Investing Can Reflect Moral Values - and Higher Portfolio Values, Too

July 12, 2021

By Faith Birdsell

By Faith Birdsell

Investment Intern

Investing is no longer seen as just a means to increase your finances, but also as a contributor toward change. With all the turmoil the past year has brought, people are more conscious of the effects their investments have. This is one reason why “ESG investing” — which looks at the Environmental, Social, and Governance factors of a company — is becoming popular.

This strategy was once used only as a way to align someone’s investment dollars with their moral values, but research shows that it can now be much more than that.

What is Causing This New Trend?

Sustainable investing has been rising in popularity in recent years due to advancements in information sharing and globalization, which makes issues in the business world more public. 2020 brought a lot of unexpected change, most noticeably a pandemic, social unrest, and market volatility.

Money invested in sustainable funds more than doubled from 2019 to 2020, reaching over $50 billion. With nearly a third of these investment dollars coming from the last quarter of the year, it signals that ESG investing is going to continue to grow in importance. Along with this comes pressure from a new generation of investors that have their own unique preferences and sustainability concerns.

Who Benefits?

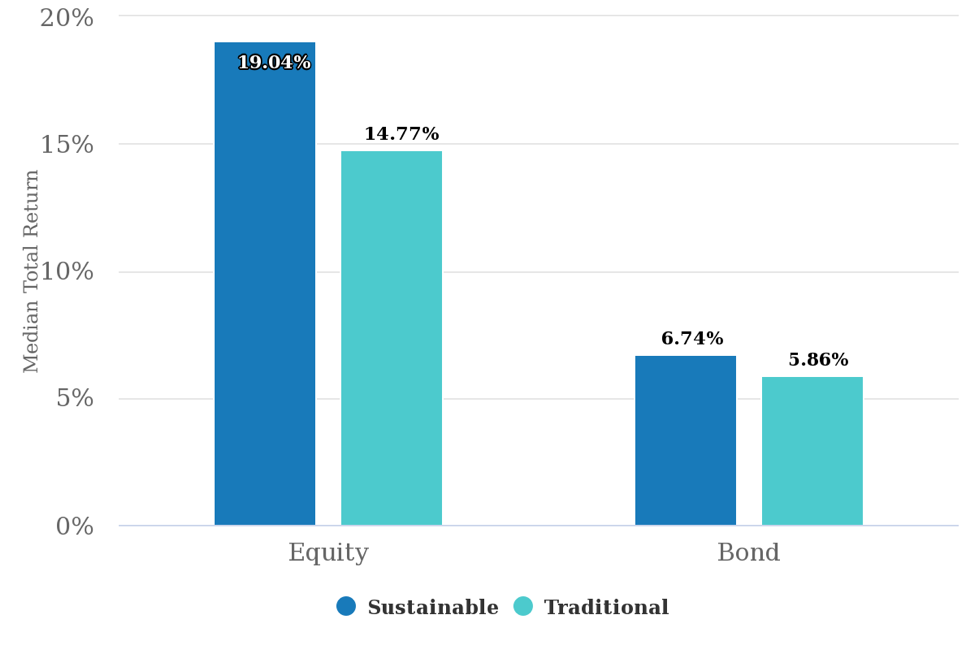

ESG strategies allow investors to support companies that reflect their own beliefs, but they have also led to higher financial returns. In 2020, both U.S. sustainable equity and bond funds outperformed their similar traditional funds, proving resiliency in a year of turbulence. The sustainable equity funds outperformed their peers by 4.3%, while sustainable bond funds surpassed traditional ones by 0.9%. ESG funds have historically overweight Information Technology firms, and this concentration is likely one of the sources of that out-performance.

Source: Morgan Stanley

Not only can investors benefit from ESG funds, but companies may also profit from sustainable practices. From a corporation’s perspective, taking notice of ESG factors can help them adjust their sustainability framework and create new competitive advantages. An increased focus on ESG values can translate to an improved brand name, higher customer loyalty, and positive public opinion. Taking steps toward sustainability presents the opportunity to reduce costs through increased resource efficiency, innovations, and greater product quality, resulting in higher returns.

Can You Actually Make an Impact?

While it is true that investing is a tool used to try and improve your financial wellbeing, it can also be something much more powerful. Not only are investors providing additional resources for a company, but they are also using their dollars as a tool to advocate for matters that are important to them. Increased investments allow companies to continue their ESG efforts, raise awareness, and make a positive impact on society.

Our focus at Security National Bank is choosing investments that have favorable long-term fundamentals. These metrics are characteristics of strong companies and often overlap ESG criteria. This has allowed our portfolios to score better than comparable benchmarks using several ESG metrics. If you have any additional questions on ESG investing, please contact your Wealth Management Advisor.