Diversity - A Strong Support in Volatile Markets

March 10, 2025

By Samuel Richter, CFP®

By Samuel Richter, CFP®

Senior Securities Analyst

The uncertainty surrounding tariffs and weaker than expected employment reports added to volatility last week. The employment readings follow the economic reports Krista discussed last week that surprised to the downside. Recent reports and tariff uncertainty add to investors’ fear of an economic slowdown.

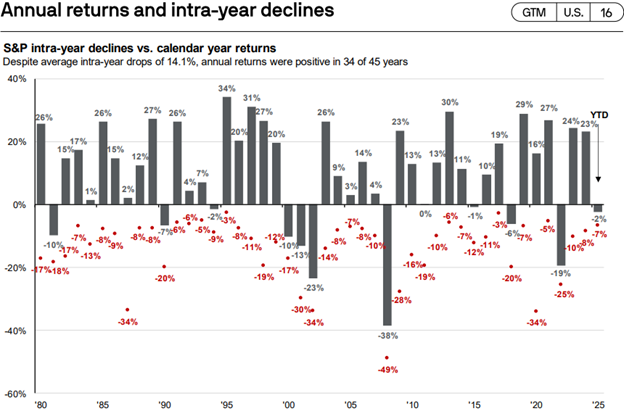

Equity markets experienced drastic swings last week and have trended lower since mid-February. As of Friday’s close, the S&P 500 dropped 6.1% from its peak, but down only 1.9% year to date. Is the intra-year decline of over 6% abnormal when looking at history?

History of Intra-Year Declines

No, the current intra-year decline is not out of the norm looking back over the past 45 years. The chart below shows the intra-year declines as red dots and the calendar year returns as the black bars. The average intra-year decline is 14.1%. Despite this, annual returns were positive in 34 of the past 45 years or 76% of the time.

Data as of March 6, 2025 Source: JP Morgan Guide to the Markets

A thing to keep in mind is the markets do not move in a straight line. We will continue to experience volatility. Remaining invested and diversified has proven beneficial for investors historically. Attempting to time the market by selling out typically hurts investors in the long run.

A Look Ahead

On Wednesday, we will get another inflation report with the release of the February Consumer Price Index (CPI). Last month, the Bureau of Labor Statistics reported CPI climbed 3.0% in January from a year ago. The report was significantly down from the peak of 9.1% in June of 2022, but remains above the Federal Reserve’s target of 2%. Economists anticipate inflation to rise 2.9% in February from a year prior.

Next week, the Federal Open Market Committee (FOMC) meets. There is a high probability of no rate change at this meeting. Federal Reserve Chairman Jerome Powell’s press conference and the release of the Summary of Economic Projections will be the top stories of the meeting giving us an updated view of what the FOMC anticipates moving forward. The market is currently pricing in roughly 3, 0.25% rate cuts in 2025.

The markets have experienced added volatility as of late with tariff uncertainty and weaker than expected economic reports. While volatility can impact the market, a broadly diversified investment portfolio dampens those affects. Please reach out to your Wealth Management Advisor if you have any questions or would like more information. Your success matters to us.