How Will Turmoil in the Middle East Impact the Market?

October 16, 2023

By Tom Limoges

By Tom Limoges

Vice President - Investments

Last week, markets reacted to heightened geopolitical tensions surrounding the Hamas attack on Israel and the conflict in the Middle East that has ensued. Words cannot express our horror at the catastrophic human toll of the events that have unfolded, and we can only hope that a lasting peace is achieved sooner rather than later.

The purpose of this blog posting is to focus on the short and long-term impact this geopolitical event has on the financial markets.

Source: Bloomberg

Interest Rates

The chart above details the rate of the 10-year Treasury bond over the last six months. Overall yields on government bonds drifted higher as better-than-expected employment data stoked inflation fears. Following a strong Jobs report on October 6, the yield on the benchmark ten-year Treasury moved above 4.8% - the highest yield since August 2007.

On the short term, geopolitical events can create uncertainty in the financial markets and place a higher premium on safe investments such as government bonds. Because more investors are buying higher quality bonds, yields declined on U.S Government bonds last week by more than 0.2%. Depending on the path forward, longer term yields could experience pressure as fear and uncertainty push more investors into safe haven investments.

Commodities - Oil

In recent weeks, oil prices trended lower as supply levels increased. Last week’s geopolitical events and, specifically, the location of those events (Middle East) caused a modest bump in the price of oil. In the short term, these events should not affect the oil supply, but increasing odds of a broader Gulf conflict would increase the risk of a supply shock and push oil prices higher.

Higher oil prices could affect inflation and apply additional pressure on the Federal Reserve and its stance on lowering those inflation numbers.

Equity Markets

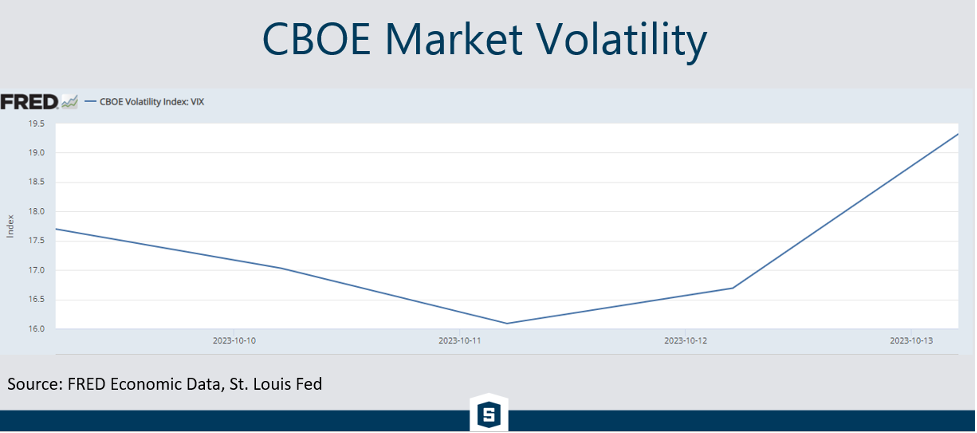

The chart above details the Chicago Board of Options Exchange Market Volatility Index over the last week. The CBOE Market volatility index measures the magnitude of the price movements of the S&P 500. The higher the index level, the more dramatic the index price fluctuations are. As a rule of thumb, the equity markets don’t like uncertainty and geopolitical events such as the one in the Middle East can raise the volatility level of the equity markets in the short term.

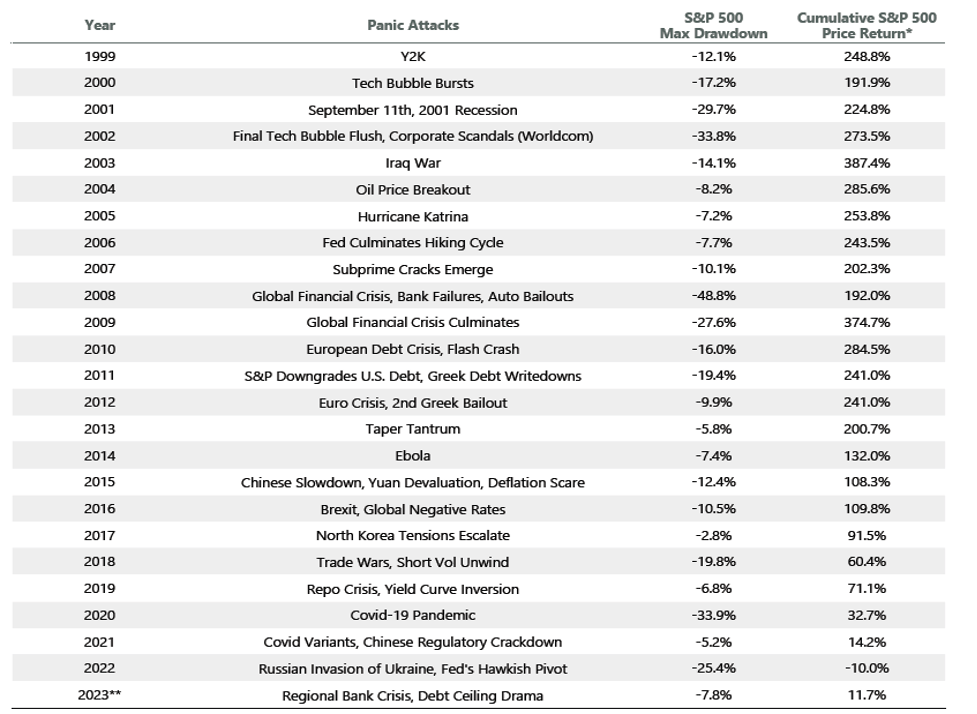

Source: Franklin Templeton, data as of 9/30/23

Short term market drawdowns can affect portfolios and cause fear and uncertainty in the minds of investors. It is important to remember that over the longer term, equity markets remain resilient. The chart above represents significant events that affected the short term performance of the S&P 500 over the last 20+ years. These short term drawdowns, while uncomfortable, are often short lived as longer term price returns since each event are significantly higher.

We are aware of the tremendous human impact of the crisis in the Middle East. Uncertainty is high and the market impact so far is modest over the last week. While it is too early to determine the long term impact on the equity markets, we know the markets remain resilient over longer time periods.

Our conservative approach to investment management serves us well during times of market volatility. Client portfolios will remain fully invested and well diversified with a focus on quality, income, and valuation. If there are additional questions, please reach out to your advisor today.