Could Your Portfolio Reflect Your Values?

October 28, 2019

By Colin O'Shea

By Colin O'Shea

Securities AnalystLately we’ve received questions from clients on sustainable or “ESG” investing. But while the popularity of ESG investing in the U.S. is growing, so is the confusion surrounding what exactly it means.

In this article, we’ll discuss ESG investing and if it might be right for your portfolio.

What is ESG Investing?

The letters “ESG” stand for Environmental, Social, and Governance — meaning that ESG investing takes into account the environmental, social and governance practices of an investment to determine if it aligns with the investor’s values. Let’s take a look at the three main ESG factors:

- Environmental: The Environmental factor takes into account climate change, natural resources and energy, waste and pollution, deforestation and many other aspects.

- Social: These factors include human rights, animal welfare, consumer protection, local communities, health and safety, diversity and more.

- Corporate governance: This includes management structure (balance of power between the CEO and board of directors), executive and worker wages and compensation, working conditions, employee relations, political lobbying and donations, tax strategy, bribery, corruption and more.

ESG vs. Socially Responsible Investing: What’s the difference?

ESG differs from Socially Responsible Investing (SRI) in that, instead of screening out companies or practices to avoid, ESG investors proactively choose where to invest. Not only are we are finding more and more people want to invest in a manner that aligns with their values, but businesses around the world are also acknowledging the importance of ESG factors and are changing their business practices to reflect this.

How has ESG investing become so important?

The term ESG first appeared in 2005 when the United Nations, the International Finance Corporation, and Swiss Government issued a report called “Who Cares Wins.” The report’s aim was to examine the role of ESG factors in regards to business practices.

A 2018 survey by TD Ameritrade showed that 60 percent of millennials view ESG investing as important compared with 36 percent of baby boomers. A similar study by Allianz Life found similar results, with 64 percent of millennials that favor ESG investing, compared to 54 percent of Gen Xers and 42 percent of boomers.

Other studies show the same results across the board. Younger people are increasingly concerned and aware of how they invest, and want more options and transparency to invest sustainably and responsibly.

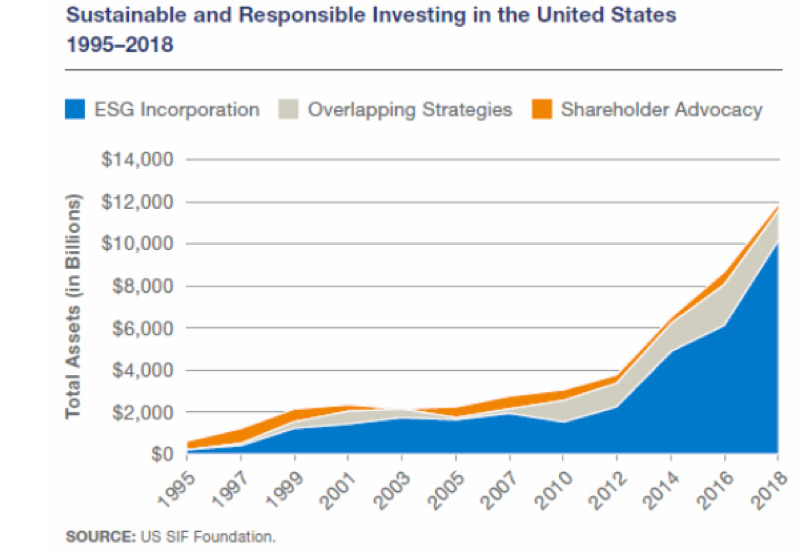

In fact, ESG based investing is now a $12 trillion business, as the chart below reflects:

This is important as we head toward the great transfer of wealth from baby boomers to millennials, a transfer that will likely continue to drive growth and interest in ESG.

Investment management firms are creating ESG-based mutual funds and exchange traded funds at an increasing pace. From 1971 to 2004, only 38 funds designated as ESG even existed. But since 2005, firms have launched more than 200 ESG designated funds — with more popping up every month.

These mutual funds and ETFs are designated ESG, and are labeled to let you know the areas on which they focus. And even for certain funds that aren’t ESG oriented, research firms have begun creating ratings to provide information of how these funds rank by ESG criteria. Research firms are also creating ESG criteria models for rating individual companies (though access to these reports often comes with a fee).

Is ESG investing right for you?

ESG investing is an admirable cause, however, there can be confusion with reporting, and two main issues regularly arise when researching ESG.

First, there are no global standards, and no regulations requiring what is to be reported. Secondly, ESG factors mean something different for every person. Your values are often deeply personal and unique.

The bottom line for ESG investing is to be specific. When advisors tell me they have someone interested in ESG investing, I have several questions I ask in return:

- What is your investment goal?

- Are you looking for broad ESG investment, or are you concerned about a specific issue? For example, some ESG funds focus on specific industries, like green energy, or solar or wind power.

- Are you as the investor willing to give up some total return performance or performance history to invest in ESG? The reason for this question is that due to the nature of ESG investing and its short existence, performance can be more volatile, not on par with the overall market; and for newer companies and funds, the performance history may not even exist. Therefore, there is more potential risk involved.

ESG investing is no longer a niche investing are, it has become mainstream. At Security National Wealth Management, as we compare our model funds across the available universe, we find that our funds rank relatively high in ESG score, while not being ESG specific. We will continue to routinely monitor our funds for ESG awareness and can help with any questions you have.