Value vs. Dividend: What's Your Stock Market Game Plan?

October 12, 2020

By Tom Limoges

By Tom Limoges

Asst. VP - Investments As temperatures began to cool this week and leaves turn from green to beautiful golds and reds, it is evident that fall is peaking in this part of the Midwest. When I think of fall, I am often reminded of my favorite team sport, FOOTBALL! As a youth coach, I enjoy the opportunity to work with kids and improve their knowledge of the game and help them become better competitors. Both before and during a game, coaches often look for ways to gain an advantage over their opponent to improve the outcome for their team.

Investment managers often employ a similar approach – having a game plan, but always searching for opportunities to improve outcomes for their clients. Does that opportunity currently lie in growth-oriented stocks or dividend stocks?

Game Plan: Valuations

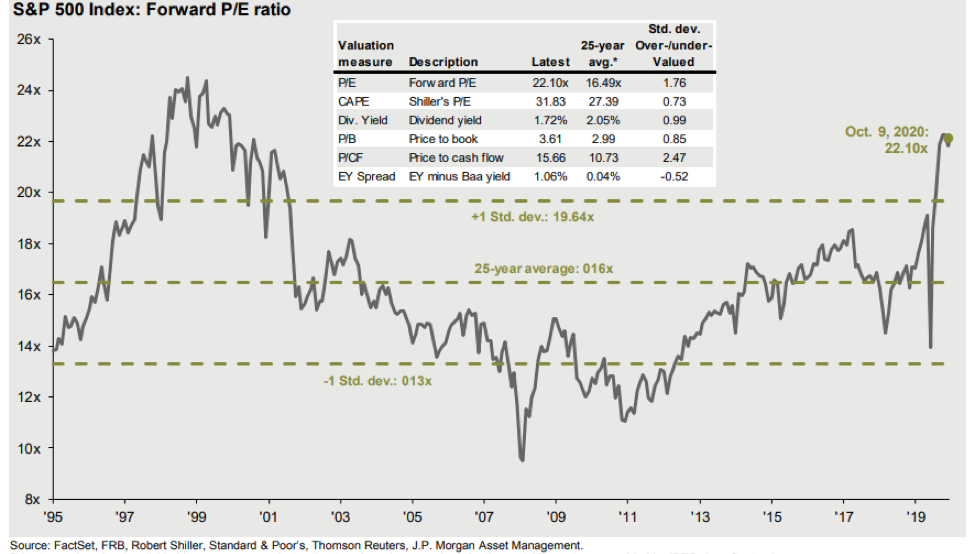

Over the last 10 years, stock valuations expanded and are now trading at more elevated levels (see above chart) by most common measures. Much of that market growth came from investors throwing out the playbook and following the momentum by moving into mega cap and growth oriented technology stocks. Why are we concerned about market valuations? Over short-term time periods, markets can remain at elevated valuation levels for periods of time longer than expected.

However, as long-term investors, we understand that valuations play a large role in projecting longer-term returns from the markets, and by most measures, U.S. large stocks (especially growth) are expensive. By contrast, the valuation gap between growth stocks and dividend paying stocks is as far apart as it has been in the last 50 years, which could mark the potential for a comeback in equities that pay dividends.

Game Plan: Yields

Just like bonds that pay income in the form of coupon payments, some stocks also produce income in the form of a dividend. Combined with the appreciation on stock price, dividend payments add to the total return for the stock. Investing in yield-oriented companies over the last 10-plus years has underperformed more growth-oriented stocks — by a wide point differential. But it is also important to note that over time, market performance ebbs and flows just like the momentum of a close football game — and yields are affected less by this volatility.

The Final Score

Combined with favorable valuations and low interest rates, the outlook for dividend paying stocks is attractive. The dividend yield is a factor that is considered as we are evaluating stocks to purchase for our clients. Additionally, we have slightly increased our exposure to more value oriented investments in recent years to gain exposure to this sector of the market. Our solid game plan is built upon a balanced and diversified portfolio, and we analyze the game footage and keep track of the long-term data that will set us apart come game time.

With SNB as the coach of your investment team, trust that we are always looking for ways to get an advantage and end with a W in your investment portfolio. Contact an advisor today to go over your game plan.