When it Comes to Investing, "Home Country Bias" Hits Even Closer to Home

July 12, 2019

By Mike Moreland

By Mike Moreland

Vice President Investments

Many of us have heard the term, “home country bias.” This means that while choosing investments, individuals tend to focus on their own countries. Familiarity creates a comfort zone, so to speak. Did you know this extends to regional investing in the U.S. as well?

The value of the world’s stock markets is about evenly divided between the U.S. and everywhere else. Thus, a global index fund contains about half U.S. and half international holdings. Most individual portfolios, however, do not follow this formula — because as noted above, we tend to stay with what we know. The average U.S. investor has less than one-third of his or her assets in international stocks; a similar underweight of U.S. issues is likely present for most non-U.S. investors.

Home Bias Investing in the U.S.

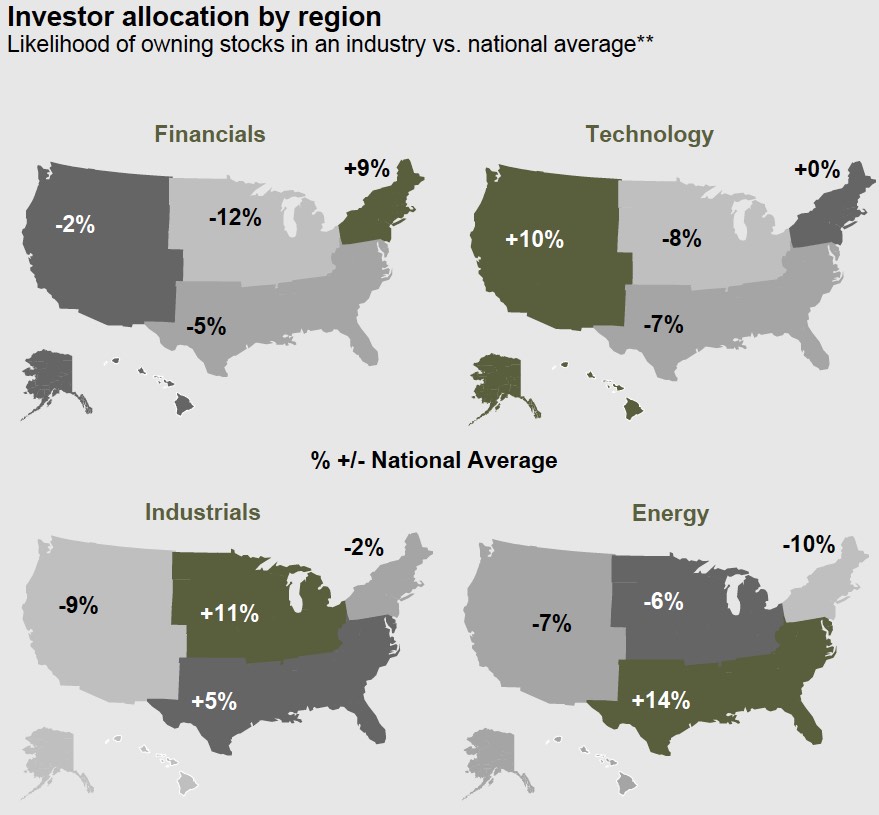

Let’s dive a little deeper into this behavior pattern. The chart below, from J.P. Morgan’s Guide to the Markets, shows this bias for the familiar on a regional level -- and the findings make sense:

- The Northeast, home to Wall Street, shows an emphasis on financial stocks relative to other regions;

- The Heartland carries an overweight in industrials, reflecting its position as the manufacturing hub of the nation;

- The Western U.S., home to Silicon Valley, emphasizes technology exposure; and

- The Southern U.S., the country’s long time center of oil production, shows a significant overweight in energy holdings versus other regions.

Source: J.P. Guide to the Markets, May 31, 2019

Source: J.P. Guide to the Markets, May 31, 2019Is a familiarity investing a bad thing? Not necessarily, as long as it’s not taken to extremes. However, history shows that a broadly diversified portfolio — by style, sector, and geography — is the best structure to produce consistent returns in a variety of environments.

At Security National Wealth Management, we plead guilty to having a small home country bias in portfolio development for our clients. At the same time, we look for value across the globe, not just in our backyard. We will continue this practice and expect it to provide the same benefits it has in the past.

For a closer look at your portfolio and how we act to protect and grow your assets, contact your Advisor today.

Leave a Comment Below: