Economic & Market Commentary: “The End of the Beginning”

October 3, 2022

In late 1942, Allied forces under Generals Alexander and Montgomery defeated a German army under Rommel in North Africa, the first major Western theater victory of World War II. In his announcement to Parliament, Winston Churchill stated, ‘Now, this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.’

The Fed’s Line in the Sand

Equity markets staged a dramatic rally in mid-summer. The consensus view was that the Federal Reserve, after multiple above-average rate hikes, would moderate its aggressive tightening. Chair Powell’s short comments following the Jackson Hole symposium disabused markets of this notion. Mr. Powell noted that reining in inflation will ‘...require…a restrictive policy stance for some time’, that will ‘...bring some pain to households and businesses’. And, perhaps most important, he stated, ‘The historical record cautions strongly against prematurely loosening policy’. This last comment was a pointed reference to the failed monetary policies of the 1970s that led to the inflationary spiral of that period.

Clearly, the Fed’s message was that we are much closer to the beginning of the tightening cycle than its end, with all of the concomitant impacts on economic activity and financial markets. If we’re fortunate, however, perhaps we’re closing in on the end of the beginning.

The 2.0% Inflation Target is Still a Long Way Away

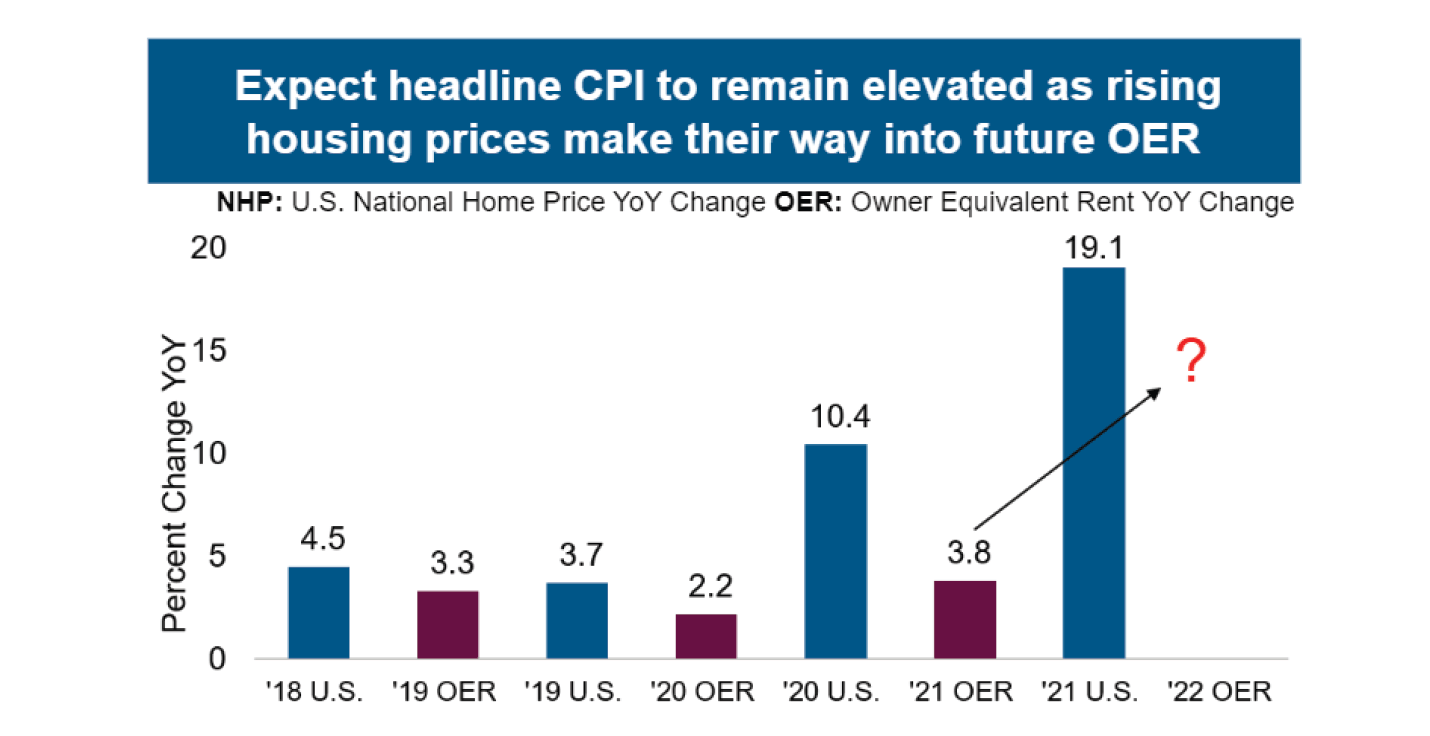

Whether one looks at energy, travel and leisure, or used car prices, immediate inflationary pressures are subsiding. The first question is whether the pace of increases will slow enough to reduce headline inflation levels back to the Fed’s 2.0% target. Perhaps this will be the case for some of the more volatile components. That said, food prices will continue to rise. Other categories – housing in particular – will be additive to inflation data for some time to come. Let’s look at history.

The Shelter component comprises just under one-quarter of the Consumer Price Index. Until the early 1980s, this reflected immediate changes in home prices from transaction activity. While accurate, only a small subset of the market was included in this measurement – most homeowners do not move often. The housing calculation was then changed and renamed Owners’ Equivalent Rent, better designed to capture slower-moving price adjustments for rental agreements and property turnover.

This is a more encompassing method. At the same time, however, it stretches out the impact of inflation. The full effect of the last two years’ skyrocketing housing markets will be felt well into 2023. This is suggested by the following chart, courtesy of PIMCO.

Used with permission from Pacific Investment Management Company LLC

- OER (Owners’ Equivalent Rent) makes up ~24% of Headline CPI

- Current YOY home price appreciation tends to make its way into subsequent rises in OER over the next three years

- Even if it takes three years for home price appreciation to make its way into OER, then OER would still need to rise to ~6.5% per annum.

- As such, and even if the prices of the remaining 76% of the CPI basket don’t rise at all, Headline CPI would come in at 1.6% from OER alone.

Thus the Fed’s recent harsh tone. The shelter component of CPI alone will keep the central bank from easing anytime soon. Monetary policy will remain restrictive – higher for longer – bringing with it a rising risk of recession.

The Outlook for Equities

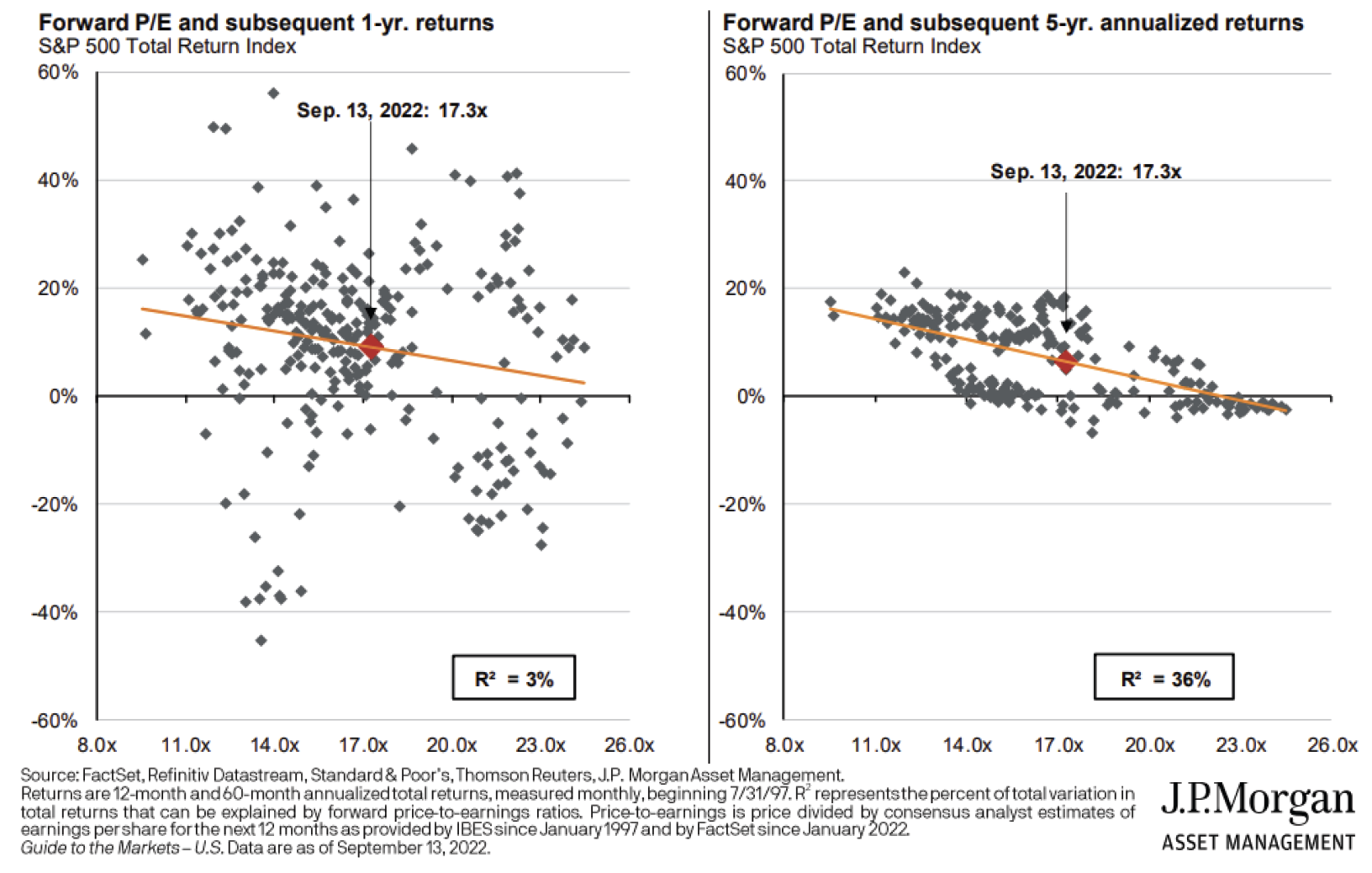

Regular readers of these Commentaries know we focus on current valuations in building an outlook for expected market returns. The higher the starting valuation, the poorer the outlook for future gains. And, while the predictive value in the short term is poor, the correlation for longer time periods is strong. As noted in the graphics below, given current valuations, the expected return for the S&P 500 over the next several years is in the mid- to upper-single digits.

International markets, while not shown here, show higher expected returns. Given the unfolding energy crisis in Europe, this is logical. The question is, ‘How much of the potential bad news is already reflected in overseas markets?’ We believe most is, and we remain firm believers in the benefits of broad global equity exposure.

A common question is, ‘When will we recover the 2022 bear market losses?’ The 2020 drawdown was recouped in a matter of months, largely due to massive fiscal and monetary stimulus in response to the pandemic-induced recession. That won’t be the case in this cycle. While fiscal policies remain expansionary, monetary policies will focus on inflation, not protection of asset values. A quick snap-back is possible, but history suggests we’re at least a couple of years before we recapture the January market peak.

Our position

We remain fully invested in our client portfolios. We maintain a value tilt and broad diversification by market capitalization and geographic exposure in equities. Fixed income is high quality, short- to intermediate-term, and yield-conscious. We want to keep pace when the market environment is favorable, and reduce downside risk in poorer times. While sometimes there are ‘few places to hide’, this philosophy has worked well for many years. We are confident it will do so in the future. Our clients – and their success in reaching their goals – matter to us.

This Economic & Market Commentary is written by the Investment Services Department at Security National Wealth Management. Please contact us if you have any questions.