Do you have a "nothing lasts forever" investment strategy?

October 25, 2021

By Tom Limoges

By Tom Limoges

Asst. VP - Investments Sometimes, when everything is working out perfectly, as human beings we get this sense of impending doom. We can’t always enjoy the good times out of fear that they won’t last. We feel like things are too good to be true, so we borrow trouble and search for the flaw that will, in our minds, inevitably make us fail. “Nothing lasts forever” is a quote that embodies this pessimistic, fearful mindset.

The best medicine against this vague anxiety is to have a plan. Some people create habits that will sustain them in good times and in bad. Some people surround themselves with other like-minded individuals to give them perspective and support.

In a similar way, investors feel uneasy when things are going well because they fear the inevitable “bust” to counteract the current “boom.” This uneasiness might cause them to prematurely abandon their investment strategy, and ultimately miss out on potential growth.

Is this too good to last ...

On Thursday of last week, the U.S. stock market hit another all-time high. This new high added to the week’s strong gains which were driven by positive third quarter earnings reports. This most recent gain marks the 55th record close for the S&P 500 this year. At the same time, the market Fear Index measured by the CBOE VIX Index closed with a low not seen since the start of the pandemic. What do the recent all-time highs mean for the future of the market? Should investors make changes to their investment allocation?

So far, the fourth quarter has lived up to the historical trend of delivering some of the best market returns. At the same time, investors remain on edge as to what the near term holds for the markets. There is an old saying that the stock market climbs a “Wall of Worry,” and there has been plenty of headlines in the last few months. From regulatory tightening in China, to the Delta Variant, inflation fears, as well as the Fed hinting at raising interest rates. Throughout this whole period of concern, the stock market has continued to march higher.

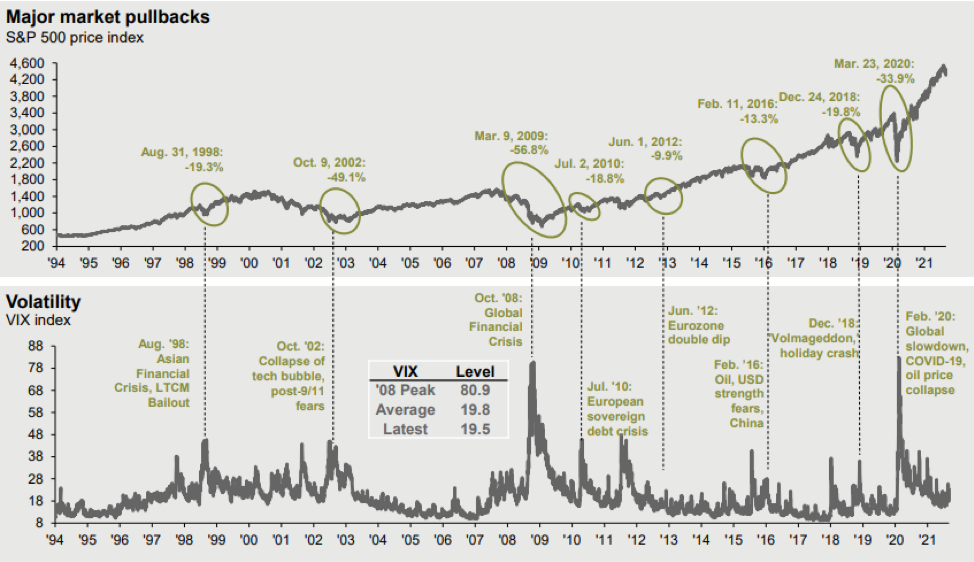

Source: JP Morgan Data as of September 30, 2021

Or just right?

For long term investors, this is good news and a repeating theme of the markets throughout history. The above chart shows the march of the S&P over time. Over the last 25+ years, there have been many global events (too many to mention) that have been reasons to postpone investing, yet the stock market has remained resilient and moved higher over time.

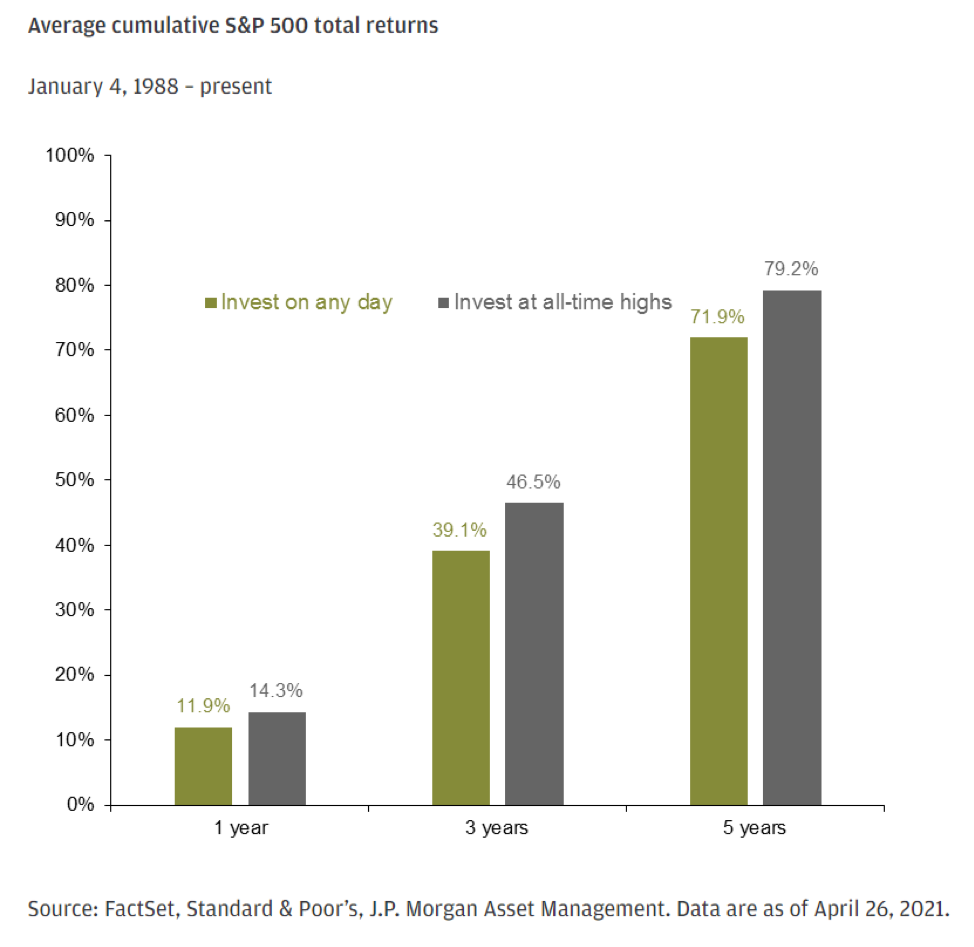

So what do these new all-time highs mean for the future equity markets? While the short-term answer is anyone’s guess, the chart below shows that on average, markets can continue to move higher even after hitting new all-time highs. Stock market valuations remain elevated compared to historical standards, which could indicate lower future returns; however, the markets reaching a new all-time high is no reason to sit on the sidelines.

Our philosophy

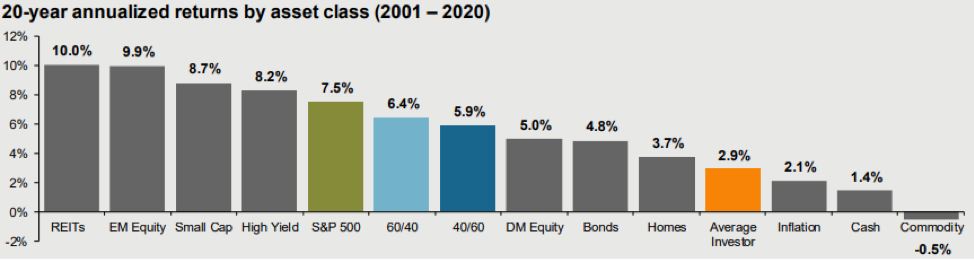

At Security National Bank, our philosophy has been to develop an investment strategy and stay fully invested to that strategy over time. This strategy works because our rebalancing efforts force the portfolio to buy when the markets have declined and sell when the markets are higher and this reduces the emotional ties to the market. In the below chart, you can see what the markets (green) have returned over the last 20-years. The blue bars indicate diversified investment portfolios. The orange bar on the right indicates the average investor return. The average return for the investor is much lower because their emotions and biases can spur bad decisions and make the investor miss out on the market upside.

Source: JP Morgan Guide to the Markets

Record setting highs can be both exhilarating and anxiety provoking. The fear of losses can also impact investor’s thoughts and behaviors. The lesson that can be learned from this is to have solid investment habits and plans that take the emotion out of process. While it is true that nothing lasts forever, there are still ways to use data to inform decision making instead of acting on emotion. We are here to help you manage that process.