Do you understand the financial risks you are taking?

October 5, 2020

Michelle Holmes, CFA

Michelle Holmes, CFA

AVP - Investments

My colleague Ted Hanson mentioned last week that lower interest rates may cause some bond investors to reach further out on the risk spectrum to maintain their income stream. What does this mean?

Some traditionally conservative bond investors will look to areas of the bond market that offer higher yields, while others will turn to the stock market. Both options come with added risk.

Not all bonds are created equal

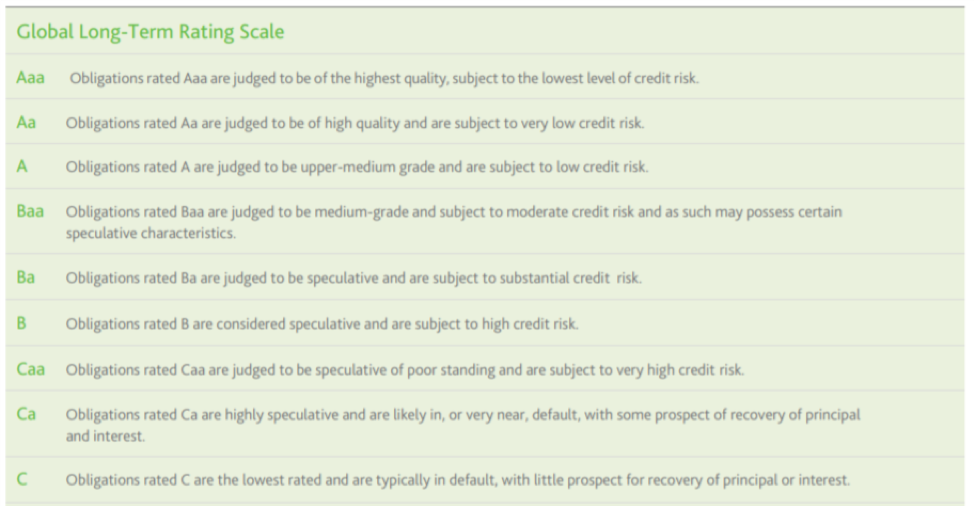

Some investors will stick with investing in bonds, but not all bonds are created equal. Different types of bonds will offer varying income streams and risk levels. Bonds are like consumer loans except for the investor takes the place of a bank and lends money to a government, municipality or corporation. Just like consumers, the bond issuers are given a credit rating based on their financial stability. The lower the grade, the more income the investor demands in order to take on the credit risk of the issuer (borrower).

Credit risk is the risk of loss from the issuer failing to make timely payments of principal and interest. The U.S. Treasury market is considered the “risk-free” market. Rates on other bonds are usually quoted at some premium to the “risk-free” rate. This premium or spread compensates investors for the credit and liquidity risk involved in investing other types of bonds.

Source: www.Moodys.com

What is liquidity risk?

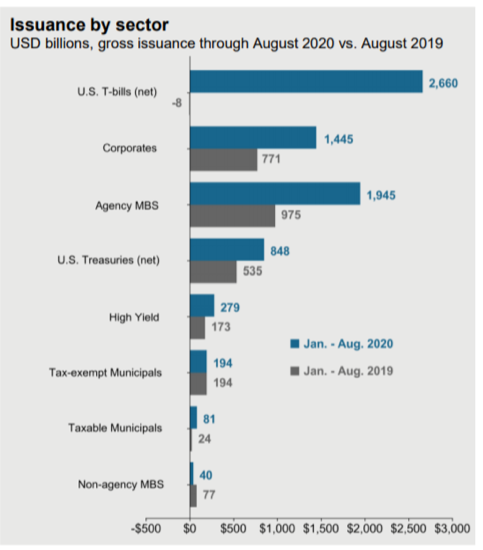

Liquidity risk is the risk that an investor will not actually be able to buy or sell at the value indicated by the market. Unlike most stocks, bonds do not trade on an exchange. They are bought and sold through bond brokers - over the counter. There are primary dealers that agree to make a market in U.S. Treasuries to keep liquidity flowing in that sector of the bond market. Other bond sectors do not offer the same liquidity. It depends on how much supply comes to market in a given year, and how much inventory is available in the secondary market. As you can see in the chart below, there is not as much issuance of new debt in other areas of the bond market as U.S. Treasuries this year.

Source: J.M. Morgan Guide to the Markets® as of September 29, 2020

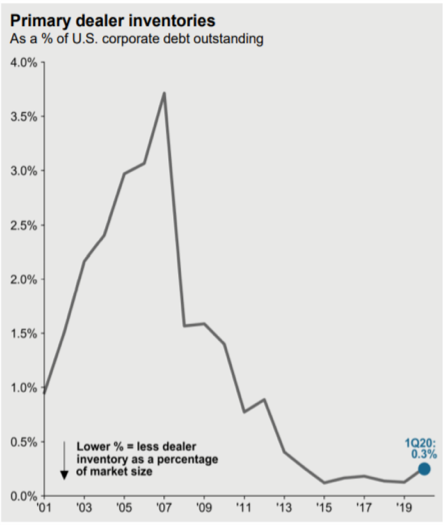

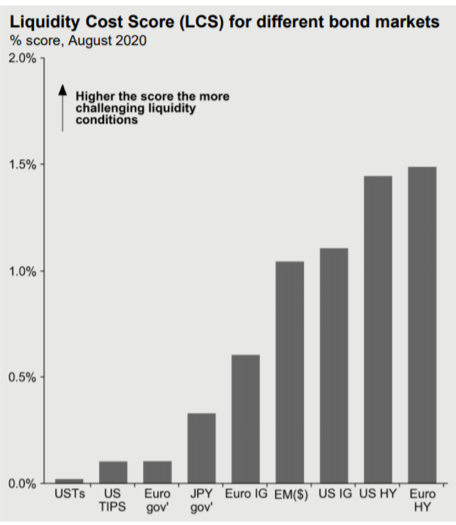

Some fixed income investors follow a buy and hold strategy, which means that they typically hold the bonds they purchase until maturity. This reduces the supply of bonds that trade in the secondary market. The chart below on the left shows that bond brokers are not holding as many bonds in their inventories, which also reduces the amount of available supply for the secondary market. The smaller the supply of bonds and the less often they trade, the more liquidity risk increases as seen in the chart on the right. Generally, investors demand a higher yield to compensate for liquidity risk.

Source: J.M. Morgan Guide to the Markets® as of September 29, 2020

Some investors may move into stocks

Other investors move further out on the risk spectrum and look to the stock market when searching for additional income. Some companies and certain types of stocks (like utility stocks) return larger portion of their profits to shareholders in the form of dividends. Investors who traditionally invest in bonds may purchase shares of these types of companies to earn more income when interest rates are low.

Instead of going to a bank to get a loan or a bond, a business can raise cash to fund their operations by issuing stock. Investors who purchase the company’s stock own a small portion of the company. This entitles the investor to share in the profits and growth of the company. Most stocks trade on an exchange but some smaller issuers may trade privately or through brokers.

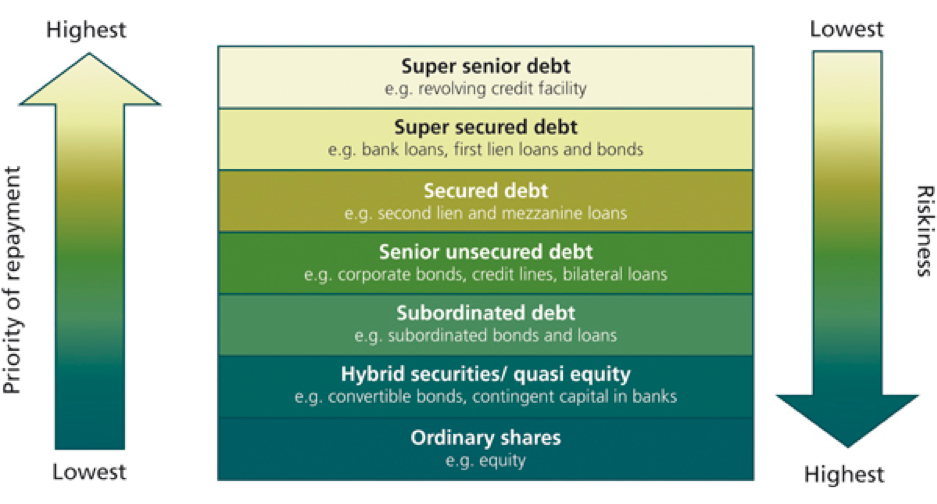

The reason stocks (also known as equities) are generally more risky than bonds have to do with the capital structure of a company. The order of priority of repayment in a bankruptcy is based on the capital structure. If a company goes bankrupt, the highest priority of payment goes to the secured debt holders first, then works through the rest of the capital structure giving the lowest priority to the stockholder. There are some bond types that are considered secured debt (like mortgaged-backed securities), however most bonds are considered unsecured debt. Unsecured debt falls below secured bank loans and other secured debt in the capital structure, and stands a better chance of at least a partial repayment in the event of a bankruptcy than stock holders.

Source: M&G Investments

Whether you stick with traditional investments or move out on the risk spectrum, investing comes with varying degrees of risk, income and return potential. It is important to understand the risks you are taking.

For 136 years, Security National Bank has helped families and businesses plan and execute a strategy to make them financially secure. Over the decades, much has changed in the community, economy and investment markets and we have helped people make sound investment choices. Please allow us the chance to help you develop or enhance your financial security. Contact one of our financial representatives to discuss your portfolio risk.