Fed Watch: Hopes Dashed for a "Powell Pivot"

September 26, 2022

By Michael List, CFP®

By Michael List, CFP®

Investment Management Officer

This summer Amazon debuted its new series, The Lord of the Rings: The Rings of Power, related to the popular films and books, The Lord of the Rings. In the third movie Return of the King, the future king, Aragorn, rallies the troops declaring, “A day may come when the courage of men fails, when we forsake our friends and break all bonds of fellowship, but it is not this day.”

Alas, “A day may come when inflation recedes, when we will not have to fill these updates with Fed policy,” ... but it is not this day.

Fed raises rates for third straight meeting

The Federal Reserve met last week and raised their target rate another 0.75%, for a third straight meeting. While the rate increase was anticipated, the tone from Chairman Powell’s comments was interpreted as more hawkish (more likely to raise rates and keep them elevated).

Powell reiterated, “The FOMC (Federal Open Market Committee) is strongly resolved to bring inflation down to 2%, and we will keep at it until the job is done.”

What is the Fed looking for for?

The FOMC is still data dependent, before they change course on rate decisions they are looking for three things: a continuation of growth running below trend, movements in labor market showing a return to better balance between supply and demand, and “clear evidence” that inflation is moving back down to 2%.

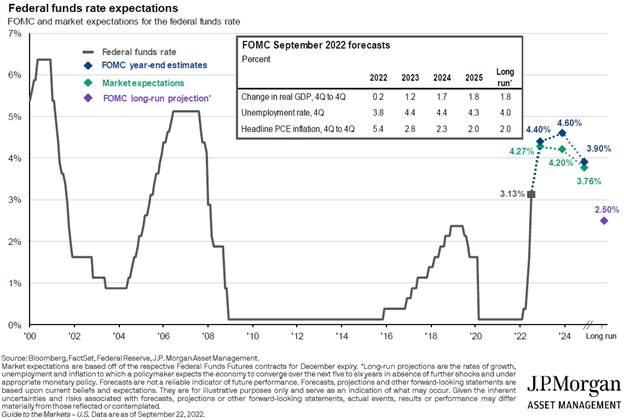

This has led to aligning FOMC estimates and market expectations for the Fed fund’s rate exceeding 4.25% by the end of 2022 as seen in the chart below from J.P.Morgan.

Meanwhile, central banks around the globe have joined the Federal Reserve, with many other countries increasing rates between 0.5% and 1.0% this week. The synchronization of global central banks aggressively increasing rates to combat inflation led stocks to sell off to new lows and bond rates to rise to levels not seen in over a decade.

In early summer, market participants had been hoping for a Powell Pivot, when the Federal Reserve would stop raising rates and begin cutting, perhaps in early 2023. The Fed’s meeting and comments last week put an end to speculators’ hopes for a Powell Pivot.

As noted in previous market comments, near-term Fed cuts are unlikely, given how far central banks had fallen behind the curve with inflation. Correspondingly, portfolios under our care will continue to be overweight in dividend paying value stocks and high quality shorter maturity bonds.

If you would like to review your portfolio, contact an advisor today. Your financial success matters to us.