Fireworks in the First Half: Tax Refunds and Early-2026 Growth

January 5, 2026

By Dustin Saia

By Dustin Saia

Securities Analyst

Happy New Year everyone! I hope you were able to take time to celebrate with friends and family and enjoy the many festivities that come with ringing in a new year. One of the most recognizable events of New Year’s celebrations is a spectacular fireworks show, lighting up the sky as we turn the page on the calendar. This year, those fireworks might extend beyond January 1st. A fuse appears to be burning under the U.S. economy, as projections for increased tax refunds set the stage for a burst of consumer spending in the first half of 2026.

Tax Refunds on the Way

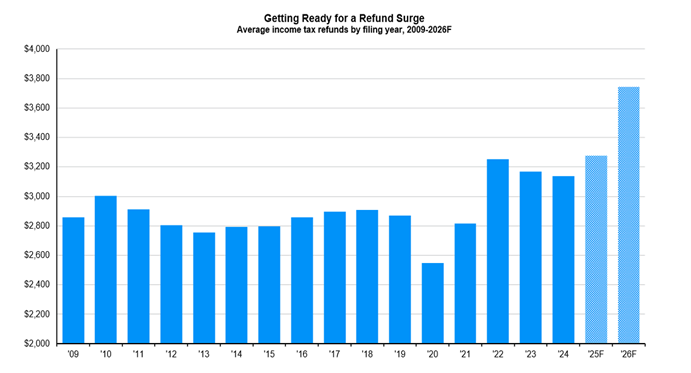

Due to the One Big Beautiful Bill Act (OBBBA), signed into law on July 4th, 2025, U.S. taxpayers are projected to receive increased income tax refunds in 2026. As shown in the chart below, average refunds have steadily increased over time, with projections for 2026 coming in just shy of $3,800.

Source: J.P. Morgan, The investment implications of the refund surge

The legislation extended key elements of the 2017 tax cuts and introduced several new provisions. These include the elimination of income tax on tips, overtime pay, and auto loan interest, a higher state and local tax (SALT) deduction through 2030, and permanent increases to the standard deduction and child tax credit. Importantly, many of these changes were made retroactive to the beginning of 2025, meaning withholdings were not adjusted during the year and many taxpayers likely overpaid their taxes.

The combination of expanded tax benefits and unadjusted withholdings set the stage for unusually large refunds early in 2026. We discussed additional details and provisions of the bill in more depth in our July 2025 commentary.

What This Means for the Economy and Markets

Larger tax refunds can have a meaningful impact on economic activity, particularly when they arrive in a relatively short window of time. With more discretionary income available, consumers are likely to increase spending, creating a stimulatory effect across the economy.

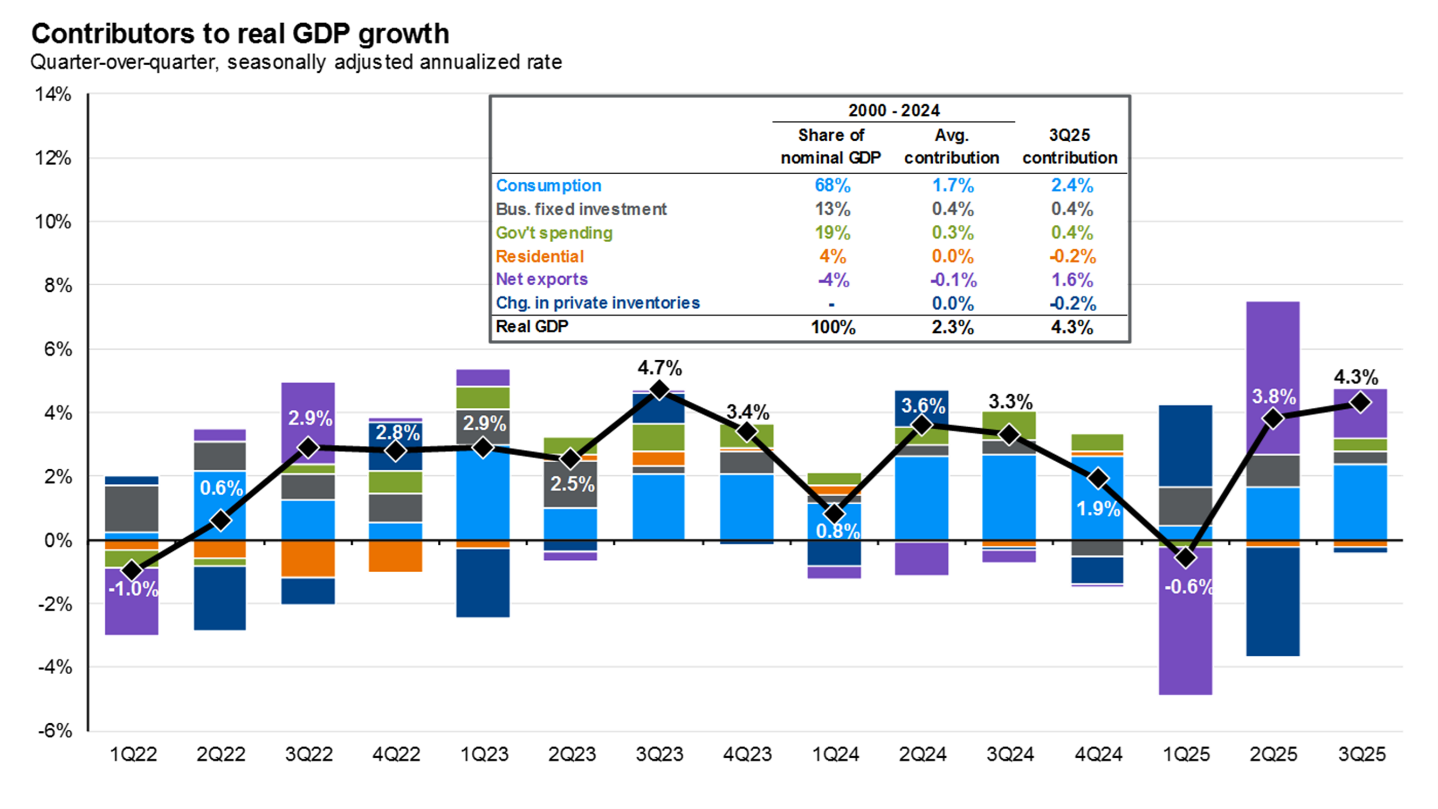

The chart below highlights why this matters. Gross Domestic Product (GDP), a measure of overall economic growth, reflects the total value of goods and services produced in the U.S. The chart breaks down the contributors to GDP growth from 2000 through 2024, with consumer spending highlighted in light blue. Over this period, personal consumption has accounted for roughly two-thirds of U.S. GDP growth, underscoring the central role that consumer spending plays in driving the economy.

Source: J.P. Morgan, Guide to the Markets

This burst of activity may prove temporary. Because most tax refunds are received in the first half of the year, there is a risk that much of this stimulus is spent down before the second half begins.

Takeaway

Increased tax refunds have the potential to create a strong start to 2026, fueling consumer spending and supporting economic growth in the first half of the year. Like a fireworks display, however, these effects may be bright but short-lived, with momentum easing as the year progresses.

Risks remain, and all good things eventually come to an end. For investors, the most important approach is to stay focused on long-term goals, maintain discipline, and avoid reacting to short-term economic noise. In the meantime, enjoy the fireworks and welcome the new year. As always, if you have any questions or would like to review your financial plan, please

reach out to an advisor today. Your financial success matters.