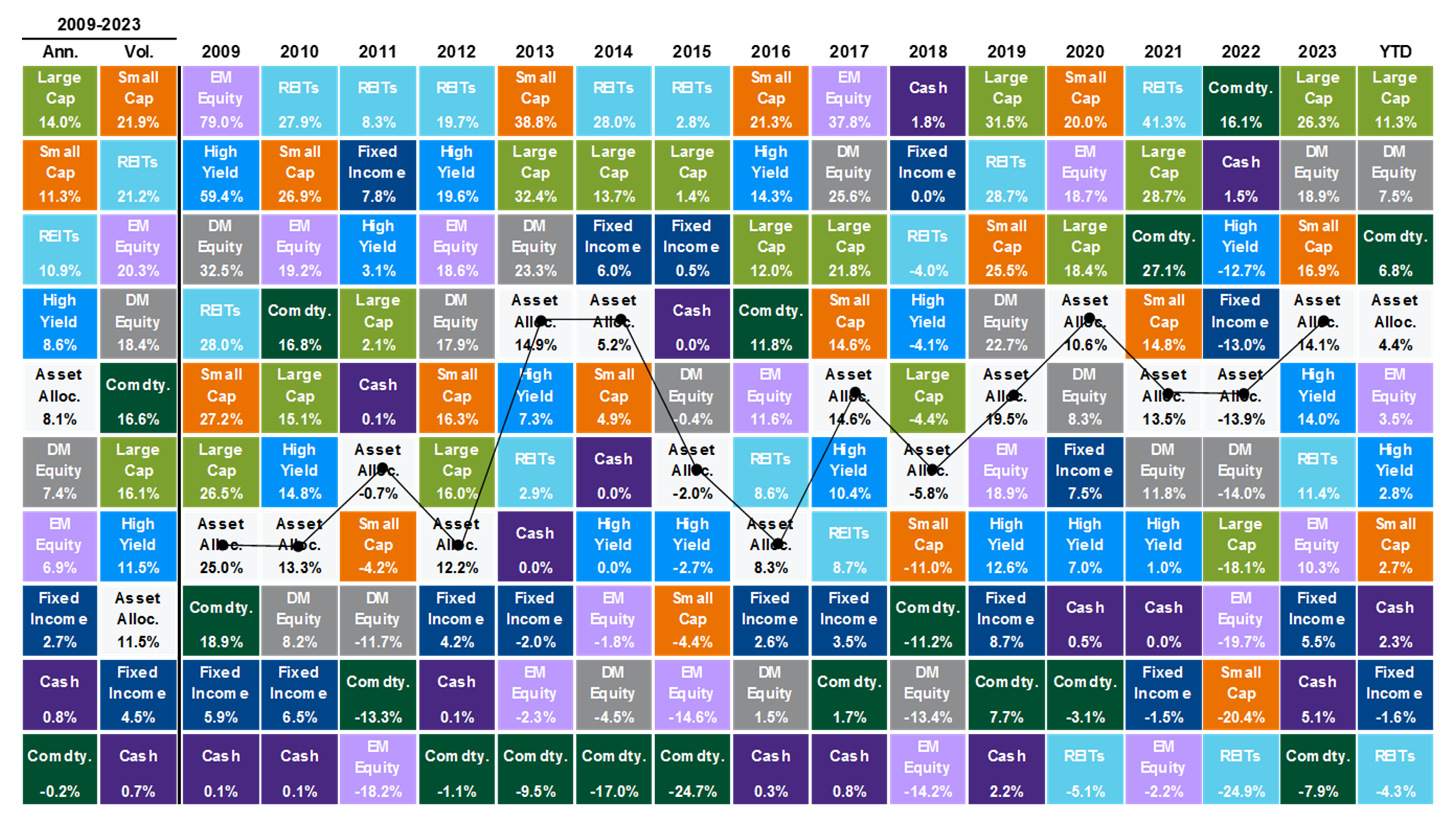

Source: JP Morgan Guide to the Markets

Data as of 5/31/2024

This chart shows the annual performance of various asset classes over the last fifteen years. Each year, the performance of each asset class is ranked from top to bottom. While there is no rhyme or reason to which asset class produces the best or worst return, the white diversified portfolio having all asset classes produces the most consistent results with low volatility. This consistency is first- and essential- to seeing results over time. Why is it important to be diversified? Because it allows your portfolio to “get on base!”

"Your goal shouldn't be to buy players; your goal should be to buy wins. In order to buy wins, you need to buy runs."

This last quote highlights the importance of focusing on the “big picture" rather than just the individual elements. To generate wins, you first develop a strategy of scoring runs. Smart, successful investing is more important than just picking stocks and other investments (or the “players”). By focusing on the end goal and spreading risk, both baseball managers and investors can achieve sustained success in their respective fields. At Security National Bank, our advisors work with our clients to develop a winning gameplan to produce consistent results over the long term. If you would like more information on what this entails, please reach out to one of our advisors today. Your success matters to us.