Has Diversification Struck Out?

June 27, 2022

By Tom Limoges

By Tom Limoges

VP - InvestmentsBaseball is a sport of failure, and it can be frustrating to those who play, coach, and watch the sport. Last weekend, I had the opportunity to speak with my son’s baseball coach, a former college pitcher. He told me a story of a batter that he faced from a cross-town rival who always had his number. He put together a solid game plan and threw the kitchen sink at him, but it didn’t matter – the batter made it on base more times than not. A lot like some aspects of baseball, the first half of the year has been frustrating for most investors. Additionally, the game plan of portfolio diversification has not worked as expected.

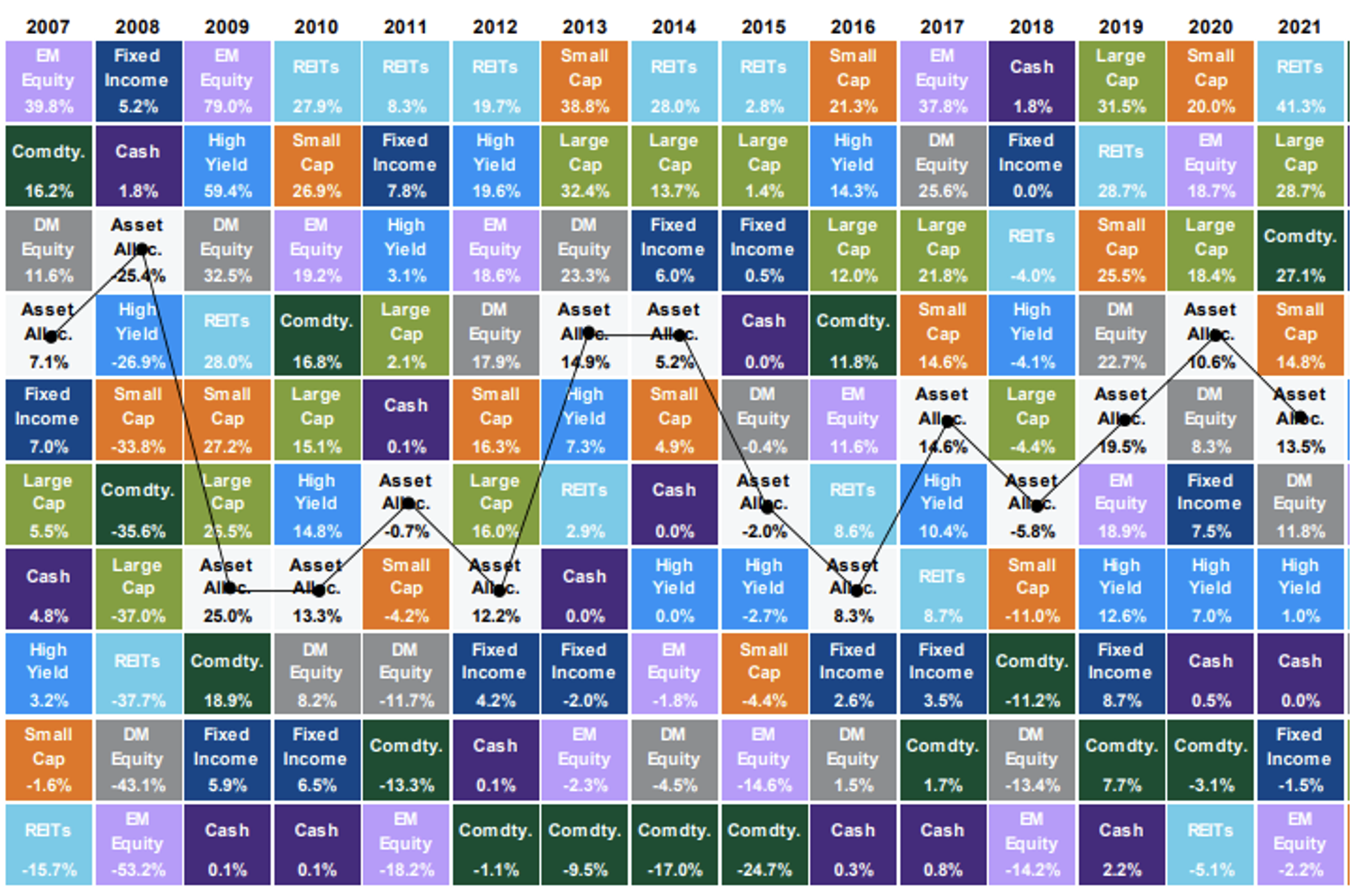

Asset Class Returns Over Time

YTD Data as of 12/31/2021 Source: JP Morgan Guide to the Markets

As the above chart indicates, the market winners and losers can vary on an annual basis. Picking next year’s winner is completely unpredictable. During periods of stock market volatility, fixed income investments (dark blue boxes) have historically produced positive returns and outperform most areas of the stock market. Investors can make a game plan for this volatility by diversifying their investments (white boxes). By diversifying, investors can reduce volatility and produce more consistent returns over time with less volatility compared to investing in single asset classes. A good baseball coach studies the statistics of their own players, as well as those they will be facing on the field. Taking all these things into consideration help the coach make a solid game plan. Even the best laid plans can go awry…

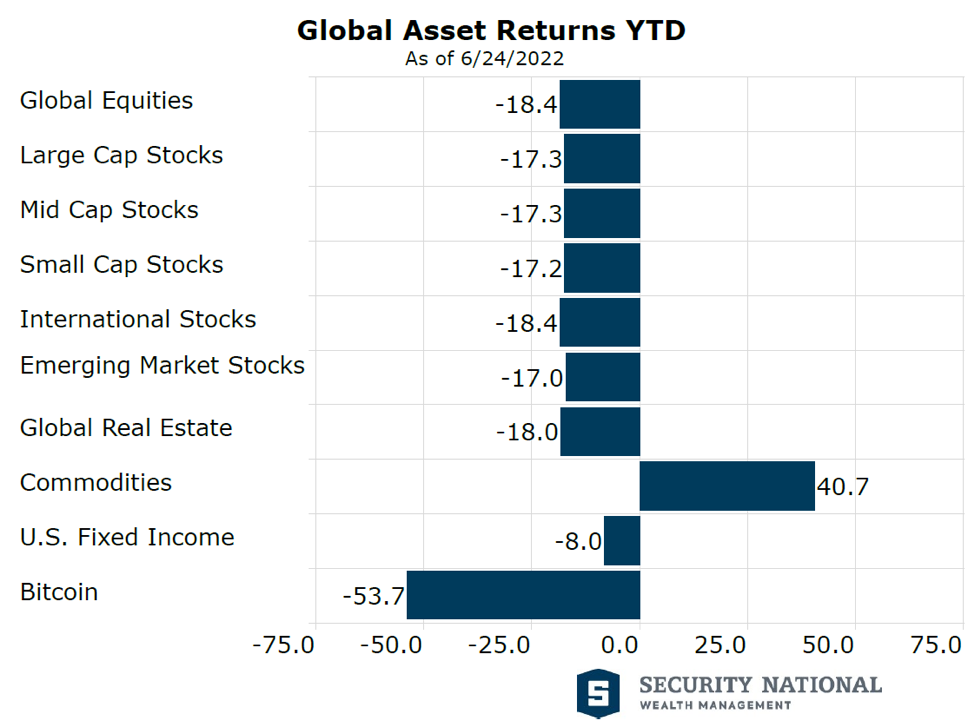

Source: Morningstar Direct

The above chart indicates the challenging market environment for most asset classes this year. With the exception of the commodity markets, returns for most asset classes have been negative. Bitcoin, which hit a few dingers in recent years has struck out at the plate – failing to provide any diversification benefits. Even fixed income (bonds), which tend to perform well during volatile market environments experienced the worst start to the year in over 40 years due to rising interest rates. A good baseball team has a deep bench- many talented players who have a record of being able to pitch, catch, or hit well over time. But even the best teams can have an “off” game.

So where do we go from here? In many cases, it is important to take a long term approach when looking at investments. Over the short term, volatility can exist for even the most diversified portfolio (left side of the chart). When looking at longer term time periods, however, diversified portfolios and patience are still the winning strategy.

To my wife, baseball games seem to last forever. That’s why there are so many innings in baseball- to help level out the uncertainty and unpredictability of each pitch, every at-bat, and every inning. As I stated earlier, baseball is a sport of failure. It takes perseverance and determination to stick with it long enough to see the beauty in it. Investing is much the same way- let us help you make a successful game plan to ride out the highs and lows of your investments today.