Hold Your Horses - Effects From Rate Changes May Be Surprising

September 29, 2025

By Ted Hanson

By Ted Hanson

Portfolio ManagerAs the father of a four-year-old, I often find myself saying phrases many parents are familiar with: “Hold your Horses”, “Not so fast”, or “Are you sure?”. The past few weeks I’ve also had to repeat these to myself several times as I think through the ramifications of the Federal Reserve's most recent rate cut. As the recent action filters through the economy, it’s important to remember not all rates react in tandem.

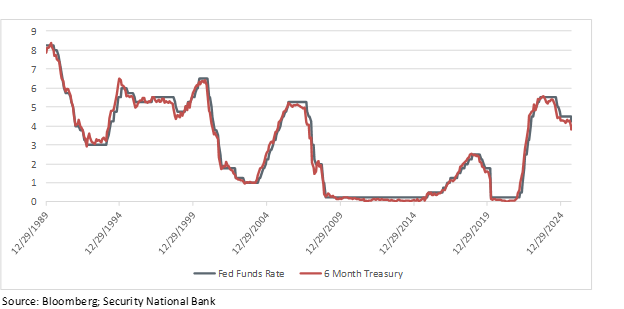

On September 17th the Federal Reserve announced its decision to reduce the Fed funds rate by 0.25%, the first reduction this year. While the announcement was expected, the effects of the change may be surprising to some. What is often overlooked is how the Fed funds rate has a larger influence on short-term rates than longer-term. As the chart below shows, the 6-month U.S. Treasury yield closely mirrors the Federal Reserve’s rate actions over the last 35 years.

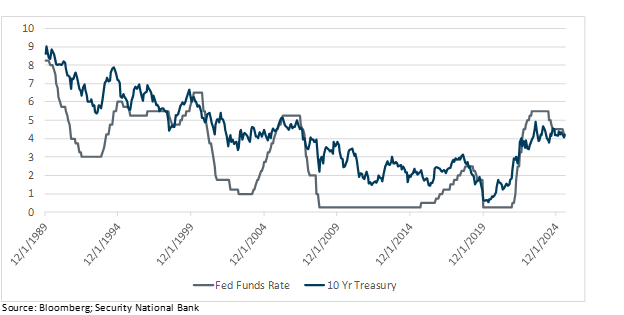

However, longer-term rates are influenced by bond market participants and forward-looking assumptions. What market participants think of future economic growth, inflation, fiscal spending, etc. influences what yield is demanded to buy longer-term maturities. Depicted in the next chart, you’ll notice the yield for a 10-year U.S. Treasury is less correlated to the Fed Funds rate. In fact, it rose last year when the Federal Reserve last cut rates due to concerns of fiscal spending and tariff induced inflation pressures.

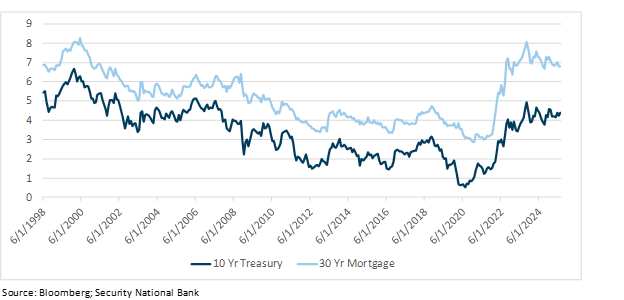

This is important because changes in shorter vs longer-term rates can affect everyone differently. For example, many loans such as mortgages and credit card rates are benchmarked to longer-term rates. The last chart below highlights the strong correlation between the 10-year U.S. Treasury and 30-year mortgage rates.

However, many savings rates (money market funds, savings accounts, short-term CDs, etc.) react closer to the Federal Reserve moves. Last year’s rate cuts from the Federal Reserve (as well as this year thus far) are a good example of why we need to pause and think about how rate changes affect our personal lives.

For those with excess cash balances or short-term investments, it continues to be a prudent time to re-evaluate those positions. Extending maturities and locking in yields today may prove beneficial if the Fed determines more rate cuts are necessary this year.

Nonetheless, those looking to borrow funds may be in a different position, as longer-term rates are not guaranteed to decline in the near future. Government deficit spending and inflation concerns continue to limit how far long-term yields may fall.

Therefore, our job in managing your wealth is to not rush into decisions, “hold our horses”, and consider the ramifications of how changes can affect your financial goals. Call us today to discuss your financial picture and how changing rates will impact you. Your success matters to us.