Exploring ETFs: Opportunities, Drawbacks, and the Growing Marketplace

September 1, 2025

By Dustin Saia

By Dustin Saia

Securities AnalystInvestors now face more choices than ever before. Exchange-traded funds (ETFs) are a prime example. There are now over 4,300 ETFs listed in the U.S., officially outnumbering publicly traded companies.1 With their rising popularity, it’s important for investors to understand how ETFs work and the potential benefits and drawbacks of using them.

What is an ETF?

Investors can invest in many ways including through stocks, bonds, mutual funds, or ETFs. ETFs, like mutual funds, pool money from many investors to buy a mix of stocks, bonds, or other assets. The key difference compared to mutual funds is that ETF shares trade on the stock market, so you can buy or sell them throughout the day, just like an individual stock. This means prices fluctuate and can differ slightly from the fund’s Net Asset Value (NAV). Comparatively, mutual funds always trade at their NAV, which is calculated at the end of each trading day.

ETFs also use a unique “in-kind” creation and redemption process. This process allows large financial institutions, called authorized participants, to exchange baskets of securities for ETF shares (and vice versa). This helps keep prices close to NAV and often avoids taxable sales, making ETFs generally more tax efficient.

The History of ETF Growth

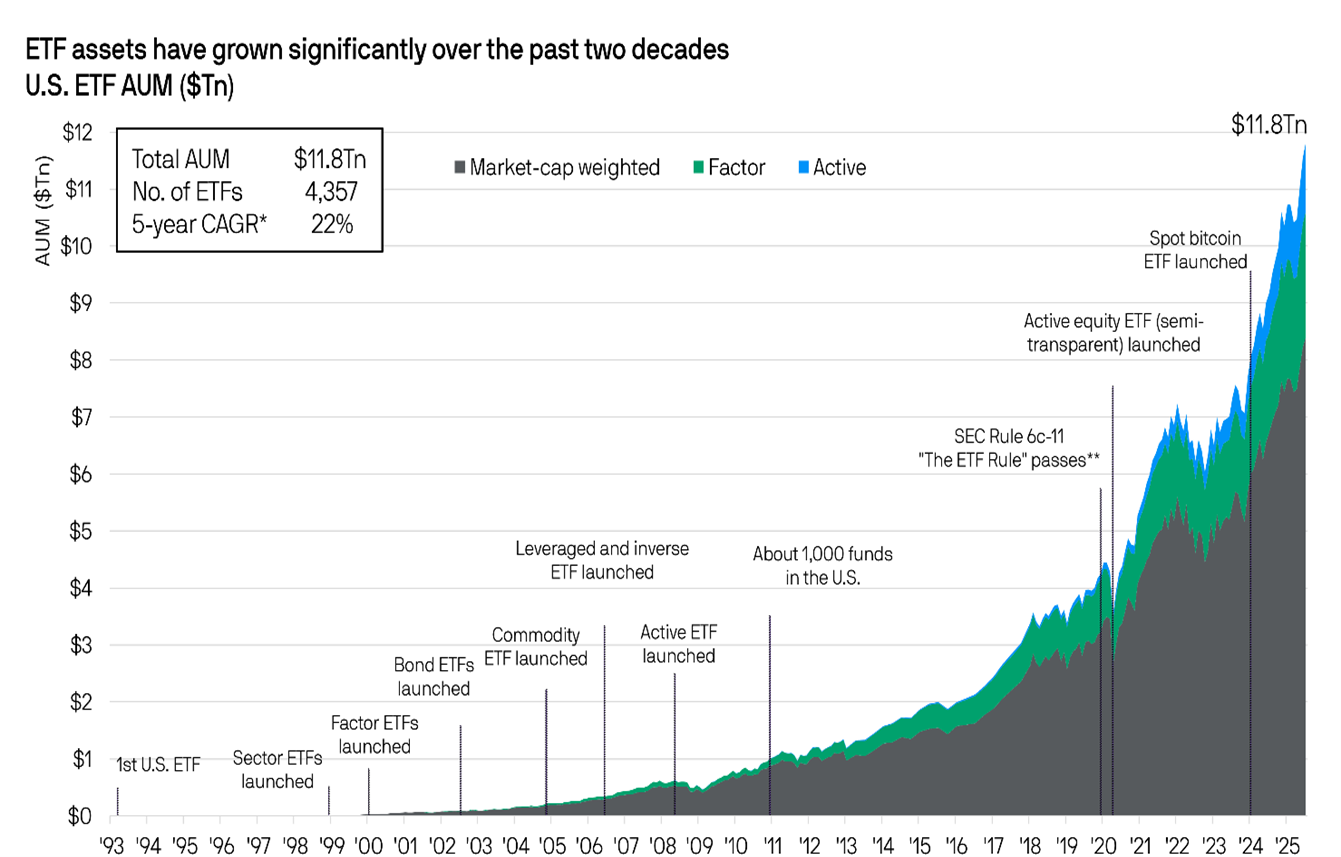

The first U.S. ETF, the SPDR S&P 500 ETF (SPY), launched in 1993 to track the S&P 500. Over time, ETFs expanded beyond simple index tracking to include bonds, sectors, factors, commodities, leveraged strategies, and actively managed funds. A major boost came in 2019 with SEC Rule 6c-11, known as “The ETF Rule”. This rule simplified approvals and formalized the creation and redemption process, making it easier for ETFs to manage inflows and outflows efficiently. As seen in the chart below, this variety and regulatory support fueled rapid growth. Today there are more than 4,300 ETFs in the U.S., holding nearly $12 trillion in assets. What began as a single index tracker now offers investors a wide range of options, bringing both opportunities and challenges.

Source: JP Morgan Data as of 07/31/2025

Source: JP Morgan Data as of 07/31/2025

Benefits and Drawbacks

This naturally leads to the question of what benefits ETFs offer and what drawbacks investors should know. Thanks to the creation and redemption process, ETFs can be more tax efficient and often have lower capital gains distributions. Many ETFs are low cost because they have historically tracked indices passively, though fees are rising in some areas as new strategies, including active ETFs, become more common. ETFs also provide daily transparency, so investors can see exactly what the fund holds and how it is priced throughout the day.

On the downside, trading ETFs can involve hidden costs that do not show up in the stated expense ratio. Because ETF shares trade continuously on the market, you rarely get the exact price you see. Investors usually pay a little more when buying and receive a little less when selling. These differences are often larger in volatile markets when prices move quickly, and it is harder for buyers and sellers to agree on a trade. Small trading costs can add up over time, especially for larger positions or during periods of high market volatility.

Another challenge is the sheer number of ETFs now available. While more options can be good, too many choices can overwhelm an individual investor. Today, it is more important than ever to either do your homework or get a trusted opinion to understand each ETF's strategy, holdings, and risks before investing.

At Security National Bank, we continue to monitor the evolving ETF landscape. By leveraging our research and expertise, we aim to guide clients toward investments that best align with their goals and strategies, easing the burden of choice they face today. As always, if you have any questions on ETFs or your portfolio, please reach out to your advisor. Your financial success matters.

1 Bloomberg. (2025, August 25). There are now more ETFs in US than there are individual stocks.