Have We Reached the Bottom of the Bear?

October 17, 2022

By Jonathan Smith

By Jonathan Smith

Securities AnalystBear markets usually follow a pattern; they decline, they fluctuate for a while, hit bottom, and then hit the breakthrough phase. The rally late last week has investors asking the question: Have the markets reached bottom this year? The S&P 500 entered into a bear market in June this year, meaning the index declined 20% from its peak. Inflation has been the big theme throughout the year, but are we starting to see signs of the breakthrough phase?

September Inflation Points

Last week, the release of September economic data gave investors clues on the direction of the economy. On Wednesday, the Producer Price Index, which measures the prices that U.S. businesses get for the goods and services they produced, jumped 0.4% for the month, 8.5% annually. On Thursday, the Consumer Price Index, which measures the change of prices paid by consumers for goods and services over a period of time, also rose 0.4% for the month, 8.2% annually. Both readings indicate inflation has momentum and remains persistent, despite Federal Reserve interest rate hikes this year. This data will likely guide the Federal Reserve to stay the course in raising interest rates.

Performance After Recessions

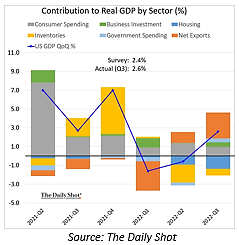

The stock market is a leading indicator for future economic activity. As we have seen this year, the large decreases in stock prices are reflective of a future recession. On the other hand, investors tend to predict when economic conditions will improve. The stock market does not represent today’s economy, but rather what the economy will reflect months and years down the road. Investors are predicting a recession looming in the next year, indicated in this year’s market lows.

As illustrated in the chart above, the average performance of risk assets after a recession has been favorable on a cumulative basis. To be clear, no one has a crystal ball to time when these market events take place. But bear markets follow a pattern, and the signs are suggesting that there is a chance we may be near the bottom of this bear market.

As we start to see signs that the bottom of the bear is near, more volatility in the near term is expected. We will keep our portfolios defensively positioned to hedge the near term risks of hotter inflation and interest rate risks. If you have questions, contact us and let's review your portfolio together. Your financial success matters to us!