Forecasting Inflation: A Look at the Tools of the Trade

January 21, 2025

By Ted Hanson

By Ted Hanson

Portfolio ManagerLiving in the Midwest, I find myself constantly checking the temperature. As this weekend showed, it is not unusual for a 30-degree temperature change to occur in a matter of days (without including wind chill)! Knowing what to expect each morning helps me gauge how many layers to wear, or if I should plan for a messy drive to work. Last week, we weren’t only checking in on the weather but looking to gauge whether inflation cooled in the past month. Let’s check in.

Producer Price Index (PPI)

First, the Producer Price Index (PPI). PPI measures the change in prices domestic producers receive for their goods and services. Measuring inflation from the perspective of the product manufacturer or service supplier is commonly used to see what inflation is in “the pipeline” for consumers, since can heavily influence what is charged to the consumer. December’s reading of PPI was better than expected, coming in at 0.2% for the month compared to 0.4% in November. Nonetheless, the annualized PPI growth rate of 3.3% remains high, as energy and transportation rose. This offsets the decrease in food-related products. This first inflation reading of last week set the stage for the highly anticipated Consumer Price Index (CPI) to come the following day.

Consumer Price Index (CPI)

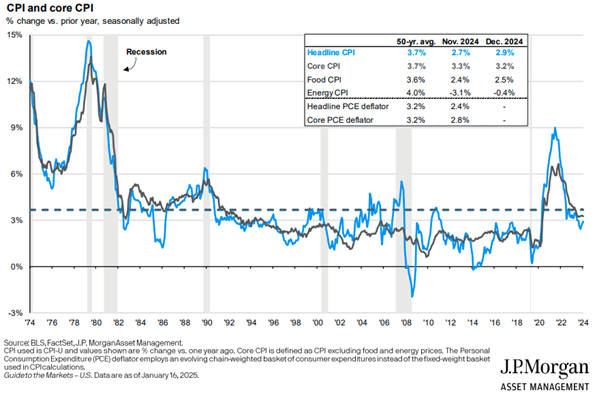

The Consumer Price Index (CPI) measures the change in prices paid by U.S. consumers for goods and services. CPI is closely followed due to its effects on the Federal Reserve’s monetary policy, Social Security cost-of-living adjustments, the consumer’s pocketbook, and much more. Like PPI, the December CPI reading was viewed as better than expected. CPI rose 0.4% in the month and increased to an annualized rate of 2.9%, up from 2.7% the previous month. While the headline number was hot, most of the rise was a result of increases in energy prices. Stripping out the more volatile food and energy prices, core CPI came in lower than anticipated and reduced the annualized rate from 3.3% to 3.2%. Importantly, shelter inflation continues to be the primary reason CPI remains above the Federal Reserve’s 2% target. Nonetheless, significant progress has been made in recent months. The shelter components of CPI printed at 0.3% in December, close to pre-pandemic levels and is showing signs of further progress in the months ahead.

Looking Ahead

While December’s check on inflation showed reasons for optimism, there remains risks moving forward. Primary headline risks to inflation include tariffs, seasonality, and unpredictability in the energy sector. It has yet to be determined how these risks will play out and their effects on CPI. However, in combination with a strong job market and anticipated continued economic growth, the Federal Reserve feels they have the opportunity to continue to assess the incoming data and the effects of inflation going forward. Therefore, it is expected the Fed will bypass a rate cut during next week’s meeting and cut one or two additional times throughout 2025.

Bearing in mind the opportunities and risk going forward, we remain optimistic for the calendar year ahead. The labor market, consumer spending, business profit margins, and many other economic indicators point toward a continued expansion. Just like any other year, there are headlines and risks to monitor as we move forward. Therefore, portfolios under our charge will remain fully invested, while attentive to valuations and quality. Please

reach out today if you’d like to check the temperature on your portfolios and to discuss the forecast ahead. Your success matters to us.