Does the "January Effect" Still Exist?

February 7, 2022

By Jonathan Smith

Securities Analyst

New year, new goals. January has typically been a time for us to review our past successes and try to improve on anything that didn’t meet our expectations. Often, we look for patterns and trends to help guide our decision making for the upcoming year. Investments are no different.

What is the “January Effect”?

The “January Effect” is a perception that stocks tend to rise during the first month of the year.

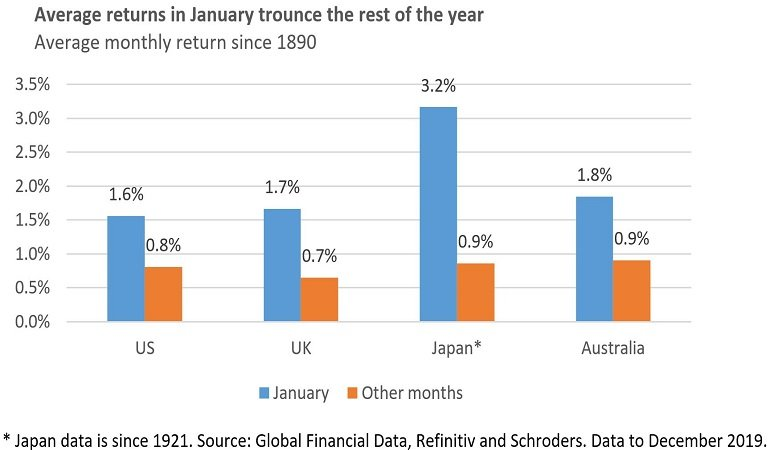

Between the years 1890 and 2019, January outproduced every other month in the stock market by 0.8%.

Source: Schroders

There are several explanations that contribute to this rally pattern. First, through rebalancing, investors typically buy back stocks that were sold for tax purposes in the prior year. Another reason may be that January is a good time for new investors to follow through on their New Year’s resolutions by beginning to trade stocks, driving activity up.

In any case, some investors theorize that a good January in the stock market is a good predictor for the rest of the year, and they use the signal to make decisions for the upcoming year’s investments.

How has the Theory Fared Recently?

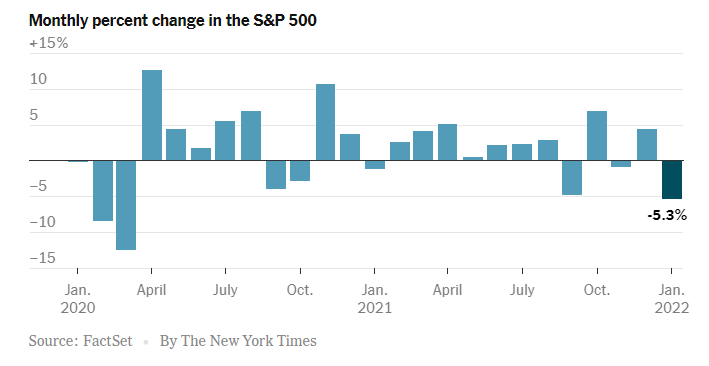

The January Effect has not held up during the last three years — including last month. January 2022 was a tough month for investors, as both stocks and bonds fell. The S&P 500 closed the month down 5.3%. This decline was attributed to increased projections of potential rate hikes by the Federal Reserve. This caused investors to sell out of some of their speculative and higher valued growth stock positions.

However, a tough January doesn't necessarily paint a bleak picture for the rest of 2022. The chart below shows the S&P 500's monthly returns during the last three years. As you can see, in contrast to previous trends, January has not been a reliable predictor of the remaining months of the year.

Source: New York Times

While historically January has been a strong month for stocks, it does not always provide a clear prediction of how the remainder of the months may perform in the markets. There are many factors in the economy, and things like current events and world headlines will continue to be factors. Therefore, following the “January Effect” theory may not always prove to be the best guide for predicting future performance.

Our Take

At Security National Bank, we structure our clients’ portfolios to meet changing market conditions. Diversification plays a large role in reducing volatility in challenging market environments. Please reach out to your Wealth Management advisor to discuss any questions that you may have on our strategies.