How will mid-term elections affect the market?

August 19, 2022

By Krista Eberly, CFP®

By Krista Eberly, CFP®

Investment Management Officer

As my colleague mentioned last week, most broad based markets have recovered half of the losses from their lows back in June. Will this rally continue from here? Unfortunately, it is too early to tell. However, we can use history as a guide to see what to expect in the final months of the year.

After the worst first half in fifty years for both equity and fixed income investors, the markets came roaring back in July. In fact, it was the fourth best July for the S&P 500 since 1926 according to Blackrock. The S&P 500 rose 9.2% compared to the historical average of 2.0% in July. In addition, history shows that the average return is positive in the final five months of year. If July is a positive month, the following five-month return is 5.3% on average; if it is a negative month, the average return is 2.9%. Hopeful news in a challenging year.

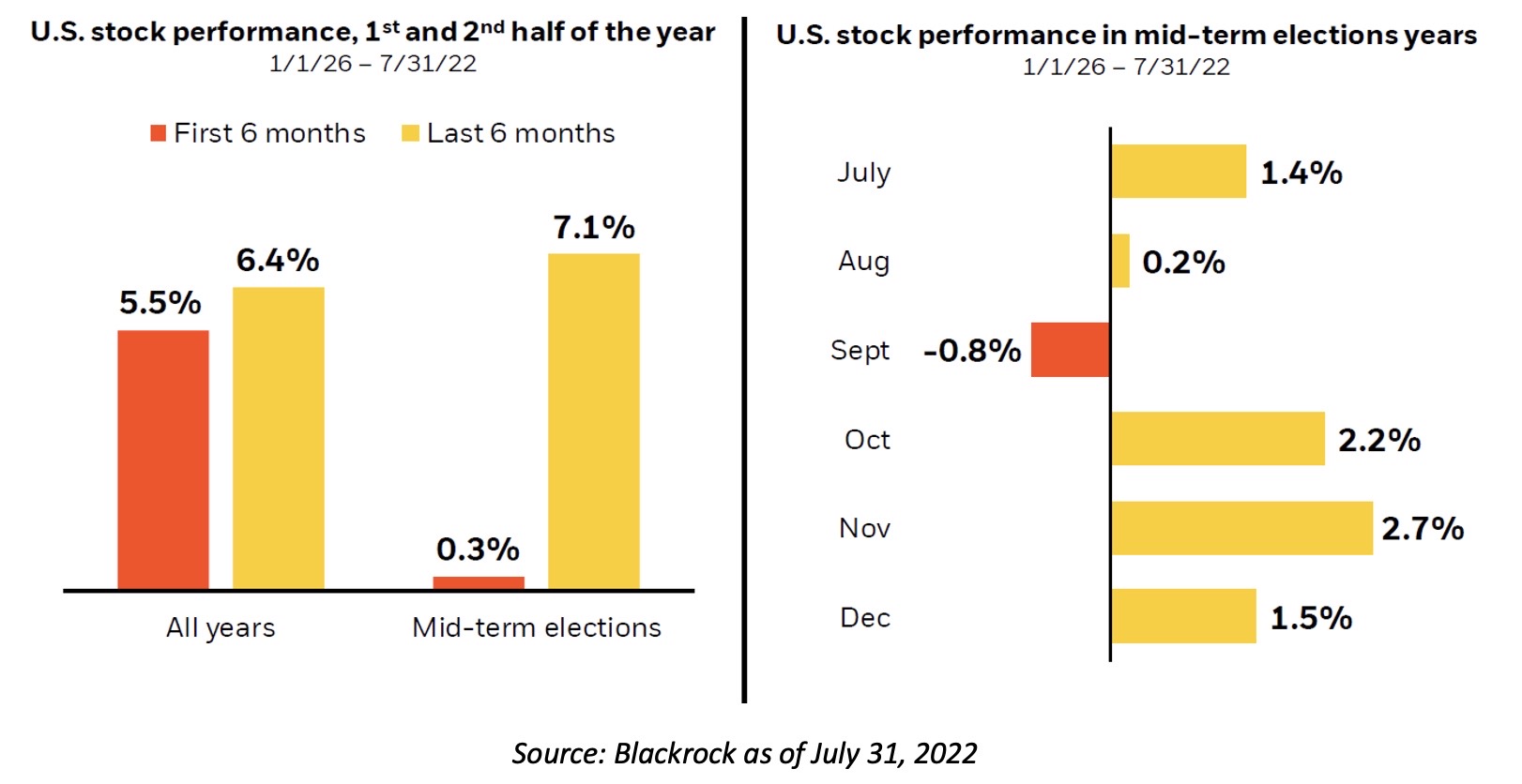

As we get into the fall, a key topic on investors’ minds is mid-term elections. Particularly, how do the markets perform during a mid-term election year? Blackrock looked at the history of returns on the S&P 500 since 1926 and the results are below. A few things to note on this. First, returns in the first half of an election year are mediocre at best, with an average of just 0.3%. Second, returns are stronger on average in the second half of a mid-term election year compared to all years. Third, markets typically decline on average in the month of September before rallying in the final three months of a mid-term election year. Why is this?

Mid-term elections bring additional unknowns to the current economic environment. Markets don’t like uncertainty and this triggers volatility in the weeks leading up to Election Day. However, once it is over and the outcome known, markets breathe a sigh of relief. In addition, the fourth quarter of the year has positive seasonality on its side, whether it is an election year or not.

As I mentioned above, it is too early to tell if we have reached a market bottom as uncertainties remain. However, we have history on our side as we get into the final months of the year. As Mark Twain once said, “history doesn’t repeat itself, but it does rhyme.”

While we wait to see how the rest of the year plays out, now is a good time to review your long-term goals and ensure that you are still on the path to achieving them. If you have not yet reviewed your accounts this year, please give your Wealth Management Advisor a call today. Your financial success matters to us.